Why Harris County Probate Matters When You’re Already Dealing with Loss

Harris County probate is the legal process for handling a deceased person’s estate in Harris County, Texas. Losing a loved one is hard enough without having to steer complex legal procedures alone.

Quick Overview of Harris County Probate:

- What it handles: Probating wills, administering estates, appointing guardians, and resolving estate disputes

- Where it happens: Five dedicated Probate Courts at 201 Caroline, Houston, TX 77002

- Time limit: Generally 4 years from date of death to probate a will

- Filing fee: $360 for most new estate filings

- Court hours: Monday-Friday, 8:00 AM to 4:30 PM

- Key requirement: Attorneys must file electronically (pro se filers exempt)

Harris County operates five dedicated probate courts that handle everything from simple will probates to complex guardianships. These courts help families steer some of life’s most difficult transitions.

The system can seem overwhelming when you’re grieving and trying to understand legal terms and deadlines. However, understanding the basics can help you make informed decisions about whether you need professional help.

The majority of people offering wills to probate use an attorney to represent them—and for good reason. The Texas Estates Code requires strict compliance, and even small mistakes can cause significant delays or complications.

Understanding the Harris County Probate Courts

Harris County has one of Texas’s most comprehensive probate court systems, with five dedicated probate courts—five of only 24 such courts in the entire state. These courts have the focused knowledge and sensitivity to handle everything from probating a will and dealing with a guardianship to facing complex trust litigation.

Beyond typical decedent’s estates and will probates, they also manage guardianships, mental health proceedings, trust litigation, and even wrongful death cases that intersect with estate matters. This focus helps streamline the process when a family faces multiple legal challenges, such as settling an estate while also establishing guardianship for a surviving relative.

The Court’s Primary Responsibilities

The Harris County Probate Courts have a broad scope of responsibilities. Their primary job is probating wills—validating the document and ensuring the deceased’s wishes are followed.

They also handle administering estates when someone dies without a will (intestate administration), following Texas law to determine who inherits property. A key duty is appointing guardians for minors or incapacitated adults who cannot manage their own affairs.

The courts also oversee fiduciaries (executors, administrators, and guardians) to ensure they act in the best interests of the estate or ward. When family conflicts arise, these courts step in for resolving estate disputes, such as will contests or disagreements among heirs. Finally, they handle mental health commitments, balancing individual rights with the need for court-ordered services.

For more detailed information about how these courts operate, you can learn more about probate court in Houston, Texas.

Key Contacts and Locations for the Harris County Probate Courts

All five Harris County Probate Courts are located in the Harris County Civil Courthouse at 201 Caroline, Houston, TX 77002. The courts are open from 8:00 AM to 4:30 PM, Monday through Friday, but be sure to check the official holiday schedule before visiting.

- Probate Court No. 1: Judge Jerry W. Simoneaux, Jr. (832-927-1401)

- Probate Court No. 2: Judge Pamela Medina (832-927-1402)

- Probate Court No. 3: Judge Jason A. Cox (832-927-1403)

- Probate Court No. 4: Judge James Horwitz (832-927-1404)

The most reliable source for current information is the Official Harris County Probate Courts Directory. This resource provides updated contact information and specific procedural requirements.

The Harris County Probate Process: A Step-by-Step Guide

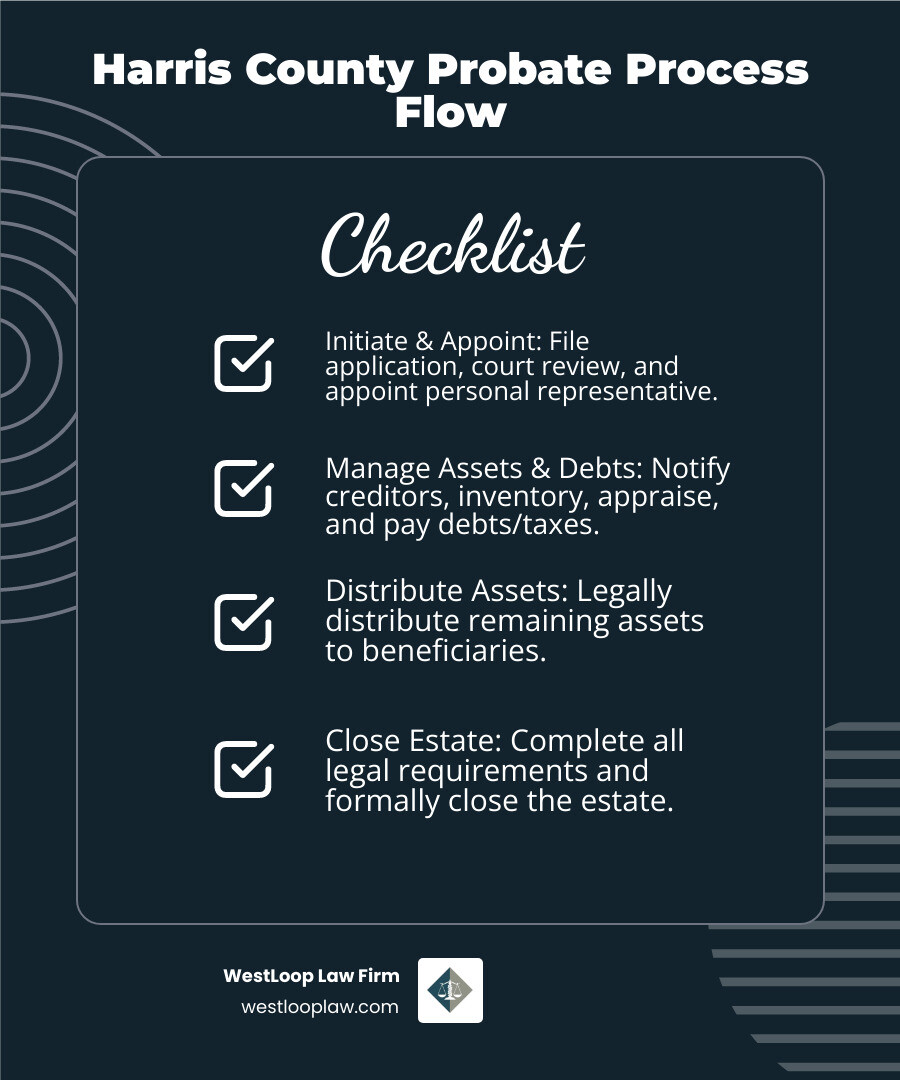

Knowing the steps of the Harris County probate process can help you steer this unfamiliar territory. While every estate is unique, the basic route is consistent. The journey typically starts with filing an application, followed by court hearings. The court then appoints a personal representative (an executor or administrator) to manage the estate. This representative is responsible for notifying creditors, settling debts, and finally, distributing assets to the rightful heirs or beneficiaries.

Initiating a Case: Timelines and First Steps

A crucial deadline that often surprises people is the four-year statute of limitations to probate a will, which starts from the date of death. Missing this deadline can create serious complications for your family, as Letters Testamentary or Administration generally cannot be issued after four years.

Your first step is choosing the right application. This could be an Application for Probate of Will, an Application for Administration (if there’s no will), or a Small Estate Affidavit for smaller, qualifying estates. For incapacity issues, you’ll file Guardianship applications.

It’s important to know that neither the County Clerk nor the Courts provide legal forms. You or your attorney must draft them. For more detailed guidance on legal requirements, check out our information on Probate Laws in Houston, Texas.

E-Filing Mandates and Procedures

Since 2014, attorneys must e-file documents in Harris County probate cases via EFileTexas.gov. If you hire a lawyer, they will handle this for you. Pro se litigants (those representing themselves) are exempt from this mandate but may choose to e-file.

There are exceptions to the e-filing rule. Original wills and bonds must still be submitted in person. An attorney can e-file a copy of the will, but the original document must be delivered to the County Clerk within three business days. The e-filing system is efficient, with a low rejection rate, and documents are considered filed if submitted before midnight on the due date. For more details, visit the Guide to E-Filing in Texas.

Understanding Fees for a Harris County Probate Case

The initial filing fee for most new estates is $360. However, other costs will arise. Letters of Testamentary, Administration, or Guardianship cost $2 each for certified copies, and you will likely need several.

Other potential fees include:

- $25 for an inventory filed more than 90 days late.

- $25 for guardianship annual accounts and $10 for the annual report.

- $10 for claims filed against the estate.

- $8 for citations.

- $750 for Attorney Ad Litem deposits in certain cases.

- $515 to $690 for mental health filings.

Be aware of extra charges, like a $25 fee for documents over 25 pages filed late and a $30 fee for a returned check. You can pay by cash, check, money order, or credit card (with a surcharge for remote payments). For the complete fee schedule, visit the Downloadable Forms and Fee Information from the Harris County Clerk.

The Role of the Harris County Clerk

In the Harris County probate system, it’s important to distinguish between the courts and the Clerk’s office. While judges in the Probate Courts make legal decisions, the Harris County Clerk’s office manages the administrative side. They are responsible for filing your documents, maintaining all court records, and issuing official letters needed to manage estate business.

Crucially, the Clerk’s staff cannot give you legal advice. They can explain filing procedures and costs but cannot advise on which documents to file or how to complete them. They are administrative professionals, not attorneys.

Accessing Records and Ordering Documents

Harris County provides convenient online access to many probate records, reducing the need for in-person visits. Most e-filed documents are available for viewing and printing (with a watermark) for free within minutes of being accepted by the court.

When you need official copies, you have several options. You can purchase non-certified copies online to be emailed to you. However, for a certified copy with a raised seal, which some institutions require, you must visit the Clerk’s office in person or order by mail or fax.

The Search Harris County Probate Records Online portal is the best starting point for most document searches. For documents not found online, you can visit the Clerk’s office or submit a request by mail or fax. Your attorney will typically handle these requests, but if you are representing yourself, knowing how to access records is key to staying organized.

Navigating the System: Remote Hearings and Legal Help

Harris County probate courts have adapted to modern technology, making the system more accessible. Understanding these procedures, such as virtual hearings, can reduce stress during a difficult time. However, technology doesn’t simplify the complex legal requirements of probate law, which is why knowing when to seek professional help is crucial.

Participating in Virtual Court Proceedings

Many Harris County probate hearings now occur via Zoom, saving families the stress of traveling to the courthouse. The courts provide resources to help, such as Probate Court 1’s Video Guide on Using Zoom in Probate Court, which covers basics and digital evidence management.

Each court has its own rules for remote appearances. For instance, Probate Court No. 4 may require clients to be physically present in their attorney’s office during Zoom hearings to ensure procedural integrity. Some courts also offer live streams on YouTube, allowing family members to observe hearings remotely.

Successful virtual participation requires preparation: a stable internet connection, a quiet space, and familiarity with Zoom. Always test your setup before the hearing.

Resources for Pro Se Litigants

A “pro se litigant” is someone who represents themselves in court without an attorney. While this is your right in a Harris County probate case, it’s important to understand the challenges. Probate law is highly technical, and the Texas Estates Code requires strict compliance. Even small mistakes can lead to significant delays and costs.

The County Clerk’s office cannot provide legal advice or legal forms. While the County Law Library is a useful resource, understanding legal procedures and implementing them correctly are very different tasks. Guardianship cases are particularly technical and demand precise compliance.

Most people who attempt to handle probate pro se find that the potential cost of mistakes outweighs the expense of hiring a professional. There are significant Benefits of Working with a Probate Lawyer in Houston. Consider that the majority of people in Harris County hire legal counsel because they understand that getting it right the first time is a worthwhile investment.

Frequently Asked Questions about the Probate Process

When you’re dealing with the loss of a loved one, the Harris County probate process can be confusing. Here are answers to the questions we hear most often.

How long do I have to probate a will in Harris County?

You generally have a strict four-year deadline from the date of death to file an application to probate a will. After four years, obtaining Letters Testamentary becomes extremely difficult.

While exceptions for “good cause” exist, they are challenging to prove and legally complex. Missing the deadline can result in higher legal fees, more complex court proceedings, or even the complete inability to probate the will. Once an estate is opened within the four-year window, however, there is no time limit for how long it can remain open to settle all matters.

Do I need an attorney for probate in Harris County?

Legally, you can represent yourself (pro se), but the vast majority of people who successfully probate a will in Harris County hire an attorney. The Texas Estates Code is incredibly technical and demands strict procedural compliance that is not intuitive to non-lawyers.

The County Clerk’s office cannot provide legal advice. An experienced attorney helps you avoid common pitfalls that can delay or derail your case. They know the court’s expectations and how to handle unexpected complications. If you anticipate a dispute, a Probate Challenge Lawyer in Houston, TX is even more critical. Hiring an attorney is an upfront cost that often prevents more expensive problems later.

How much does it cost to start a probate case?

The initial court filing fee for most Harris County probate cases is $360. However, this is just the beginning. Additional costs include:

- Certified copies of Letters ($2 each), needed for banks and other institutions.

- Citation fees ($8 each) to notify interested parties.

- Publication costs to notify creditors.

- Attorney ad litem deposits for cases involving minors or incapacitated persons.

Attorney fees will likely be the largest expense. Costs vary greatly depending on the estate’s complexity. A simple, uncontested probate will cost far less than a case involving business interests or family disputes.

Conclusion

Navigating Harris County probate while grieving is a significant challenge. From understanding the five dedicated Probate Courts and the four-year filing deadline to managing e-filing and fees like the initial $360 filing fee, the process can feel overwhelming.

Probate law is complex by design to protect vulnerable people and honor a decedent’s final wishes. This complexity is why preparation and understanding the system are so important.

While you can represent yourself, most people choose to work with an attorney. Small procedural mistakes can lead to major delays, extra costs, and unnecessary stress. An experienced probate attorney provides guidance and peace of mind, helping you avoid pitfalls and ensuring the process is handled correctly.

At WestLoop Law Firm, we understand that every family’s situation is unique. Our team combines experience in both personal injury and probate law, providing comprehensive support whether you’re dealing with a wrongful death claim or need guidance through estate administration.

You don’t have to steer this alone. We’re here to help you through each step.

Contact an experienced Harris County Probate Attorney for a consultation