Probate Court Houston Texas: Master 3 Easy Steps

Understanding Probate Court in Houston, Texas

When a person passes away or becomes unable to manage their affairs, legal steps often follow. In Houston, these matters are handled by dedicated courts.

What is probate court houston texas?

- A dedicated court system in Harris County, Texas.

- Its primary role is to legally settle a person’s estate after death.

- This includes validating wills, appointing executors, paying debts, and overseeing the distribution of assets to heirs.

- It also handles guardianships for minors and incapacitated adults.

- Harris County has five dedicated probate courts to manage these cases.

Navigating the legal system after a loved one’s passing or when facing incapacity can be challenging. Understanding the probate court houston texas system is a vital first step. Dealing with legal terms and court processes adds a heavy burden during an already difficult time.

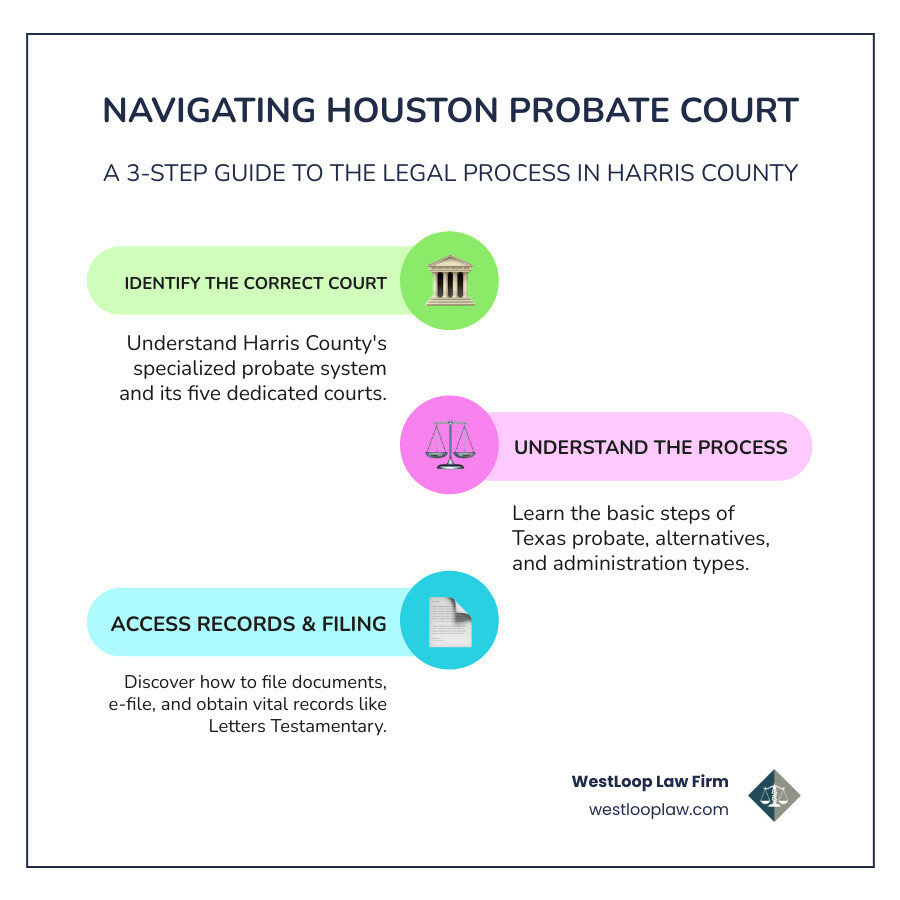

This guide simplifies how to find and understand probate court information in Houston. We will cover the courts, the probate process, and how to access important records to ensure a loved one’s estate is handled correctly.

Step 1: Identify the Correct Houston Probate Court

Knowing where to go is the first step when handling legal matters after a death or when someone needs help managing their affairs. Harris County has a dedicated probate court houston texas system with “statutory probate courts.” This means the judges and staff focus on probate, guardianship, and mental health proceedings, which often makes the process smoother for families. These five courts are centrally located in downtown Houston.

What is a Probate Court and What Does it Handle?

A probate court houston texas is where the legal journey of an estate begins. It validates wills and appoints an executor to manage the estate, ensuring debts are paid and assets are distributed to heirs. These courts also handle a wide range of complex cases, including:

- Validating Wills: Ensuring a will is legally sound.

- Appointing Executors and Administrators: Granting legal authority to manage an estate.

- Guardianships: Appointing a guardian to protect the well-being and finances of a minor or an incapacitated adult.

- Trust Disputes: Resolving disagreements over trust management.

- Wrongful Death Cases: Overseeing settlements, especially when minors or incapacitated individuals are involved.

- Mental Health Proceedings: Handling sensitive matters like involuntary commitments while protecting legal rights.

As Judge Jerry Simoneaux of Probate Court No. 1 notes, “We serve people at their most vulnerable moments with compassion and efficiency.” For more basics on Texas probate, see A guide to probate and estate planning in Texas.

Harris County’s Five Probate Courts

Harris County has five statutory probate courts. Here is a quick overview:

- Probate Court No. 1

- Judge: Jerry W. Simoneaux, Jr.

- Location: 201 Caroline St., 6th Floor, Houston, TX 77002

- Phone: 832-927-1401

- Focus: A “service-first, technology-forward” mindset for accessible justice.

- Probate Court No. 2

- Judge: Pamela Medina

- Location: 201 Caroline St., 7th Floor, Houston, TX 77002

- Phone: 832-927-1402

- Focus: Fairness, impartiality, and empathy for the vulnerable.

- Probate Court No. 3

- Judge: Jason A. Cox

- Location: 201 Caroline St., 7th Floor, Houston, TX 77002

- Phone: 832-927-1403

- Focus: A special Mental Health Docket, often held at the Harris County Psychiatric Center.

- Probate Court No. 4

- Judge: James Horwitz

- Location: 201 Caroline St., 7th Floor, Houston, TX 77002

- Phone: 832-927-1404

- Focus: A thoughtful and careful approach to helping families during difficult times.

- Probate Court No. 5

- Judge: Fransheneka “Fran” Watson

- Location: 1115 Congress St., 5th Floor, Houston, TX 77002

- Phone: 832-927-1405

- Focus: Judge Watson brings extensive experience as a civil litigator and public servant.

Judges are elected by the community. If a vacancy occurs, the Governor may appoint a temporary replacement until the next general election.

Step 2: Understand the Texas Probate Process & Its Alternatives

Understanding the probate process, guided by the Texas Estates Code, can feel overwhelming. The path forward depends on the size and complexity of the estate. A small estate might qualify for a simple process, while a larger one may require full administration. Knowing the differences is key to navigating the probate court houston texas system.

What Are the Basic Steps of Probate in a Houston Texas Court?

While every estate is unique, the probate process generally follows a clear roadmap:

- File the Application: Draft and file an application with the correct probate court. It includes details about the deceased, the will (if any), heirs, and the estate’s estimated value. The original will and a death certificate are also required.

- Post Notice: The county clerk posts a public notice of the application at the courthouse, allowing at least 10 days for anyone to contest the will or appointment.

- Attend a Prove-Up Hearing: A brief hearing is held where the judge validates the will or identifies legal heirs. Uncontested hearings are often very short.

- Qualify as Executor/Administrator: The appointed person takes an oath and may post a bond. They then receive “Letters Testamentary” or “Letters of Administration,” which grant legal authority to act for the estate.

- Notify Creditors: The executor must publish a notice for unknown creditors and send direct notices to known creditors within specific deadlines.

- File an Inventory: Within 90 days of qualifying, file a detailed inventory of all probate assets and their values with the court.

- Handle Claims and Pay Debts: Review and pay all valid creditor claims according to Texas law, selling assets if necessary.

- Distribute Assets: After all debts are paid, distribute the remaining assets to the beneficiaries or heirs.

- Close the Estate: Formally close the estate, which may involve filing a closing affidavit or a final accounting with the court.

When is Probate Required vs. When Can it Be Avoided?

Not every death requires a full probate case. Probate is generally needed when the deceased owned assets solely in their name without a designated beneficiary (like a house or bank account) or when there are significant debts. It’s also used to formally transfer property titles or resolve family disagreements.

However, probate can often be avoided for “non-probate assets” that pass directly to a beneficiary, such as:

- Life insurance policies

- Retirement accounts (401(k)s, IRAs)

- Bank accounts with Payable-on-Death (POD) designations

- Transfer-on-Death Deeds (TODD) for real estate

- Jointly owned property with rights of survivorship

Texas also offers simpler alternatives to full probate:

- Small Estate Affidavit (SEA): For small estates (under $75,000 in personal property, excluding the homestead) without a will.

- Muniment of Title: A quicker option to transfer title to real property when there is a will and few debts.

- Determination of Heirship: A court process to legally identify heirs when there is no will.

- Affidavit of Heirship: Can sometimes be used to transfer real property without court involvement.

For more details, see this guide on Transferring Property After Death and Avoiding Probate Court (TexasLawHelp.org).

Independent vs. Dependent Administration

When formal probate is required, Texas offers two main types:

- Independent Administration: The executor manages the estate with minimal court supervision. This is faster, less expensive, and preferred for most estates where the will allows for it and there are no major disputes.

- Dependent Administration: The court must approve nearly every action, from selling property to paying debts. This offers more protection but is significantly slower and more costly. It’s typically used in contentious cases or when required by law.

Typical Timeline and Costs in Harris County

The timeline and costs for probate in Harris County vary by case complexity and administration type.

Costs include court filing fees, fees for certified copies of documents (like Letters Testamentary), and potential bond premiums. Attorney fees for a straightforward independent administration can be a few thousand dollars, but complex or contested cases will be significantly more. E-filing also involves state and county fees.

Regarding timelines:

- Independent Administration: 6-9 months

- Dependent Administration: 1-2 years or more

- Muniment of Title: 1-3 months

- Small Estate Affidavit: 1-2 months

- Determination of Heirship: 3-6 months

Disagreements among heirs, complex assets, or tax issues can extend these timelines.

Step 3: Steer Filing and Records for Probate Court Houston Texas

Once you know which process is needed, the next step is learning how to interact with the probate court houston texas system. This involves understanding the role of the Harris County Clerk, filing documents, and accessing records.

What is the Role of the Harris County Clerk in probate court Houston Texas?

The Harris County Clerk’s office is the administrative center for all probate matters. They are the official record keeper for all five probate courts.

Key responsibilities include:

- Maintaining Official Records: Keeping every document filed in a probate case, from wills to court orders.

- Processing Filings: Receiving and processing all documents submitted to the courts.

- Issuing Citations: Handling the official legal notices for probate proceedings.

- Providing Public Access: Making court records accessible to the public, both online and in person.

The Harris County Clerk’s Probate Department is located at 201 Caroline, Suite 800, Houston, TX 77002, and is open weekdays from 8:00 AM to 4:30 PM. For more information, visit their webpage for the Harris County Clerk’s Office Probate Courts.

How to E-File and Find Forms

In Harris County, filing documents with the probate court houston texas is primarily done electronically.

E-filing is mandatory for all attorneys through the statewide portal, EFileTexas.gov. They must submit documents as searchable PDFs. Individuals representing themselves (“pro se” parties) are not required to e-file but may choose to do so.

Regarding official forms, neither the County Clerk nor the courts provide templates for wills or probate applications. The Texas Estates Code and resources at the Harris County Law Library (1019 Congress, Houston, Texas 77002) can provide guidance.

There is a special rule for the original will. While a copy is e-filed with the application, the original document must be physically delivered to the County Clerk within three business days of the electronic submission.

Obtaining Letters Testamentary and Other Vital Records

Once appointed, an executor or administrator receives official documents called “Letters Testamentary” (with a will) or “Letters of Administration” (without a will) to prove their legal authority.

These letters are essential for managing the estate, such as accessing bank accounts or transferring property. You can request certified copies in several ways:

- Online Portal: Purchase certified or non-certified copies through the Harris County Clerk’s Document Search Portal. Online certified copies may lack a raised seal, which some institutions require.

- In-Person: Visit the Harris County Clerk’s Probate Department for copies with a raised seal.

- By Mail: Use the appropriate request form available from the clerk’s office.

Be aware of the informal “60-day freshness rule.” While Letters don’t expire, most financial institutions prefer to see copies issued within the last 60 days. This may require you to request fresh copies periodically.

Common Pitfalls to Avoid in Harris County Probate

Navigating the probate court houston texas system has common traps that can cause delays and extra costs. Being aware of these pitfalls can help you avoid them.

-

Missing the Four-Year Deadline: Texas law, under Texas Estates Code Section 256.003, generally requires a will to be filed for probate within four years of the person’s death. Missing this deadline usually means the estate is treated as if there were no will, forcing a more complex and costly “Determination of Heirship.”

-

Filing in the Wrong Court: Ensure you are filing in the correct court with proper jurisdiction over the estate. Filing in the wrong court causes significant delays.

-

Incomplete Documentation: Submitting applications or other documents with missing or incorrect information will lead to rejection and delays. Always double-check all paperwork.

-

Mishandling Creditor Notices: Executors have a legal duty to notify creditors within specific timeframes. Failure to do so can result in personal liability for the estate’s debts.

-

Family Disputes: Disagreements among family members can derail the process and lead to expensive litigation. Mediation or family settlement agreements can help resolve conflicts.

-

Executor Misconduct: An executor has a “fiduciary duty” to act in the best interests of the estate. Mishandling funds, self-dealing, or neglecting duties can lead to removal and legal action.

-

Failing to File the Inventory: A detailed inventory of estate assets must be filed with the court within 90 days of the executor’s appointment. Missing this deadline can create problems with the court.

-

Ignoring Guardianship Registration (JBCC): Individuals involved in guardianships may be required to register with the Judicial Branch Certification Commission (JBCC). Non-compliance can result in penalties.

Frequently Asked Questions about Houston Probate

Do I need an attorney for the probate process in Houston?

While not always legally required, hiring an attorney for most probate matters is highly recommended. An executor or administrator has a fiduciary duty to act in the best interests of all beneficiaries and creditors. A mistake can lead to personal liability.

The complexity of probate proceedings and the Texas Estates Code’s strict deadlines and requirements make it easy to miss a crucial step. An experienced probate court houston texas attorney can steer the system efficiently, protect you from liability, and save time and stress.

While you can represent yourself (pro se) in some simpler matters like a Small Estate Affidavit, it is strongly discouraged for formal estate administrations. Because an executor represents the interests of others, courts in Harris County generally require you to be represented by an attorney. The peace of mind that comes from professional guidance is invaluable.

How are vacancies on the Harris County Probate Court bench filled?

When a judicial vacancy occurs on the probate court houston texas bench, the Governor of Texas typically makes an interim appointment. This appointee serves until the next general election, at which point the voters of Harris County elect a judge to fill the position. All judges must be licensed attorneys with a required number of years of legal experience.

What happens if I miss the four-year deadline to probate a will?

Missing the strict four-year deadline to probate a will, as established by Texas Estates Code Section 256.003, has serious consequences. The court will likely treat the estate as if no will existed, and assets will be distributed according to Texas’s intestate succession laws, not your loved one’s wishes.

This usually forces the estate into a Determination of Heirship proceeding, which is typically more complex, time-consuming, and expensive than a timely probate. There is a narrow exception to probate a will as a Muniment of Title after four years, but it is difficult to qualify for. Acting promptly is the best way to honor your loved one’s wishes and avoid complications.

Your Next Steps in Navigating Houston Probate

You’ve now learned how to Identify the Correct Court, Understand the Texas Probate Process, and Steer Filing and Records. This knowledge provides a clear picture of the path ahead in the probate court houston texas system.

As you move forward, organization is key. Keep all documents, communications, and financial records together, and pay close attention to deadlines, especially the four-year window for probating a will.

While some simple estates can be managed alone, probate often involves legal complexities. As an executor, you have significant responsibilities. Professional guidance can make the process smoother and less stressful.

At WestLoop Law Firm, our practice includes both personal injury and probate law. This unique focus allows us to provide effective, compassionate advocacy for Houston families, ensuring your loved one’s estate is handled with the care it deserves.

You don’t have to steer this alone. For personalized guidance on your specific situation, we invite you to learn more about how our Houston probate lawyers can help. Visit our page to learn more about how a Houston probate lawyer can help. We’re here to offer a steady hand and sound advice.