Why Finding Qualified Estate Lawyers Matters Most During Life’s Difficult Moments

When searching for estate lawyers in my area, you need professionals who grasp the legal complexities and emotional weight of protecting your family’s future. The right legal guidance is crucial, whether you’re planning ahead or navigating the aftermath of a loss.

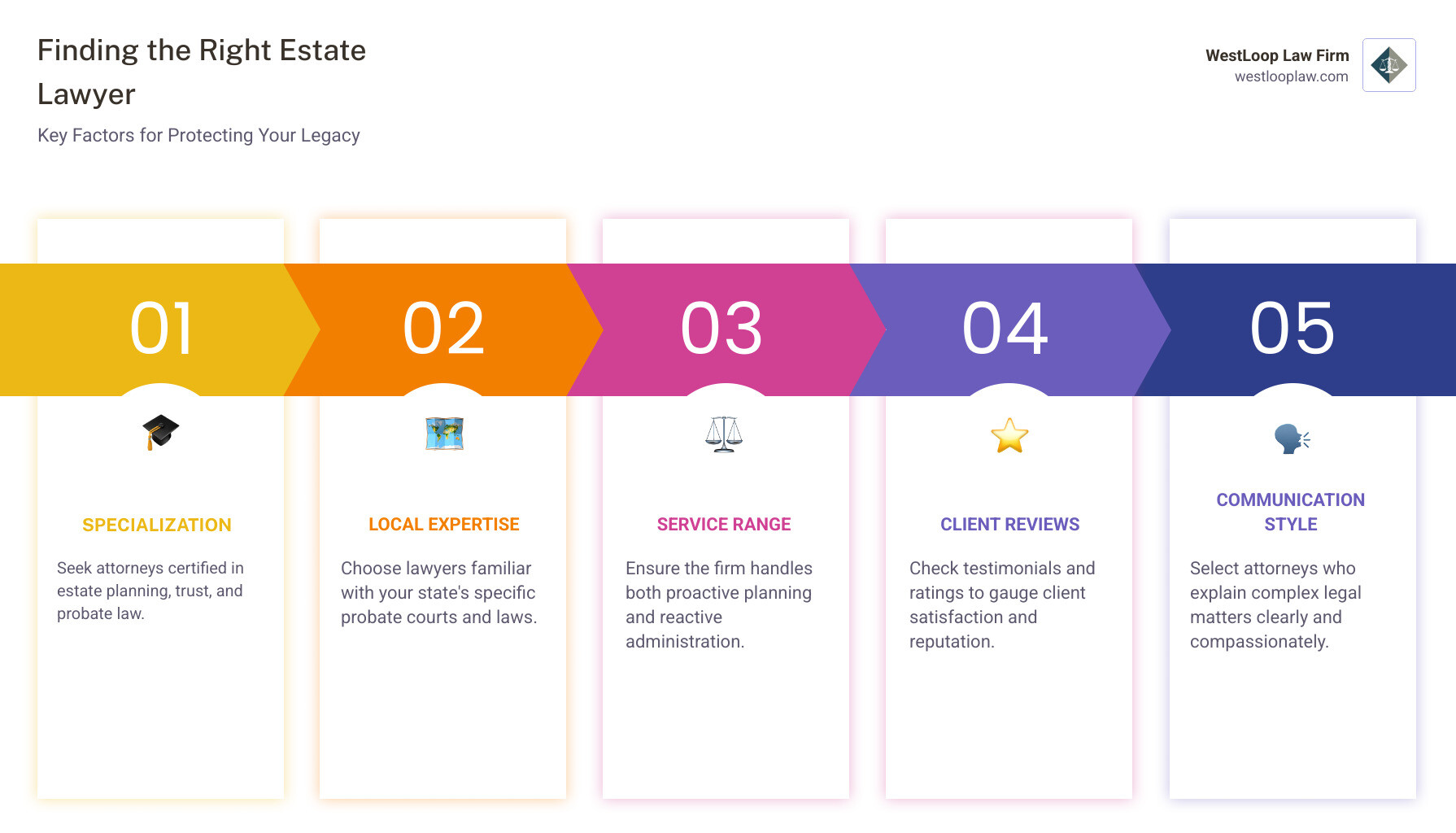

Quick Guide to Finding Estate Lawyers:

- Focused Practice – Look for attorneys certified in estate planning, trust, and probate law

- Local Experience – Choose lawyers familiar with your state’s probate courts and laws

- Service Range – Find firms handling both planning (wills, trusts) and administration (probate)

- Client Reviews – Check testimonials and ratings from previous clients

- Communication Style – Select attorneys who explain complex legal matters clearly

Estate lawyers serve two main roles: proactive planning to protect your assets and wishes, and reactive support when families face probate or disputes. In states like California and Texas, probate can last 9-24 months and be costly without proper planning. The stakes are high for your family’s financial security, but experienced attorneys can help you avoid stress, minimize taxes, and ensure your wishes are honored.

Basic estate lawyers in my area glossary:

What Do Estate Lawyers Actually Do?

When you search for estate lawyers in my area, you’re seeking professionals who handle some of life’s most important decisions. We act as your family’s financial guardians, providing comprehensive services for asset protection and peace of mind. Our work involves two main areas: creating a solid plan before it’s needed and guiding families through the legal process after a loved one passes away.

Core Estate Planning Services

The planning side of our practice is where we help families get ahead of potential problems. This is necessary for anyone who owns a home, has children, or wants to control their legacy.

Wills form the foundation of an estate plan, specifying how your assets are distributed and naming guardians for minor children. Without one, Texas law dictates asset division, which may not align with your wishes.

Trusts are powerful tools that allow assets to bypass the lengthy probate process. They also offer greater control over how and when beneficiaries receive their inheritance.

Powers of Attorney ensure someone you trust can handle your financial affairs if you become unable to do so, preventing court intervention during a medical emergency.

Healthcare directives let you make medical wishes known ahead of time, appointing a healthcare agent and outlining your end-of-life care preferences.

Tax minimization strategies use current federal and state tax laws to reduce your family’s tax burden.

Asset protection strategies shield your wealth from potential creditors and legal claims, often using special trusts or business structures.

| Feature | Will | Revocable Living Trust |

|---|---|---|

| Avoids Probate | No, generally requires | Yes, for assets held in the trust |

| Privacy | Public record | Private |

| Effective Date | Upon death | Upon signing |

| Asset Management (Incapacity) | No, requires separate POA or guardianship | Yes, trustee manages assets |

Probate and Estate Administration

When someone passes away, their estate usually goes through the probate court process. This is where our administration services become crucial.

In Texas, the probate process can be lengthy and complex, often overwhelming grieving families. This is similar to California, where it can last 9-24 months.

Executor assistance is a key service. We guide executors through their significant legal responsibilities, from initial court filings to final asset distribution.

Trustee guidance helps those managing trusts understand their duties in managing and distributing trust assets to avoid personal liability.

Fiduciary duties are the legal obligations of executors and trustees. We ensure these duties are met, protecting both the fiduciary and the beneficiaries.

Asset distribution and debt settlement require following specific legal procedures to settle all legitimate debts before distributing assets to beneficiaries.

With experienced legal guidance, families can steer the intimidating probate process while honoring their loved one’s wishes.

Key Moments to Consider Hiring an Estate Lawyer

When searching for estate lawyers in my area, timing is critical. Key life events and financial milestones are the perfect opportunities to protect your loved ones and prevent future conflicts. Many people wait too long, but planning becomes essential the moment you have a child, a home, or simply a wish to be respected.

Life Triggers for Seeking Legal Advice

These moments of joy often come with new responsibilities and new reasons to plan ahead.

Marriage or divorce dramatically alters your legal and financial landscape. Your estate plan must be updated to reflect these new realities.

Birth or adoption of a child makes it essential to name legal guardians in a will. Without one, a court will make this critical decision for you.

Purchasing real estate is a major investment. How you hold title to property impacts taxes and what happens upon incapacity, so proper structuring prevents future complications.

Starting or selling a business requires special planning. Business succession ensures your company benefits your family, while a sale creates sudden wealth that requires immediate plan updates.

Receiving a significant inheritance must be integrated into your plan to address tax implications and protect the new assets.

Planning for retirement is when asset allocation, beneficiary designations, and long-term care planning become crucial to securing your legacy.

The Tangible Benefits of a Professional Plan

Working with estate lawyers in my area provides concrete benefits that protect your family’s financial future.

Avoiding probate is a primary benefit. A well-crafted plan helps your family avoid this public, costly, and time-consuming court process that can last 9-24 months.

Minimizing estate taxes keeps more money in your family’s hands. We implement strategies to reduce federal and state tax obligations. For details, the IRS website offers guidance on federal estate and gift tax rules.

Protecting beneficiaries is vital. A smart plan can shield inheritances from a beneficiary’s creditors or a divorce and ensure assets for minors are managed wisely.

Providing clarity eliminates the guesswork that can tear families apart by clearly documenting your wishes.

Preventing family disputes may be the most valuable benefit. A difficult conversation now is better than a court battle later. The best time to plan is before you need it.

Handling Complex Scenarios and Finding the Right Fit

Not all family situations are simple. When dealing with conflicts, special needs heirs, or unique assets like digital currencies, you need estate lawyers in my area with experience in complex scenarios. Even well-crafted plans can face challenges, requiring attorneys who blend legal knowledge with an understanding of family dynamics.

Resolving Estate Disputes and Litigation

Inheritance court battles are emotionally charged and can permanently damage relationships. We’ve seen these disputes tear families apart.

Will contests arise from claims of invalidity, such as lack of mental capacity or undue influence, where someone was pressured to change their will.

Breach of fiduciary duty occurs when executors or trustees mismanage assets or fail to communicate. Beneficiaries can take legal action to recover damages.

Inheritance disputes often stem from long-standing family dynamics or unclear language in a will, leading to disagreements over asset distribution.

When conflicts cannot be resolved through discussion, we provide strong legal representation in court to fight for your rights and achieve the best possible outcome.

Planning for Unique Family Needs

Some families need more than a basic will and trust to address their unique circumstances.

Guardianship for minors must be legally established in your will. Without it, a court, not you, decides who will raise your children if you pass away.

Special Needs Trusts are essential for providing financial support for disabled loved ones without disqualifying them from vital government benefits like Medicaid. This requires careful legal structuring.

Business succession planning creates a smooth transition for your company, addressing ownership and management transfer. We structure these plans to minimize taxes and prevent conflicts, protecting the business you’ve built.

Planning for digital assets is crucial. Your estate plan must include provisions for accessing online accounts, cryptocurrency, and digital files to ensure your family can manage them.

The key to handling these complex scenarios is working with attorneys who understand that every family is different and requires personalized legal guidance.

How to Find the Best Estate Lawyers in My Area

Finding the right estate lawyers in my area requires more than a quick search. It’s about choosing qualified counsel who understands local laws, communicates clearly, and cares about your family’s future. This thoughtful choice can save your loved ones from stress and costly mistakes later.

Critical Factors for Choosing Estate Lawyers in My Area

When you’re ready to choose an estate lawyer, several key factors can help you identify the right fit.

Focus on estate law is key. Choose attorneys who focus on estate planning, probate, and trust law, as they are current on changing laws. Board certification indicates a high level of knowledge and experience.

Years of experience are vital. At WestLoop Law Firm, our combined experience in Texas probate and estate law ensures efficient and effective representation for both planning and administration.

Client testimonials and reviews reveal an attorney’s approach. Look for comments on clear communication, compassion, and responsiveness. Legal knowledge must be paired with empathy.

Communication style should be clear and jargon-free. The right attorney explains complex concepts in plain English and is a determined problem-solver for your family.

Knowledge of local Texas probate courts is crucial. Our firm’s familiarity with Houston’s probate courts, rules, and personnel can streamline the process and prevent complications.

Understanding the Costs of Hiring Estate Lawyers in My Area

Cost is a major concern when hiring estate lawyers in my area. Understanding common fee structures helps you make an informed decision.

Flat fees for planning are common for services like wills and trusts. This provides cost predictability, which many families appreciate.

Hourly rates for administration or litigation apply to complex matters like probate or disputes. An experienced attorney can provide a reasonable estimate based on your case’s complexity.

Consultation fees vary. This initial meeting is your chance to discuss your needs and see if the firm is a good fit.

The value of preventing costly future mistakes is immense. Proper planning is an investment that avoids high probate fees and expensive legal battles over unclear wills, saving your family money and emotional distress.

When you work with experienced estate attorneys, you’re not just paying for documents—you’re investing in peace of mind, family harmony, and financial protection.

Frequently Asked Questions about Estate Law

Estate planning can feel overwhelming, and it’s normal to have questions. As we’ve helped Houston families, we’ve noticed common concerns. Here are answers to the most frequent questions we hear from those searching for estate lawyers in my area.

What is the role of an executor or trustee, and how can an attorney assist them?

An executor is responsible for submitting a will to the probate court, locating assets, paying debts, and distributing the remaining property according to the will. A trustee manages assets held in a trust, making distributions and investments as the trust document directs. This can be a long-term role.

Both positions come with significant legal responsibilities known as fiduciary duties. An estate lawyer is crucial for assisting executors and trustees. We guide them through complex legal procedures, help with asset management and tax filings, and handle any disputes. Our support helps you fulfill your duties correctly and avoid costly personal liability.

What happens if a person dies without a will in Texas?

When a person dies in Texas without a will (dying “intestate”), state law dictates how their assets are divided. These rigid statutory rules may not reflect the person’s wishes, and property could go to relatives they didn’t intend to benefit. The court must formally identify all legal heirs, which can be a complicated and lengthy process. If the deceased had minor children, a judge will appoint their guardian.

Contrary to popular belief, dying without a will does not avoid probate; it often makes the process more complex and expensive. A written estate plan is the only way to ensure your wishes are followed.

How can estate planning help protect my business and real estate assets?

Estate planning is vital for protecting business and real estate assets. For real estate, placing property into a trust can help it avoid the costly and time-consuming probate process. We also help structure ownership (e.g., joint tenancy, in a trust) to minimize taxes and protect against creditors.

For business owners, succession planning is essential to ensure a smooth transition of ownership and management. A clear plan prevents a forced liquidation and preserves the business’s value for your family. It can also minimize estate taxes on business interests. Our firm’s combined experience in probate, real estate, and corporate law allows us to create a comprehensive strategy to protect all you have built.

Secure Your Legacy and Gain Peace of Mind

Proactive planning is truly a gift you give to your loved ones. When you work with estate lawyers in my area, you create a protective shield around your family’s future, ensuring your legacy is preserved according to your wishes.

At WestLoop Law Firm, we use our combined experience in law and probate to guide Houston, Texas families. We understand that experienced counsel is essential, as cookie-cutter solutions don’t work for unique family situations. We are committed, knowledgeable, and effective in changing a potentially chaotic process into a manageable one.

Don’t let uncertainty dictate your family’s future. Take the first step today toward securing your legacy and gaining the peace of mind that comes from knowing your loved ones will be protected.

Contact a Houston probate lawyer to start planning your future