Estate planning for high net worth 2026: Secure Future

Why Estate Planning for High Net Worth Families in Houston Demands a Unique Approach

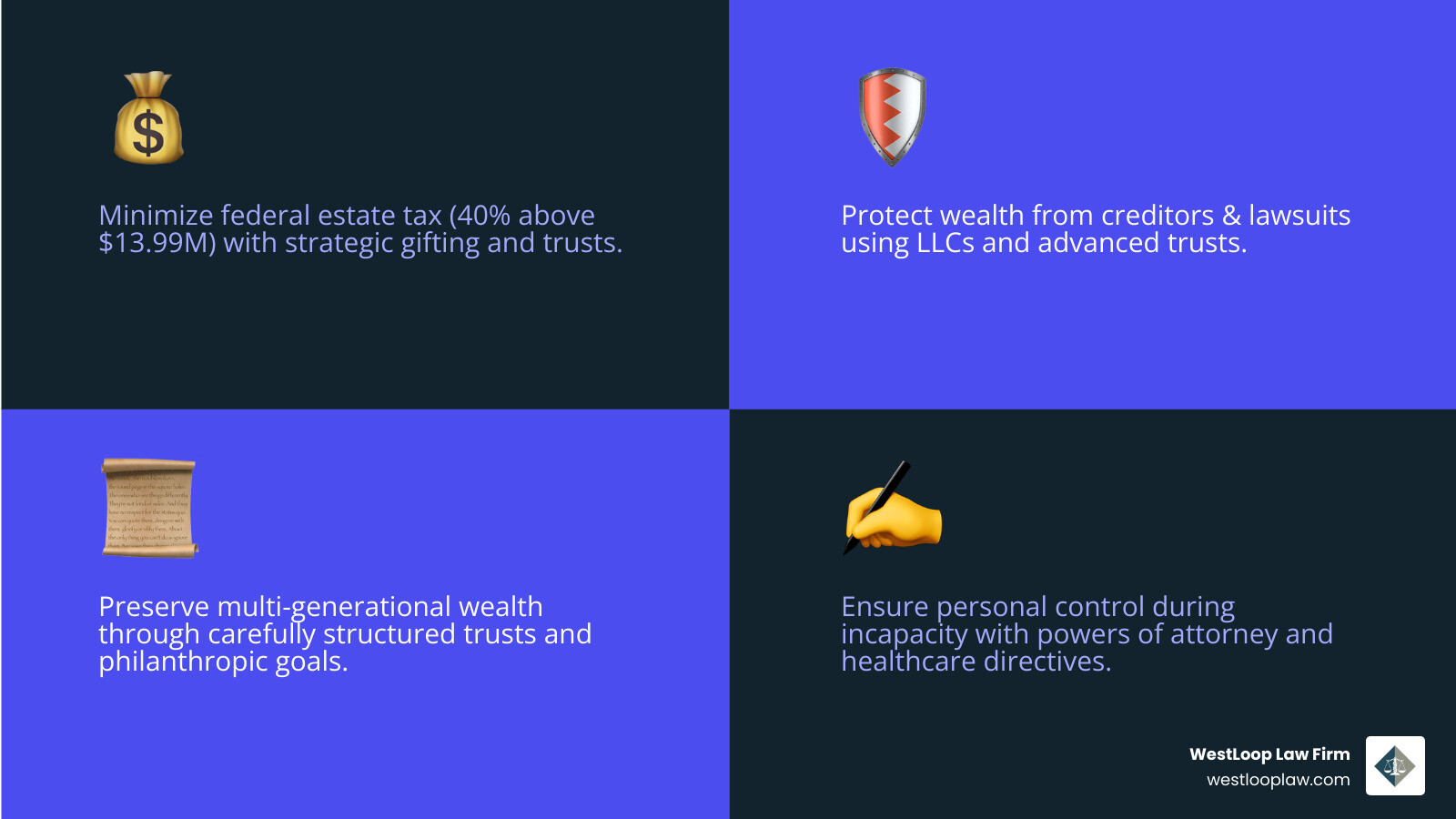

Estate planning for high net worth individuals in Houston involves more than a simple will. With significant assets, your estate faces unique challenges requiring sophisticated strategies to protect wealth, minimize taxes, and secure your legacy.

Core High-Net-Worth Estate Planning Strategies in Houston:

- Tax Minimization: Use lifetime gifting, irrevocable trusts, and charitable strategies to reduce estate tax exposure.

- Asset Protection: Shield wealth from creditors and lawsuits through LLCs and trusts.

- Business Succession: Implement buy-sell agreements for Houston-based business interests.

- Incapacity Planning: Establish powers of attorney and healthcare directives.

- Legacy Preservation: Create trusts to protect assets across multiple generations.

For Houston families, improper planning can lead to a 40% federal tax on assets above the exemption, and your holdings in the Energy Corridor or River Oaks could be vulnerable to disputes in Harris County Probate Court.

The current federal estate tax exemption of $13.99 million per person is set to drop to around $7 million in 2026. This creates a narrow window for Houston families to use strategies that lock in today’s favorable tax environment. Affluent families must steer complex trust structures, business succession, and asset protection for holdings like commercial real estate, private equity, and art collections, which require specific legal knowledge.

Estate planning for high net worth terms you need:

Why High-Net-Worth Estate Planning in Houston is a Different Ballgame

For Houston families with significant assets, estate planning for high net worth is about strategic preservation, protection, and legacy transfer. The complexity grows with the value of your estate, demanding a forward-thinking approach beyond simple asset distribution. Learn more about how we assist Houstonians on our Estate Planning Houston page.

The Primary Goals of Affluent Estate Planning

The main objectives of estate planning for high net worth individuals include:

- Minimizing Tax Burdens: Reducing federal estate and gift taxes is critical, especially with a 40% tax rate on assets over the exemption.

- Protecting Wealth: Shielding assets from potential lawsuits, creditors, and divorce proceedings is a priority for high-net-worth individuals.

- Ensuring a Smooth Transition of Assets: A key goal is a private, seamless transfer of assets, avoiding the public probate process in Harris County Probate Court.

- Planning for Personal Incapacity: A robust plan must include provisions for managing your financial and medical affairs if you become unable to do so.

- Fulfilling Philanthropic Goals: We can integrate charitable strategies to support causes you care about while gaining potential tax benefits.

This approach secures your family’s future and peace of mind. For more on this, see our resource on Protecting Family Future: The Importance of Estate Planning.

How Planning Differs for High-Net-Worth Houstonians

Estate planning for high net worth individuals in Houston is distinct due to:

- Federal Estate Tax Exposure: Houstonians with estates over the federal exemption ($13.99 million per person in 2025) face a 40% tax, requiring advanced reduction strategies.

- Complex Asset Portfolios: Wealth often includes business interests in the Energy Corridor, real estate, art, and private equity, each with unique transfer rules.

- Higher Litigation Risk: Affluent individuals and business owners face a greater risk of lawsuits, making asset protection crucial.

- Need for Advanced Trusts: Simple wills are insufficient. Sophisticated trusts are needed for tax efficiency, asset protection, and multi-generational wealth transfer.

- International Assets: Holdings or family abroad add complexity, requiring knowledge of foreign tax laws.

A custom strategy is essential. To understand common challenges in Houston, read our article on Common Issues & Solutions in Houston Estate Planning.

The Tax Man Cometh: Minimizing Estate Taxes for Large Houston Estates

Minimizing taxes is a cornerstone of estate planning for high net worth individuals in Houston. With the federal estate tax looming, strategic planning is essential.

Understanding the Federal Estate & Gift Tax Landscape

The federal estate tax is a major concern for affluent Houston families. Key points include:

- Current Federal Exemption: In 2025, the exemption is $13.99 million per person, allowing significant tax-free wealth transfer.

- 2026 Sunset Provision: This exemption is set to drop to about $7 million in 2026, creating urgency for planning.

- 40% Federal Tax Rate: Assets exceeding the exemption are taxed at a hefty 40%.

- Annual Gift Exclusion: You can gift up to $19,000 per recipient annually (in 2025) without using your lifetime exemption.

- Spousal Portability: A surviving spouse can use the deceased spouse’s unused exemption, but it must be claimed on an estate tax return (Form 706) within five years.

For more on gifting, see our resource on Lifetime Gifts and the Annual Gift Tax Exclusion.

State-Level Taxes: The Texas Advantage and Beyond

- Texas’s Lack of State Estate Tax: Houstonians benefit as Texas does not have a state estate or inheritance tax.

- Planning for Out-of-State Assets: If you own property in states with estate or inheritance taxes, your plan must account for those jurisdictions. A map of states that levy such taxes shows where this may apply.

Our Houston team can help steer these state-specific issues. For guidance, see our Estate Tax Attorney Houston page.

Advanced Tax-Reduction Strategies

Sophisticated strategies are key to estate planning for high net worth individuals:

- Irrevocable Life Insurance Trusts (ILITs): An ILIT owns your life insurance policy, excluding the death benefit from your taxable estate.

- Grantor Retained Annuity Trusts (GRATs): A GRAT transfers appreciating assets to a trust, allowing growth to pass to beneficiaries free of estate tax.

- Family Limited Partnerships (FLPs): FLPs consolidate family assets, allowing you to gift ownership interests at a discounted valuation to reduce your taxable estate. Learn more about Family Limited Partnerships (FLPs) in Texas Estate Planning.

- Intentionally Defective Grantor Trusts (IDGTs): An IDGT removes assets from your estate for tax purposes while you pay the income tax, allowing the trust to grow tax-free for beneficiaries.

- Charitable Giving: Strategies like Charitable Remainder Trusts (CRTs) and Donor-Advised Funds (DAFs) can reduce your taxable estate while supporting causes you care about.

These complex strategies require careful implementation. Find out more about Tax Saving Estate Planning: Maximizing Benefits.

Building Your Legacy Fortress: Advanced Estate Planning for High Net Worth Houstonians

For Houston’s affluent families, building a lasting legacy means safeguarding wealth and ensuring its responsible transfer through trusts, asset protection, and succession planning.

| Feature | Revocable Trust | Irrevocable Trust |

|---|---|---|

| Control | Grantor retains full control; can amend/revoke | Grantor relinquishes control; generally unchangeable |

| Tax Impact | Assets included in taxable estate | Assets removed from taxable estate |

| Asset Protection | No protection from creditors | Strong protection from creditors/lawsuits |

| Probate Avoidance | Yes | Yes |

| Flexibility | High | Low |

The Central Role of Trusts

Trusts are the workhorses of estate planning for high net worth. They hold assets for beneficiaries and offer flexibility.

- Revocable Living Trusts: These avoid the public probate process in Harris County Probate Court and provide for management if you become incapacitated.

- Irrevocable Trusts: These are key for tax minimization and asset protection, as assets are removed from your taxable estate and shielded from creditors.

- Dynasty Trusts: These trusts preserve wealth for multiple generations, leveraging the generation-skipping transfer (GST) tax exemption.

- Spousal Lifetime Access Trusts (SLATs): A SLAT allows one spouse to make a gift into a trust for the other spouse, removing assets from their combined estates while maintaining indirect access. This is a powerful tool to use the current high federal exemption before it potentially drops in 2026.

Properly funding a trust is critical. Explore options on our Houston Estate Planning Trust Structures page.

Asset Protection: Shielding Your Wealth

High-net-worth individuals are often targets for lawsuits. Proactive asset protection is essential.

- Using LLCs for Rental Properties: Placing Houston rental properties, such as those in The Heights, into separate LLCs segregates liability.

- Segregating Assets: Maintain a clear separation between personal and business assets to protect your personal estate.

- Prenuptial Agreements: These are vital for protecting pre-marital or inherited wealth from divorce proceedings.

- Insurance Coverage: High-limit umbrella liability policies provide an extra layer of protection.

Our article on Family Limited Partnerships (FLPs) in Texas Estate Planning details how these entities can also aid in asset protection.

Integrating Business Succession and Philanthropy

Estate planning for high net worth must integrate business and charitable goals.

- Business Succession Planning: A formal plan ensures business continuity. This includes buy-sell agreements, which predetermine how ownership is transferred, and leadership transition plans. Learn more at Estate Planning for Small Business Owners.

- Charitable Giving: Integrating philanthropy can provide tax benefits. Strategies include Charitable Remainder Trusts (CRTs), Donor-Advised Funds (DAFs), and private family foundations. For more, visit Charitable Giving Houston: Incorporating Philanthropy into Your Estate Plan.

Beyond the Balance Sheet: Planning for Incapacity, Heirs, and the Future in Houston

Estate planning for high net worth goes beyond assets to include planning for incapacity, preparing heirs, and maintaining the plan’s relevance.

Preparing for Incapacity: Your Voice When You Don’t Have One

Planning for potential incapacity is a critical part of any Houston estate plan. Key documents include:

- Durable Power of Attorney (DPOA): Appoints an agent to make financial decisions if you become unable to do so.

- Medical Power of Attorney (MPOA): Designates an agent for healthcare decisions, which is vital in facilities like Houston Methodist or Texas Medical Center.

- Living Will (Advance Directive): States your wishes for end-of-life medical treatment.

- HIPAA Release: Allows your agents to access your medical information to make informed decisions.

Without these, a court may appoint a guardian, a costly and public process. Learn more about Power of Attorney: Managing Financial & Medical Affairs.

Ensuring Responsible Stewardship by Heirs

To ensure heirs become responsible stewards of wealth, consider these strategies:

- Incentive Trusts: These can be structured to encourage positive behaviors, such as educational achievements or matching earned income.

- Staggered Distributions: Inheritances can be distributed in stages (e.g., at ages 25, 30, and 35) to allow beneficiaries to gain financial experience.

- Financial Education: Proactively educating heirs about financial management is invaluable.

- Family Mission Statements: Creating a statement can provide a guiding philosophy for how inherited wealth should be used.

For more on this topic, see Family Matters: Houston Estate Planning Attorneys on Inheritance Planning.

The Importance of Regular Reviews

Your estate plan is a living document that requires regular reviews, especially for high-net-worth individuals in Houston.

- Why Review? Life changes, tax laws shift (like the impending 2026 exemption change), and asset values fluctuate. An outdated plan can be as problematic as no plan.

- Triggers for Review: Major life events like marriage, divorce, birth, death, significant wealth changes, or moving to another state demand a plan review.

- Recommended Frequency: We recommend reviewing your estate planning for high net worth every 2-3 years to ensure it remains aligned with your goals and current laws.

Regular maintenance helps avoid costly mistakes. Learn what to avoid in our guide to Houston Estate Planning Mistakes to Avoid.

Frequently Asked Questions about High-Net-Worth Estate Planning in Houston

How do billionaires avoid estate taxes?

There is no single trick. It involves a lifetime of legal strategies to minimize estate taxes. These include maximizing lifetime gifts, using the annual gift exclusion, and transferring assets with the lifetime gift exemption. They also use advanced trusts like GRATs and ILITs to remove appreciating assets from their estate, leverage valuation discounts with FLPs, and engage in significant charitable giving through foundations and charitable trusts.

What are the most common misconceptions about high-net-worth estate planning?

Common myths about estate planning for high net worth that lead to errors include:

- “A will controls everything.” Not always. Beneficiary designations on accounts like IRAs and life insurance policies often override a will.

- “Creating a trust protects my assets.” A trust is only effective once it is properly “funded” by transferring assets into it.

- “Estate planning is a one-time task.” This is false. Plans must be reviewed every 2-3 years and updated for changes in laws, finances, and life events.

- “It’s only about death and taxes.” A complete plan also covers potential incapacity, ensuring your medical and financial wishes are followed.

- “My spouse automatically gets my unused tax exemption.” No. The surviving spouse must file an estate tax return (Form 706) to claim the deceased spouse’s unused exemption (a provision known as portability).

What are the benefits of working with a Houston probate and estate planning attorney?

Working with a knowledgeable Houston attorney provides several benefits for high-net-worth individuals:

- Navigating Complexity: We guide you through evolving federal and Texas laws to ensure your plan is effective.

- Customized Strategies: We develop strategies custom to your unique finances, family dynamics, and goals, from business interests in the Galleria area to real estate holdings.

- Preventing Disputes: A well-drafted plan can prevent costly disputes in Harris County Probate Court.

- Tax Efficiency: We help implement advanced strategies to minimize federal estate taxes, especially with the potential 2026 exemption changes.

- Asset Protection: We integrate strategies to shield your wealth from creditors and lawsuits.

- Team Coordination: We work with your financial advisors and accountants to create a cohesive plan.

Secure Your Houston Legacy Today

Estate planning for high net worth individuals in Houston is a complex but essential journey for securing your family’s future. It requires a focus on tax minimization, asset protection, business succession, and incapacity planning.

The upcoming 2026 reduction of the federal estate tax exemption creates an urgent need to act. Planning now allows you to use current tax laws to your advantage.

At WestLoop Law Firm, we understand the challenges faced by affluent families in Houston. Our team guides you through this process, ensuring your plan is legally sound and aligned with your vision. We can also assist with the probate and estate administration process to see that your plan is executed correctly.

Don’t leave your legacy to chance. To build a strategy that protects your family and assets, learn more about our Houston estate planning law services.