Finding Peace During Probate: Houston’s Legal Guides

A Houston probate attorney is a legal professional who specializes in guiding families through the court-supervised process of validating wills, distributing assets, and settling estates in Harris County and surrounding areas. If you’re searching for qualified probate assistance in Houston, here’s what you need to know:

Quick Guide to Houston Probate Attorneys:

- Average Cost: $3,000-$9,500 (flat fees common)

- Typical Timeline: 1-3 months for uncontested cases

- Court Filing Fees: $700-$1,600

- Board Certification: Few attorneys have this special credential

- Small Estate Option: Available for estates under $75,000

When a loved one passes away, the last thing you want to worry about is navigating complex legal procedures. Yet probate—the court process that validates a will and oversees asset distribution—is often unavoidable during an already difficult time.

“The time when a family has suffered the loss of a loved one is not the time to suffer a financial loss also,” notes one experienced Houston probate attorney, highlighting why many firms now offer flat fee arrangements rather than unpredictable hourly billing.

Most Houston probate attorneys offer free initial consultations and can help with:

- Validating and executing wills

- Administering estates with or without a will

- Handling real estate transfers

- Representing clients in probate court

- Managing creditor claims and disputes

Whether you’re dealing with a straightforward will execution or complex family disagreements, finding the right legal partner can transform a potentially stressful process into a manageable one.

Many Houston probate attorneys now provide innovative client portals that allow you to track case progress, upload documents, and complete routine tasks without unnecessary attorney fees for administrative work.

Find more about Houston probate attorney:

- Probate court Houston Texas

- estate law attorney near me

- estate litigation lawyer in texas

- Understanding the probate process

Understanding the Role of a Houston Probate Attorney

When a loved one passes away in Texas, families often face the complex legal process known as probate. This procedure validates wills, settles debts, and ensures assets reach their rightful beneficiaries. During such an emotionally challenging time, a Houston probate attorney becomes not just helpful, but essential.

At WestLoop Law Firm, we recognize that grief and legal paperwork make for an overwhelming combination. Our attorneys serve as compassionate guides through this unfamiliar terrain, helping executors fulfill their duties properly while ensuring beneficiaries receive what they’re entitled to.

What Does a Houston Probate Attorney Do?

A Houston probate attorney wears many hats throughout the probate journey. We start by carefully examining the will to confirm it meets all Texas legal requirements—proper signatures, witness attestations, and formal execution. This validation process forms the foundation of everything that follows.

In Harris County Probate Court, we stand beside executors and administrators, handling all necessary filings and court appearances so you don’t have to steer these waters alone. We help identify and catalog all estate assets, creating the comprehensive inventory Texas requires within 90 days of appointment.

“The relief I felt having someone who knew exactly what papers to file and when was immeasurable,” shared one client. “What seemed like an impossible mountain of paperwork became manageable steps with proper guidance.”

Debt resolution represents another critical function—we help executors properly notify creditors and resolve valid claims against the estate. Once debts are settled, we ensure assets reach beneficiaries according to the will’s instructions or, if no will exists, following Texas intestate succession laws.

When disagreements arise—as they sometimes do during emotional times—we provide skilled mediation and litigation services to resolve disputes between beneficiaries or challenges to the will’s validity. Our fiduciary duty remains protecting the estate and honoring the deceased’s wishes throughout the process.

When Is Probate Required in Texas?

Not every estate needs to go through full probate. In Texas, probate typically becomes necessary when:

- The deceased owned property solely in their name

- Assets exceed $75,000 (excluding homestead property)

- Real estate transfers to heirs are needed

- Outstanding debts require formal resolution

“About 90% of probate cases hinge on real estate,” notes our experienced Houston probate attorney. “If property’s involved, some form of probate is almost always necessary.”

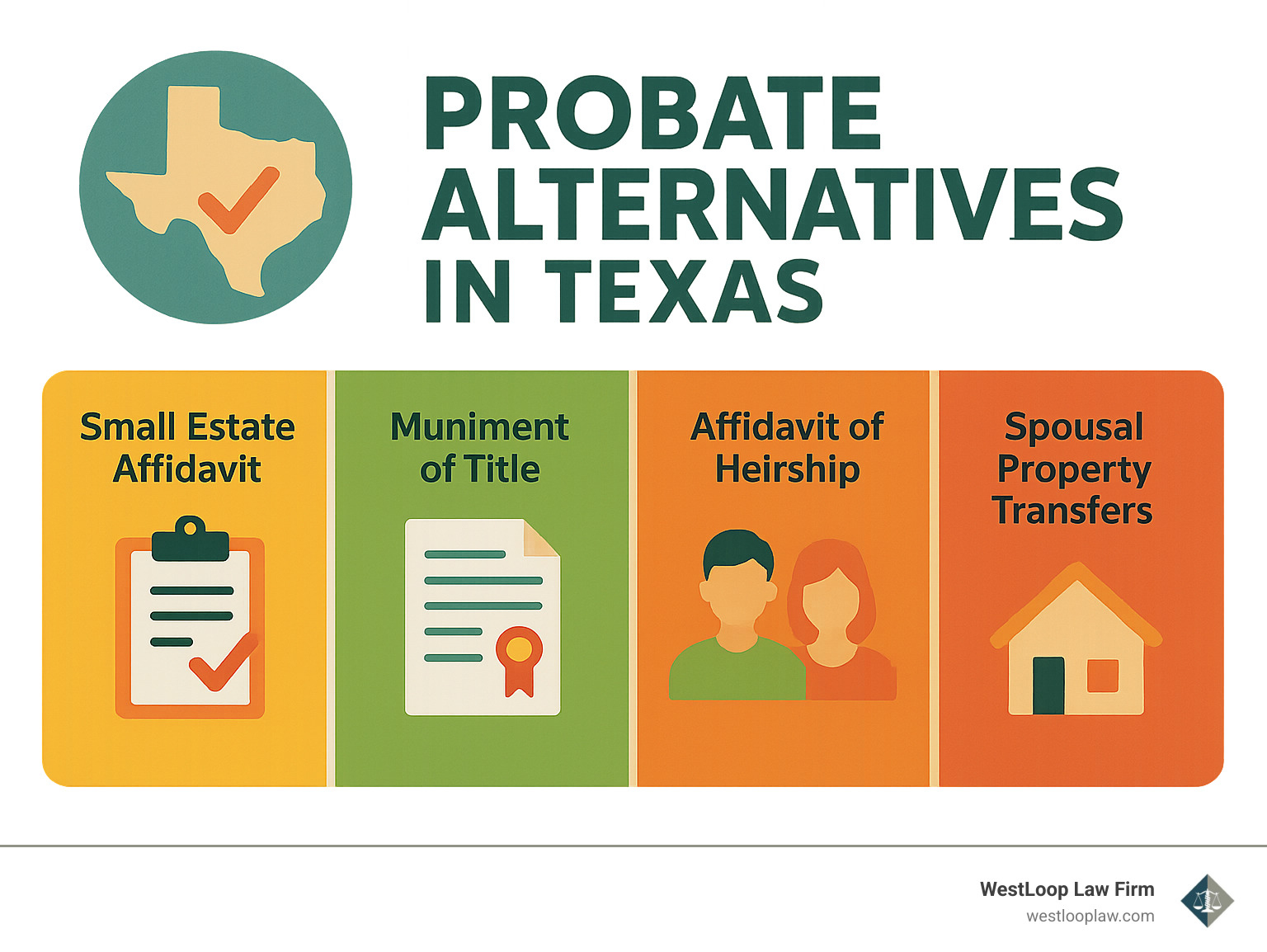

For smaller estates valued under $75,000 (excluding homestead), a Small Estate Affidavit often provides a simpler alternative. This streamlined procedure allows heirs to collect assets without going through full probate administration.

Another efficient option is Muniment of Title, which works well when a valid will exists, no unpaid debts remain (except those secured by real estate), Medicaid has no claims against the estate, and no formal administration is needed. This process focuses primarily on transferring property titles to the new owners.

Texas law also recognizes community property principles, which can significantly impact how assets are distributed, especially for married individuals. Understanding these nuances is where professional guidance proves invaluable.

Can Probate Be Avoided?

While sometimes necessary, many Houston residents prefer to minimize or completely avoid probate. Several effective strategies exist for bypassing this process:

Revocable living trusts offer perhaps the most comprehensive solution. Assets placed in trusts pass directly to beneficiaries without court involvement. For real estate specifically, transfer-on-death deeds allow property to change hands automatically upon death, a tool Texas law specifically authorizes.

Joint tenancy with right of survivorship arrangements mean property automatically transfers to the surviving owner when one passes away. Similarly, beneficiary designations on life insurance, retirement accounts, and certain financial instruments allow these assets to pass directly to named individuals.

Many banks offer payable-on-death accounts that function similarly, transferring funds to designated beneficiaries without probate intervention.

At WestLoop Law Firm, we help clients implement these strategies during comprehensive estate planning, potentially saving their loved ones significant time, money, and emotional stress down the road. While planning for the inevitable isn’t always comfortable, the peace of mind it provides proves invaluable.

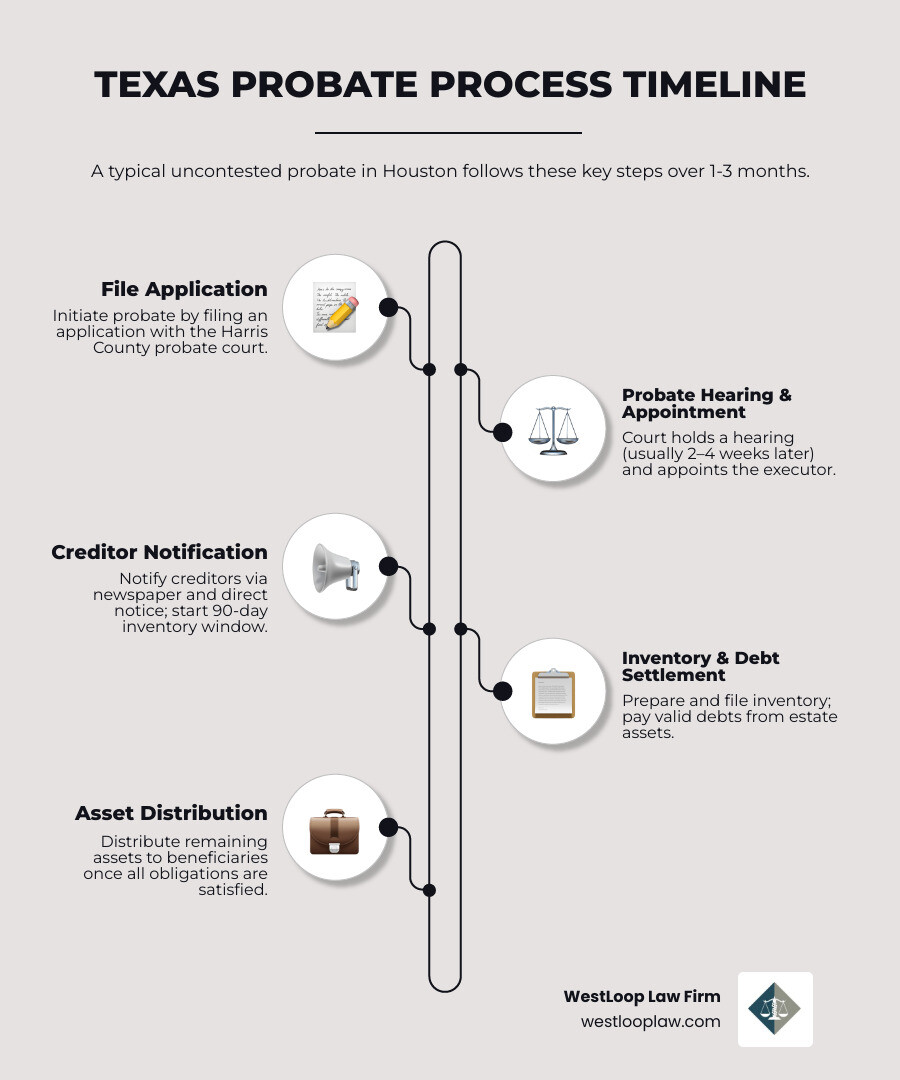

The Texas Probate Process: A Houston Roadmap

Navigating probate in Houston requires understanding the specific procedures of Harris County Probate Courts. Here’s a clear roadmap of what to expect when working with a Houston probate attorney from WestLoop Law Firm:

- Initial Filing: We prepare and file the application for probate with the appropriate Harris County Probate Court, along with the original will (if one exists).

- Waiting Period: Texas law requires a mandatory waiting period of approximately two weeks before a hearing can be scheduled.

- Probate Hearing: We attend court with the executor to prove the will’s validity or establish heirship if no will exists. This hearing is typically brief and straightforward in uncontested cases.

- Executor Appointment: The court officially appoints the executor or administrator and issues Letters Testamentary or Letters of Administration, which grant legal authority to act on behalf of the estate.

- Notice to Creditors: We publish required notices to creditors in local newspapers and directly notify known creditors.

- Estate Inventory: Within 90 days of appointment, we help prepare a comprehensive inventory of all estate assets for court filing.

- Debt Settlement: Valid creditor claims are paid from estate assets.

- Asset Distribution: Remaining assets are distributed to beneficiaries according to the will or Texas intestate succession laws.

- Final Accounting: In dependent administrations, we prepare a final accounting for the court; in independent administrations, this step is often simplified.

“Texas probate law provides for independent administration in most cases, which significantly streamlines the process compared to many other states,” explains a senior attorney at WestLoop Law Firm. “This means less court supervision and greater efficiency.”

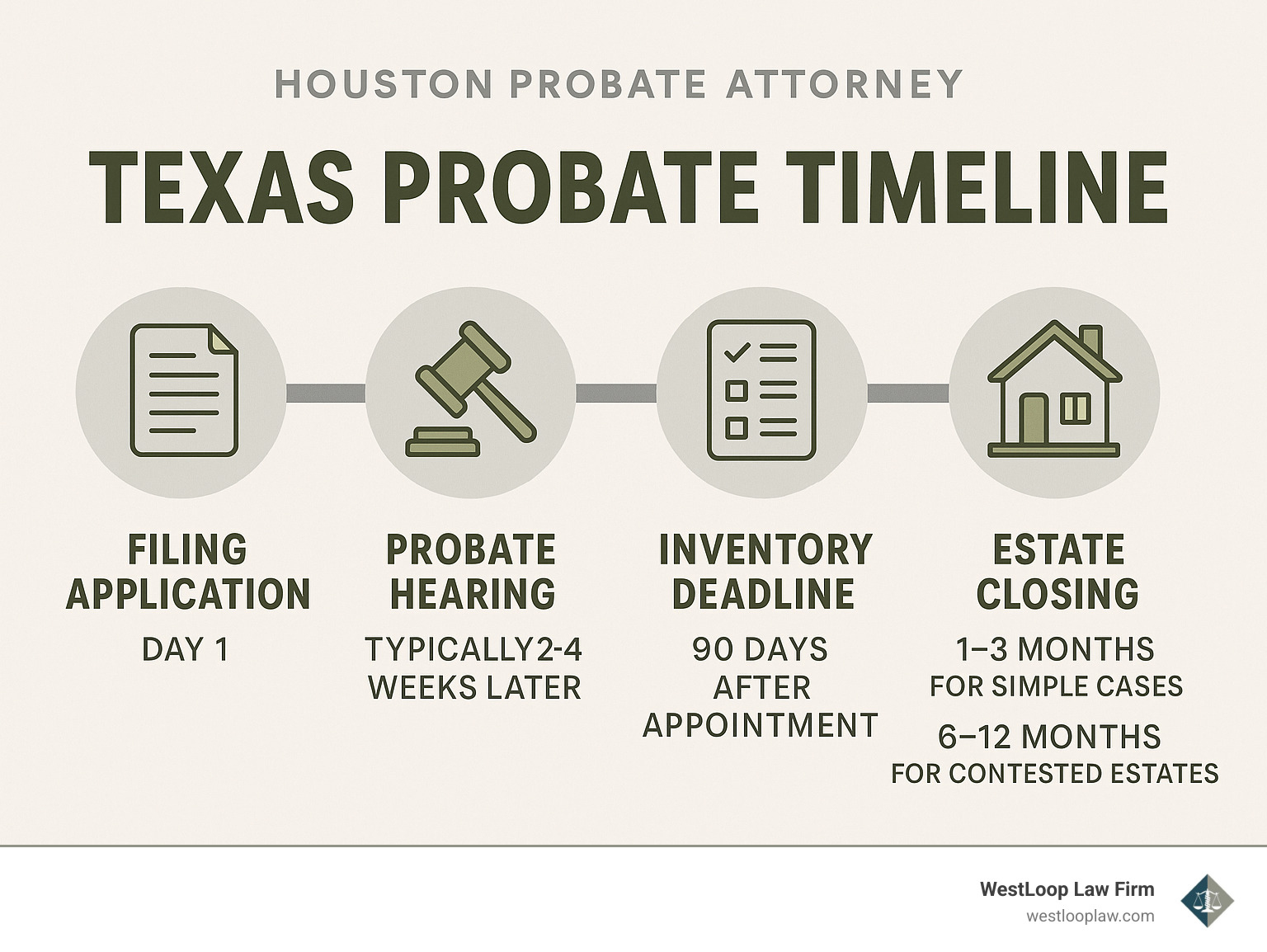

Step-by-Step Timeline (1-3 Months Typical)

For uncontested probates in Houston, the timeline typically follows this pattern:

- Day 1: Application filing date

- Weeks 2-4: Probate hearing and executor appointment

- Week 4-8: Inventory preparation and creditor notification

- Day 90: Deadline for filing inventory with the court

- Months 1-3: Asset distribution for simple estates

- Months 6-12: Completion for more complex estates

Factors that can extend this timeline include:

- Will contests or beneficiary disputes

- Complex or hard-to-value assets

- Outstanding tax issues

- Creditor claims requiring litigation

- Real estate that needs to be sold

Out-of-State Executors & Remote Filings

Living outside of Texas doesn’t prevent you from serving as an executor. As experienced Houston probate attorneys, we regularly assist out-of-state executors with:

- Appointing a registered agent in Texas (required for non-resident executors)

- Handling court appearances via virtual hearings when possible

- Conducting consultations by phone or video conference

- Managing document signing through secure electronic means

- Filing court documents by mail when in-person appearance isn’t necessary

“With today’s technology, we can handle most aspects of probate remotely,” notes our senior probate counsel. “We’ve helped executors from California to New York administer Texas estates without requiring multiple trips to Houston.”

Choosing the Best Probate Lawyer in Houston – Insider Criteria

Finding the right Houston probate attorney isn’t just about picking a name from search results. It’s about finding someone who’ll guide you through one of life’s most challenging transitions with both expertise and heart.

At WestLoop Law Firm, we’ve noticed clients feel most confident when their attorney meets certain key criteria. Board certification in estate planning and probate law stands at the top of this list – it’s a rare credential that shows an attorney has gone the extra mile to demonstrate specialized knowledge. As our lead counsel often says, “This certification isn’t just another framed document on the wall – it represents hundreds of hours of focused study and proven expertise.”

The ideal attorney also knows the ins and outs of Harris County’s probate courts. Each court has its own personality, with judges who have distinct preferences and procedures. An attorney who regularly works these courts can steer them efficiently, potentially saving you months of unnecessary waiting.

Fee transparency has become increasingly important to families. Many clients tell us the last thing they wanted during grief was financial uncertainty. That’s why many Houston probate attorneys now offer clear flat fees rather than the traditional hourly billing that can lead to unwelcome surprises.

During emotional times, communication style matters tremendously. Legal jargon can feel overwhelming when you’re already stressed, so look for an attorney who explains complex concepts in plain language. As one client recently told us, “I didn’t need more confusion – I needed someone who could make this make sense.”

Modern firms now offer secure client portals where you can check case progress, upload documents, and complete tasks independently. This technology not only keeps you informed but can also reduce your overall costs.

Perhaps most importantly, the best Houston probate attorney combines legal expertise with genuine compassion. Probate happens during a difficult time, and an attorney who acknowledges the human side of this process can make a world of difference.

Key Questions to Ask a Houston Probate Attorney

When you sit down for that initial consultation, come prepared with questions that will reveal whether this attorney is truly the right fit. Ask about their fee structure – do they charge by the hour or offer predictable flat fees? What exactly is included, and what might cost extra?

Inquire about their experience: “How many probate cases like mine do you handle each year in Harris County?” An attorney who handles dozens of similar cases will likely steer yours more efficiently than someone who only occasionally works in probate.

Don’t hesitate to ask about timeline expectations based on your specific situation. While no attorney can predict exact dates, experienced ones can give you a realistic range based on the complexity of your case.

Communication expectations should be clear from the start: How often will you receive updates? Who will be your day-to-day contact? Will that person respond promptly to your questions?

A good attorney will also be forthright about potential complications they foresee with your estate and how they would handle them. This foresight can be invaluable in preventing unpleasant surprises.

Ask about their technology – do they offer a client portal or other tools to streamline communication and document sharing? And finally, request references from clients who had similar probate situations.

Documents to Bring to Your First Consultation

Your initial meeting with a Houston probate attorney will be most productive if you come prepared with key documents. The original will (if one exists) tops the list, along with any amendments or codicils that might modify it.

Bring certified copies of the death certificate if you have them, as these will be needed for various aspects of the probate process. A comprehensive list of assets – including real estate, vehicles, bank accounts, and investments – helps your attorney understand the estate’s scope.

Recent financial statements, property deeds, and life insurance policies provide crucial details about the estate’s value and composition. Contact information for all beneficiaries named in the will ensures everyone can be properly notified.

Information about outstanding debts, including mortgages, loans, and credit cards, helps your attorney plan for creditor claims. Recent tax returns round out the picture of the estate’s financial situation.

“Don’t worry if your document collection isn’t perfect,” our intake coordinator often reassures clients. “Most people don’t have everything organized when they first walk through our door. We’re here to help you gather what’s needed – that’s part of our job.”

Costs, Timelines & Alternatives – What to Expect

When families come to us at WestLoop Law Firm, one of their first questions is often about costs. We believe in transparency about what probate will mean for your wallet and your calendar.

How Long Does Probate Take in Houston?

The good news is that Texas has one of the more efficient probate systems in the country. For most families working with a Houston probate attorney, timelines typically follow these patterns:

Simple, uncontested estates often wrap up in just 1-3 months. When we have a valid will and cooperative beneficiaries, we can move through the process smoothly.

Moderately complex estates generally take 3-6 months, while contested estates or those with complicated assets might extend to 6-12 months or longer.

“I tell my clients to think of probate like a road trip,” says our senior counsel. “We know the destination, but unexpected detours can happen. Our job is to keep you on the fastest route possible.”

Certain deadlines are non-negotiable in Texas:

- Your inventory must be filed within 90 days of appointment

- Creditors have 4 months to make claims after notice publication

- Estate tax returns (if needed) must be filed within 9 months of death

Breaking Down Probate Costs in Harris County

Probate expenses fall into several categories:

Court costs typically range from $700-$1,600 depending on which Harris County court handles your case and what type of proceeding you need. These fees cover filing the application, issuance of letters testamentary, and other administrative costs.

Attorney fees start around $3,000 for straightforward cases. Many families appreciate that our Houston probate attorney services come with flat-fee options – typically $4,500 for probate with a valid will and around $9,500 for intestate estates (without a will).

“The time when a family has suffered the loss of a loved one is not the time to suffer financial surprises too,” explains our probate team leader. “That’s why we prefer flat fees whenever possible.”

Other potential expenses include:

- Executor compensation (Texas law permits reasonable fees, often 5% of transactions)

- Bond premiums ($300-$1,000 if required)

- Publication costs for legal notices ($100-$200)

- Professional appraisals for certain assets

- Tax preparation fees

Factors that can increase costs include estate size, will contests, property sales, tax complications, and creditor disputes. We’ll always provide a detailed cost estimate during your initial consultation.

Can I Avoid Full Probate?

Not every situation requires full probate administration. Texas offers several streamlined alternatives:

Small Estate Affidavit works for estates under $75,000 (excluding homestead property) when there’s no will. This simplified procedure costs significantly less than full probate.

Muniment of Title offers an expedited process when there’s a valid will, no unpaid debts except those secured by real estate, and no need for formal administration. This option typically costs 30-50% less than full probate.

Affidavit of Heirship can transfer real property in certain situations, particularly when considerable time has passed since the death.

Spousal Property Transfers provide simplified procedures for surviving spouses in many cases.

“Many families walk in expecting the worst about probate costs and complexity,” notes our Houston probate attorney. “They’re often relieved to find they qualify for one of these simpler options.”

At WestLoop Law Firm, we’ll help you evaluate which approach makes the most sense for your situation, always looking for ways to minimize both cost and stress during this difficult time.

Frequently Asked Questions about Houston Probate

Do I Really Need a Houston Probate Attorney?

While Texas law doesn’t technically require you to hire an attorney for probate, going it alone often creates more headaches than it’s worth. Think of a Houston probate attorney as your personal guide through unfamiliar territory.

“Handling probate without an attorney is like trying to file your taxes without an accountant,” shares Maria, one of our clients. “It’s possible—but is it really worth the stress and potential mistakes?”

The value a Houston probate attorney brings includes:

Protecting you from personal liability (yes, executors can be held financially responsible for mistakes), navigating the specific requirements of Harris County probate courts, addressing unexpected complications like family disagreements or creditor claims, and perhaps most importantly, giving you space to grieve while we handle the paperwork.

For very simple estates—minimal assets, agreeable family members, and straightforward circumstances—self-representation might work. But most families find that professional guidance ultimately saves time, money, and countless sleepless nights.

What Happens If Someone Dies Without a Will in Texas?

When someone passes away without a will (legally called “intestate”), Texas has a predetermined formula for who gets what—and it might not align with what your loved one would have wanted.

For unmarried individuals, assets typically flow to children first, then to parents and siblings if there are no children, and finally to more distant relatives according to Texas law.

The situation gets more complex for married people. Generally, community property passes to the surviving spouse if all children are from that marriage. However, if there are children from previous relationships, they’ll inherit a portion of the community property. Separate property gets divided between the spouse and other heirs according to statutory guidelines.

Without a will, the probate process requires additional steps:

- A court proceeding to formally identify all legal heirs

- Appointment of an administrator (who may not be who the deceased would have chosen)

- More intensive court supervision throughout the process

As our lead attorney often says, “Dying without a will in Texas means letting the state decide what happens to everything you’ve worked for. It’s like letting strangers plan your family reunion.”

How Are Debts & Taxes Handled During Probate?

Dealing with what someone owed is a significant part of the probate process, and it follows a specific order.

For debts, executors must publish notices in local newspapers and directly notify known creditors, who then have about four months to make claims. Valid debts get paid from estate assets according to priority levels established by Texas law. If there’s not enough money to cover everything, some creditors simply don’t get paid.

“One question we hear constantly is whether families inherit debt,” notes our tax specialist. “The good news is that generally, debts that can’t be paid from the estate simply go unpaid—unless someone co-signed or guaranteed those obligations.”

The tax picture includes several important filings: a final personal income tax return, possible estate tax returns for larger estates, income tax returns for any money the estate earns during probate, and ongoing property tax obligations.

Executors who miss tax deadlines or improperly handle creditor claims can face personal liability—one more reason why having a Houston probate attorney by your side provides invaluable peace of mind during an already difficult time.

At WestLoop Law Firm, we guide executors through these obligations step by step, ensuring nothing falls through the cracks when handling a loved one’s final financial matters.

Conclusion & Next Steps

Probate doesn’t have to be a maze of confusion and stress. With compassionate legal guidance, you can honor your loved one’s wishes while finding peace during a challenging time.

At WestLoop Law Firm, our Houston probate attorneys do more than just handle legal paperwork—we walk alongside you during one of life’s most difficult journeys. We understand that behind every estate is a story, a family, and emotions that deserve respect and care.

“The greatest gift you can leave your family is peace of mind,” our founding attorney often reflects. “Proper planning and professional guidance through probate provides exactly that.”

Our approach combines legal expertise with genuine human connection:

We offer transparent communication that keeps you informed without overwhelming you with legal jargon. Our flat-fee options eliminate the anxiety of watching a billing clock tick during an already stressful time. Through our secure client portal, you’ll have 24/7 access to your case information, giving you control and peace of mind.

Every family’s situation is unique, which is why we create customized strategies rather than one-size-fits-all solutions. We’ll explore all available options to minimize both financial costs and emotional strain, whether that means pursuing a small estate affidavit, muniment of title, or full probate administration.

Whether you’re planning ahead for your own estate or facing immediate probate needs after losing a loved one, we invite you to schedule a consultation with our team. Together, we’ll develop a path forward that honors legacies while protecting your family’s future.

The journey through grief is difficult enough without legal complications. Let us handle the legal details while you focus on what matters most—healing and honoring your loved one’s memory.

For more information about our probate services or to schedule a consultation, please visit our probate lawyer in Houston page or call our Houston office directly.