Why Understanding the Difference Between Estate Planning and Probate Matters

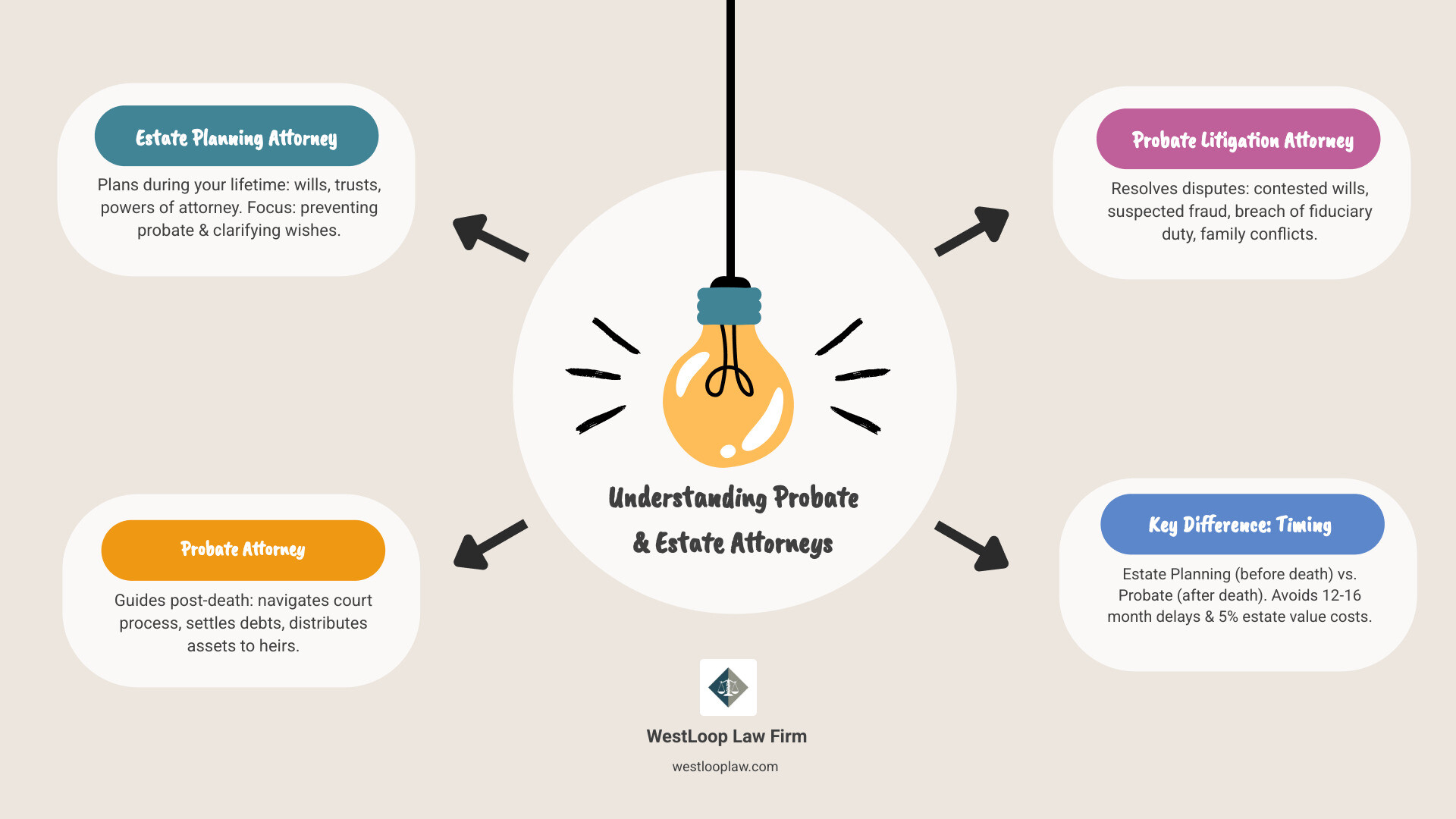

A probate and estate attorney serves two key roles: planning your estate before death or guiding your family through the court’s probate process after. The main difference is timing. Knowing which you need—and when—can save your family thousands of dollars, months of delays, and significant stress.

Quick Answer: When Do You Need Each Type of Attorney?

-

Estate Planning Attorney (Before Death): Hire when you want to create wills, trusts, powers of attorney, or plan for incapacity. Focus: preventing probate and ensuring your wishes are clear.

-

Probate Attorney (After Death): Hire when someone has passed away and their estate needs to go through court. Focus: navigating the probate process, settling debts, and distributing assets.

-

Probate Litigation Attorney (When Disputes Arise): Hire when there’s a contested will, suspected fraud, breach of fiduciary duty, or family conflict over inheritance.

The probate process can be daunting. In a state like California, it can take 12-16 months and cost up to 5% of the estate’s value in fees. Without proper planning, even a modest home can trigger a lengthy court process that delays inheritance and drains assets. Understanding what you need now helps you hire the right professional for your situation.

This guide will walk you through the key differences between estate planning and probate, explain when you need a probate litigation attorney, and give you practical questions to ask when choosing legal representation.

Probate and estate attorney terms explained:

Estate Planning vs. Probate Administration: What’s the Difference?

The core difference between estate planning and probate is timing. Estate planning is proactive—something you do while alive to control your assets and family’s future. Probate is reactive—a legal process that happens after death to settle the deceased’s affairs. Think of an estate lawyer as an architect designing your legacy’s blueprint, and a probate lawyer as a navigator guiding your family through the journey after you’re gone. This distinction determines the legal tasks involved and the type of probate and estate attorney you need.

| Feature | Estate Lawyer | Probate Lawyer |

|---|---|---|

| Timing | Proactive (during client’s lifetime) | Reactive (after someone’s death) |

| Primary Tasks | Will/Trust creation, POAs, tax planning, incapacity planning, beneficiary designation | Estate administration, asset inventory, debt settlement, beneficiary communication, court filings, dispute resolution |

| Client Focus | Individuals planning for their future and their family’s security | Executors, administrators, heirs, and beneficiaries navigating post-death legal requirements |

The Estate Lawyer: Architect of Your Legacy

An estate lawyer is the architect of your legacy, helping you create a comprehensive plan while you are alive. Their focus is on foresight and prevention, creating a legal framework to protect your family and honor your wishes. Key tasks include:

- Will Creation: Drafting a legal document to distribute assets, name guardians for minor children, and appoint an executor.

- Trust Establishment: Creating trusts, like a revocable living trust, to help assets pass to beneficiaries without court involvement, which saves time, money, and maintains privacy.

- Powers of Attorney: Granting a trusted person authority to make financial or healthcare decisions if you become incapacitated (e.g., Financial Power of Attorney, Advanced Healthcare Directive).

- Tax and Incapacity Planning: Using strategies to minimize estate taxes and planning for long-term care needs.

- Beneficiary Designations: Aligning beneficiary information on life insurance and retirement accounts with your overall plan.

An estate lawyer works with individuals and families planning for the future. An estate plan ensures your assets—no matter the size—go where you want, not where state law dictates.

The Probate Lawyer: Navigator of the Aftermath

After a death, a probate and estate attorney becomes a navigator, guiding the family through the legal process of settling an estate. Their work is administrative, ensuring assets are collected, debts are paid, and the remainder is distributed correctly. Key tasks include:

- Probate Administration: Filing the will and other necessary documents with the court to begin the formal probate process.

- Executor Guidance: Advising the executor on their legal duties and helping them avoid personal liability.

- Asset Inventory and Valuation: Identifying, locating, and appraising all estate assets, from real estate to personal belongings.

- Debt Settlement: Notifying creditors, validating claims, and paying legitimate debts and taxes from the estate.

- Beneficiary Communication: Keeping heirs informed and managing communications to prevent disputes during an emotional time.

- Navigating Intestacy Laws: If there is no will, the attorney guides the process according to state laws that determine how assets are divided.

A probate lawyer serves executors, administrators, and heirs who are navigating the legal and financial aftermath of a loss, aiming to streamline the process and minimize stress.

Why You Need a Professional Probate and Estate Attorney

Handling estate matters alone is risky. The law is intricate, with strict deadlines and technical requirements where simple mistakes can be costly. A probate and estate attorney provides essential guidance for several reasons:

- Avoiding Personal Liability: As an executor, you have fiduciary duties. An attorney helps you avoid errors that could put your personal assets at risk.

- Managing Emotional Stress: Grief can cloud judgment. A professional handles the technical details, allowing you to focus on your family.

- Preventing Family Disputes: An attorney can mediate inheritance disagreements before they escalate or represent your interests if a conflict arises.

- Navigating Court Procedures: Probate is a court-supervised process. An attorney ensures forms are filed correctly and deadlines are met, preventing costly delays.

The High Cost of DIY: Probate Timelines and Expenses

While DIY probate may seem like a way to save money, it often costs more in time, stress, and errors. The process is lengthy; a typical case in California takes 12-16 months, with complex estates lasting years. During this time, assets are frozen.

The financial costs are also substantial. Statutory fees in states like California and Florida can consume 3-5% of the estate’s gross value. For example, a California home valued over $61,500 (regardless of mortgage debt) will likely require probate. Mistakes in valuing assets, notifying creditors, or filing forms can lead to penalties and personal liability for the executor. The cost of a single error can easily exceed the fee for hiring a probate and estate attorney from the outset.

For more detailed information about the probate process, the Guide to wills, estates, and probate court from California’s Judicial Branch offers helpful resources.

When Conflicts Arise: Understanding Probate Litigation

When disputes arise that require court intervention, you enter probate litigation. This is an adversarial process that requires a litigation attorney to fight for your rights. Common disputes include:

- Will Contests: Challenging a will’s validity due to lack of mental capacity, undue influence, or fraud.

- Breach of Fiduciary Duty: Taking legal action against an executor or trustee for mismanaging funds, self-dealing, or failing to inform beneficiaries.

- Asset Division Disputes: Conflicts over how assets should be divided, especially when a will is ambiguous or non-existent (intestacy).

- Guardianship/Conservatorship Disputes: Conflicts over who should care for a minor or incapacitated adult, such as those handled in probate court under Michigan’s appointment of guardians or conservators laws.

- Trust Litigation and Elder Abuse: Challenging a trust’s terms or a trustee’s actions, or addressing cases of financial exploitation of a vulnerable person.

These cases are complex and emotionally draining, often taking months or years to resolve. An experienced probate litigator is essential to investigate claims, negotiate, and represent you in court to protect your rights.

How to Choose the Right Attorney for Your Needs

Choosing the right probate and estate attorney is a critical decision that will significantly impact your experience. The right fit can make a stressful process smoother, while the wrong one can add to your costs and frustration. To find the right fit, do your homework: read reviews, ask for referrals, and trust your instincts during consultations. At WestLoop Law Firm, we believe in a people-first approach, offering clear guidance that makes a difference. The relationship should feel collaborative and supportive.

Key Questions to Ask a Potential Probate and Estate Attorney

A consultation is your opportunity to interview a potential attorney. Come prepared with questions to find the right match.

- Experience and Focus: How long have they practiced probate and estate law? An attorney who focuses on this area will have deeper knowledge than a general practitioner.

- Local Court Familiarity: Do they regularly practice in the specific court handling your case, such as in Houston, Texas? Local knowledge helps steer procedural quirks efficiently, which is vital when you need a Houston probate lawyer for a consultation.

- Estimated Timeline: What is the ballpark timeline for your case? An experienced attorney should be able to provide an estimate, which helps you plan financially and emotionally.

- Case History: Have they handled cases similar to yours? This is especially important for complex matters like estate litigation or if you need a probate challenge lawyer.

- Fee Structure: How do they charge—flat rate, hourly, or a percentage? Clear understanding of fees prevents surprises.

- Communication Style: How will they keep you updated? You need an accessible attorney who explains things clearly. At WestLoop Law Firm, we prioritize responsive, empathetic communication.

Can One Attorney Handle Both Estate Planning and Probate?

Yes, and it’s often beneficial. Many firms, including WestLoop Law Firm, have attorneys skilled in both estate planning and probate. An attorney who drafts your estate plan will already know your wishes, which can streamline the probate process for your executor later.

However, it’s important to ensure their experience matches your current need. Some attorneys focus on planning, while others concentrate on probate administration or litigation. Always ask about their primary practice areas to ensure you’re getting the right attorney for your case.

An attorney who understands both proactive planning and reactive administration offers tremendous value. At WestLoop Law Firm, we provide this comprehensive support, ensuring the plan you create today works as intended tomorrow. This continuity provides your family with a trusted advisor during a difficult time.

Frequently Asked Questions about Probate Law

We know that dealing with probate and estate matters can feel overwhelming, especially when you’re already coping with the loss of a loved one or trying to plan for your family’s future. Over the years, we’ve noticed that many of our clients in Houston ask similar questions when they first reach out. Let’s address some of the most common concerns we hear.

What happens if someone dies without a will?

When someone dies without a will (intestate), the state, not the deceased, decides how assets are distributed. The estate still goes through probate, but the court follows Texas intestacy laws to divide property among relatives. A court-appointed administrator, rather than a chosen executor, manages the estate. This process is often longer, more complicated, and more likely to cause family disputes. For minor children, the court also decides on guardianship. Creating a will is the only way to ensure your wishes are followed.

Can probate be avoided?

Yes, with proper estate planning, probate can often be avoided or simplified. A probate and estate attorney can help you use several tools:

- Revocable Living Trust: Assets in a trust pass directly to beneficiaries, bypassing the court system entirely. This saves time, money, and maintains privacy.

- Beneficiary Designations: Naming beneficiaries on life insurance, 401(k)s, and IRAs allows those assets to transfer outside of probate.

- Joint Ownership: Property owned jointly with rights of survivorship automatically passes to the surviving owner without court involvement.

While Texas offers simplified procedures for small estates, a modest home can easily exceed the limits. Planning ahead is the most effective way to avoid probate.

How long do I have to contest a will?

The time to contest a will or trust is strictly limited by law. Once the deadline, known as the statute of limitations, passes, you lose your right to challenge, even with valid reasons. These timeframes vary by state and the nature of the claim. For example, in some jurisdictions, you may have as little as 120 days from receiving notice to contest a trust.

Because these deadlines are so short and unforgiving, it is critical to act quickly. If you suspect undue influence, fraud, mismanagement by an executor, or any other issue, contact a probate and estate attorney immediately. Waiting too long could mean losing your chance to protect your rights and your loved one’s true wishes.

At WestLoop Law Firm, we understand that these matters are about more than just legal deadlines and procedures. They’re about protecting your family, honoring your loved one’s memory, and ensuring that justice is done. We’re here to guide you through every step with the experience and compassion you deserve.

Conclusion: Secure Your Legacy and Protect Your Family

Navigating estate planning and probate law can be complex, but you don’t have to do it alone. We’ve covered the key differences between proactive estate planning (designing your legacy with a will or trust) and reactive probate administration (settling an estate after death). When disputes arise, a probate litigation attorney is needed to protect your rights.

The value of professional guidance is immense. Proper planning can help avoid a lengthy and costly probate process, which can take over a year and consume up to 5% of an estate’s value. An experienced attorney provides peace of mind during an emotional time.

At WestLoop Law Firm, we help Houston families steer these critical moments with experience and compassion. We understand the local Texas courts and believe in a people-first approach. Whether you are planning your future or settling a loved one’s estate, taking action now is a gift to your family.

Contact a Houston probate lawyer for a consultation today. Let us help you secure your legacy and protect your family.