Real estate in probate 2025: Ultimate Stress-Free

Understanding Real Estate in Probate: What Houston Families Need to Know

Real estate in probate is property owned by someone who has passed away that must go through a court-supervised legal process before it can be transferred or sold. This process validates the will (if one exists), settles debts, and ensures assets are distributed to rightful heirs according to Texas law.

Quick Overview: What You Need to Know

- Probate is required when a property owner dies and the home was solely in their name

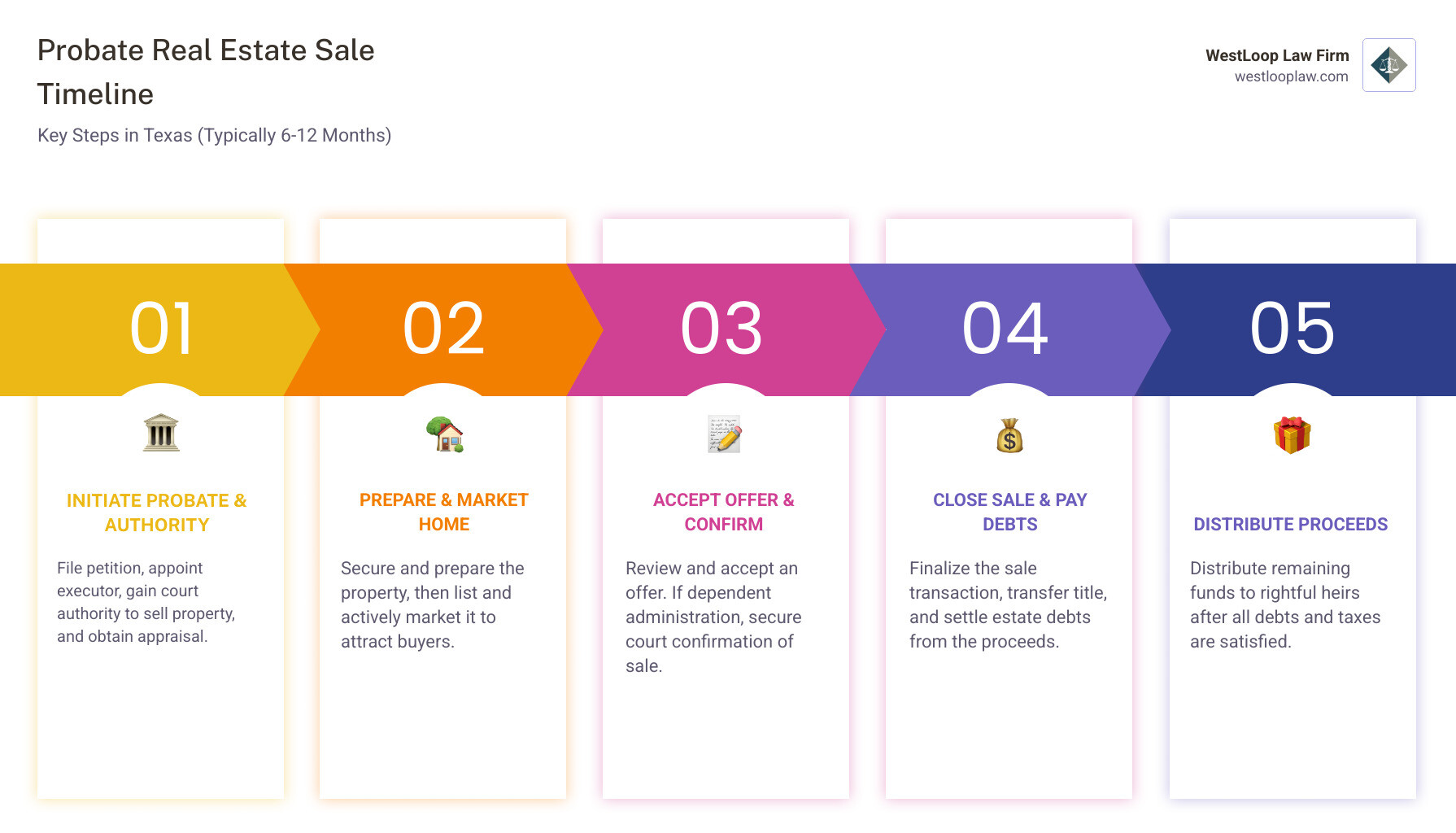

- Timeline: Selling a home in probate typically takes 6-12 months in Texas, sometimes longer

- Two types: Independent administration (less court oversight) or dependent administration (more court involvement)

- Key players: Executor/Administrator, probate attorney, real estate agent, and Harris County Probate Courts

- Sale proceeds must first pay estate debts and taxes before distribution to heirs

When someone passes away in Houston, their loved ones face a difficult time. Alongside grief comes the overwhelming task of managing their estate. If that estate includes real estate near I-10 or homes in neighborhoods around Memorial Park or the Heights, the legal process becomes even more complex.

The probate process can feel like navigating a maze. You’re dealing with Harris County courts, sorting through legal documents, and trying to understand your responsibilities as an executor or administrator. Many families don’t realize that selling an inherited home involves specific legal steps that differ from a standard real estate transaction.

This guide walks you through everything you need to know about selling a home in probate in Houston. We’ll break down the legal requirements, explain the timeline, identify potential challenges, and show you how to work with the right professionals to make the process smoother.

Whether you’re an executor handling your first estate, a beneficiary wondering about your inherited property, or someone planning ahead to spare your family this burden, understanding how probate affects real estate sales is essential.

Find more about real estate in probate:

Understanding Probate and Its Impact on Real Estate

Probate is the legal process that confirms the validity of a will (if one exists) and grants the executor or administrator the authority to manage and distribute an estate’s assets. When we talk about real estate in probate, we’re referring to property that was solely owned by someone who has passed away and must go through this court-supervised process. The purpose of probate is to ensure that the deceased person’s debts are settled and their remaining assets are properly distributed to their rightful heirs or beneficiaries according to their will or Texas law.

In Houston, most assets that are subject to probate administration come under the supervision of the appropriate Harris County Probate Court. The process involves several key steps:

- Will Validation: If there’s a will, the court determines its authenticity and legal validity.

- Executor/Administrator Appointment: An executor is named in a will, while an administrator is appointed by the court if there is no will (known as dying “intestate”). This person is responsible for managing the estate.

- Asset Inventory and Valuation: All assets, including real estate in probate, bank accounts, and investments, are identified and valued.

- Debt and Tax Settlement: Outstanding debts, funeral expenses, and taxes owed by the estate are paid.

- Asset Distribution: Finally, remaining assets are distributed to beneficiaries or heirs.

This process is fundamental for the legal transfer of property and other assets. Without it, financial institutions often won’t release funds, and titles to real estate can’t be legally transferred. For more comprehensive information, you can refer to the General Information – Probate Law – Guides at Texas State Law Library.

When is Probate Necessary for a Property in Houston?

Not every property in Houston requires probate. The necessity often depends on how the property was owned and the overall value of the estate. Here are the common scenarios where probate becomes essential for real estate in probate:

- Sole Ownership: If the deceased person owned the property solely in their name, and there’s no other legal mechanism for transfer, probate is almost always required.

- No Will (Intestate): If someone passes away without a valid will, they are said to have died intestate. In this case, the Harris County Probate Court will appoint an administrator and oversee the distribution of assets, including real estate, according to Texas’s laws of intestate succession.

- Title Transfer Issues: Even with a will, if the property’s title isn’t clear or there are discrepancies, probate may be needed to formally transfer ownership.

- Financial Institution Requirements: Often, banks or title companies require a court order (a “Letters Testamentary” or “Letters of Administration”) from the probate court to ensure they are dealing with the legally authorized representative of the estate.

- Texas Estate Value Thresholds: In Texas, if the estate’s total value is less than $75,000 (excluding homestead and exempt property), a simplified process called a Small Estate Affidavit might be used instead of full probate. However, this simplified process generally cannot be used to transfer title to real estate unless specific conditions are met, making formal probate more common for properties.

Texas Probate: Independent vs. Dependent Administration

In Texas, we primarily deal with two types of probate administration that significantly impact how real estate in probate is handled:

- Independent Administration: This is the preferred method in Texas because it involves minimal court supervision. If the will specifies independent administration and names an independent executor, or if all beneficiaries agree to it, the executor can manage and sell estate assets, including real estate, without needing court approval for most actions. This streamlines the process, making it generally faster and less costly. The independent executor has the authority to collect assets, pay debts, and distribute property with much less judicial oversight once appointed.

- Dependent Administration: This type requires significant court supervision for almost every step, including the sale of real estate in probate. The administrator (or executor, if specified) must seek court approval for many decisions, such as selling property, paying debts, and making distributions. This process is typically more time-consuming, more expensive, and less flexible, as it involves frequent court filings, hearings, and orders. Dependent administration is usually required when there is no will, if the will does not provide for independent administration, or if beneficiaries cannot agree.

Understanding which type of administration applies to an estate is crucial for anyone involved in selling real estate in probate in Houston, as it dictates the level of court involvement and the speed of the sale.

The Step-by-Step Guide to Selling Real Estate in Probate in Houston

Selling real estate in probate in Houston can feel daunting, but with a clear roadmap, it becomes manageable. As your guides, we’ll provide a clear, actionable path for executors or administrators managing a property sale in the Houston area, from initial legal steps to closing the sale.

Essential Steps for a Probate Sale

- Petition the Court and Appoint a Representative:

The very first step is to initiate the probate process in the appropriate Harris County Probate Court. This involves filing a petition to admit the will to probate (if one exists) or to determine heirship (if there is no will) and to appoint an executor or administrator. You cannot sell the property until the court officially appoints you and issues “Letters Testamentary” or “Letters of Administration.” These documents legally authorize you to act on behalf of the estate. - Secure and Value the Property:

Once appointed, your responsibility is to secure the property. This means ensuring it’s protected, insured, and maintained. Next, you must obtain an accurate valuation of the real estate in probate. This is typically done through a certified appraisal or a Comparative Market Analysis (CMA) by an experienced real estate agent who understands the Houston market. An accurate valuation is crucial for setting the right sale price and fulfilling your fiduciary duty to the estate. - Obtain Authority to Sell:

- Independent Administration: If you are an independent executor, the will usually grants you the power to sell property without specific court approval for each sale. However, it’s always wise to confirm this authority and ensure all beneficiaries are informed.

- Dependent Administration: If you are operating under dependent administration, you will need to petition the court for approval to sell the real estate in probate. This involves demonstrating to the court that the sale is necessary (e.g., to pay debts) and that the terms of the sale are fair and in the best interest of the estate.

- Market and Sell the Home:

With the authority to sell, you can now list the property. Work with a real estate agent familiar with the Houston market and probate sales. They can help market the property effectively, attract potential buyers, and manage showings. Homes in probate are often sold “as-is,” so transparency about the property’s condition is important. - Get Court Confirmation (if required):

For dependent administrations, once an offer is accepted, you’ll need to return to the Harris County Probate Court to seek confirmation of the sale. The court will review the terms of the offer to ensure it’s fair and reasonable. Sometimes, the court may even invite higher bids at the confirmation hearing. - Pay Debts and Distribute Proceeds:

After the sale closes, the proceeds are first used to satisfy any outstanding debts of the estate, including funeral expenses, medical bills, and taxes. Only after all legitimate claims and administrative costs are paid can the remaining proceeds be distributed to the beneficiaries or heirs according to the will or Texas intestacy laws. As an executor or administrator, you are accountable for these distributions.

Key Professionals for a Smooth Real Estate in Probate Sale

Navigating real estate in probate sales in Houston involves complex legal and financial considerations. We strongly recommend assembling a team of professionals to guide you:

- Probate Attorney: A probate attorney, like our team at WestLoop Law Firm in Houston, is indispensable. We ensure compliance with all legal requirements, prepare and file necessary court documents, and represent the estate’s interests. We can advise on the type of administration, interpret the will, and steer any disputes that arise.

- Real Estate Agent: A real estate agent experienced in probate sales in the Houston area understands the unique challenges, such as selling “as-is” properties and dealing with court-ordered sales. They can accurately price the property, market it effectively, and handle negotiations.

- Appraiser: An independent, certified appraiser provides an unbiased valuation of the property, which is crucial for court filings and ensuring fair market value. This is particularly important for tax purposes and to avoid disputes among beneficiaries.

- Accountant/Tax Advisor: Selling real estate in probate can have significant tax implications. An accountant or tax advisor can help you understand capital gains tax, the stepped-up basis, and other estate tax considerations, ensuring the estate fulfills its obligations.

- Title Company: A title company will conduct a thorough title search to identify any liens, encumbrances, or ownership issues that need to be resolved before the sale can close. They also facilitate the transfer of the deed.

Valuing the Property and Distributing Sale Proceeds

Accurate property valuation is a cornerstone of a successful real estate in probate sale. Why is accuracy so important? Because the value affects tax calculations, ensures fairness among beneficiaries, and minimizes the risk of legal challenges.

- Fair Market Value: The goal is to determine the property’s fair market value as of the date of the decedent’s death. This value is critical for inventorying the estate and for calculating potential capital gains tax later on.

- Certified Appraisal: A certified appraiser provides an objective, professional estimate of the property’s value. This is often required by the court or recommended for larger estates.

- Comparative Market Analysis (CMA): An experienced real estate agent can provide a CMA, comparing the property to similar homes recently sold in Houston neighborhoods like River Oaks or Katy. This helps determine a competitive listing price.

Once the real estate in probate is sold, the distribution of proceeds follows a strict order:

- Estate Debts and Expenses: The first priority is to pay all legitimate debts of the estate, including funeral costs, medical bills, outstanding mortgages, property taxes, and administrative expenses (such as attorney fees, court costs, and real estate commissions).

- Tax Obligations: Any federal estate taxes or income taxes incurred by the estate must be paid.

- Beneficiary Distribution: Only after all debts, expenses, and taxes are settled are the remaining proceeds distributed to the beneficiaries or heirs as outlined in the will or by Texas intestacy laws. As an executor or administrator, you are personally accountable for ensuring these distributions are correct, and making distributions before accounting for all expenses or debts can lead to personal liability.

Navigating Challenges and Tax Considerations

Selling real estate in probate in Houston, whether it’s a home in West University Place or a duplex near the Texas Medical Center, comes with its unique set of problems. Understanding these challenges and the associated tax implications is crucial for managing the process effectively.

Common Complications with Real Estate in Probate

While the process has clear steps, real-world situations can introduce complications:

- Heir Disputes: Disagreements among beneficiaries or heirs are unfortunately common. Family members might contest the will, the valuation of the property, or even the decision to sell. Open communication and, often, legal mediation are key to resolving these issues.

- Property Condition (“As-Is” Sales): Many real estate in probate properties are sold “as-is,” meaning the estate won’t make repairs. This can limit the buyer pool or lead to lower offers. A thorough home inspection is always recommended for buyers, but for sellers, it means being realistic about the property’s marketability.

- Market Fluctuations: The Houston real estate market can change. A lengthy probate process means the property’s value could fluctuate between the date of death and the eventual sale, potentially impacting the estate’s overall value and beneficiary expectations.

- Delays in the Court Process: The probate process can be lengthy. It’s not unusual for probate sales to take six months to a year or even longer to complete, especially if there are disputes, complex legal requirements, or heavy court dockets in Harris County. These delays can be frustrating for all parties involved.

- Title Issues or Liens: Finding unexpected liens, easements, or other title defects during the sale process can halt proceedings until they are resolved. This is why a thorough title search by a reputable title company is essential early on.

Tax Implications of Selling a Probate Property

Understanding the tax implications is vital for the estate and its beneficiaries. We strongly recommend consulting with an accountant or tax advisor to steer these complexities.

- Capital Gains Tax: Selling real estate in probate can trigger capital gains tax. However, inherited property generally receives a “stepped-up basis.” This means the property’s cost basis for tax purposes is reset to its fair market value on the date of the decedent’s death, not the price they originally paid. Capital gains tax is then calculated on the difference between this stepped-up basis and the sale price. This often significantly reduces or eliminates capital gains liability if the property sells soon after death.

- Date-of-Death Valuation: This valuation is crucial for the stepped-up basis calculation. An accurate appraisal at the time of death is essential.

- Final Income Tax Return for the Decedent: An income tax return must be filed for the decedent for the year of their death.

- Estate Taxes: While Texas does not have a state estate tax, larger estates may be subject to federal estate tax. This tax applies to the transfer of property from a deceased person to their heirs. The federal estate tax exemption amount is quite high, so it only affects a small percentage of estates. However, if applicable, these taxes must be paid before assets are distributed.

A Look from the Buyer’s Side & Future Planning

Real estate in probate isn’t just about selling; it’s also about buying. For those looking to purchase a home in Houston, a probate sale can present both unique opportunities and specific challenges.

Buying a probate home:

- Potential for a Good Deal: Probate sales can sometimes offer properties at a more competitive price due to less competition or the estate’s urgency to liquidate assets. This can be an attractive option for buyers seeking value.

- “As-Is” Condition Risk: A common aspect of probate sales is that homes are often sold “as-is.” This means the estate typically won’t make repairs, and the buyer assumes responsibility for any necessary improvements. Thorough home inspections are paramount.

- Lengthy Process: Be prepared for a potentially extended closing period. Probate sales often take longer than traditional sales because of court approvals, administrative steps, and other complexities. It’s not unusual for these transactions to take a year or longer.

- Court Approval Contingencies: For dependent administrations, the sale is contingent on court approval. This means your accepted offer might still be subject to judicial review, and in some cases, the court may even solicit higher bids, adding uncertainty to the process.

How to Avoid Probate for Your Houston Property

For Houston residents planning their own estates, understanding how to avoid probate for your real estate in Houston can save your loved ones significant time, expense, and stress. We encourage you to consider these strategies:

- Living Trusts: Placing your real estate into a revocable living trust allows the property to bypass probate entirely. Upon your death, the successor trustee you name can distribute the property directly to your beneficiaries according to the trust’s terms, outside of court supervision.

- Joint Tenancy with Right of Survivorship: If you own property with another person as “joint tenants with right of survivorship,” your share automatically passes to the surviving owner(s) upon your death, without going through probate. This is common for married couples in Texas.

- Transfer on Death Deed (TODD): Texas law allows you to execute a Transfer on Death Deed for your Houston real estate. This document designates who will receive the property upon your death, similar to a beneficiary designation on a bank account. The property then transfers directly to the named beneficiary without probate.

- Beneficiary Designations: While not directly applicable to real estate, ensuring all your other assets, like retirement accounts and life insurance policies, have designated beneficiaries will keep them out of probate. This reduces the overall size and complexity of your probate estate.

Proactive estate planning can make a world of difference for your family during a difficult time.

Frequently Asked Questions about Probate Real Estate

How long does it take to sell a house in probate in Texas?

The timeline for selling a house in real estate in probate in Texas can vary significantly, typically ranging from 6 months to over a year. Several factors influence this duration:

- Type of Administration: Independent administration is generally faster, often taking 6-9 months from filing to sale, as it requires less court oversight. Dependent administration, with its need for frequent court approvals, can easily extend beyond a year.

- Court Dockets: The workload of the Harris County Probate Courts can affect how quickly petitions are heard and orders are issued.

- Estate Complexity: Disputes among heirs, numerous creditors, or challenges to the will can prolong the process considerably.

- Property Condition and Market: How quickly the property sells on the open market also plays a role.

While some simple cases might be quicker, it’s prudent to prepare for a lengthy wait when dealing with real estate in probate.

Can an executor sell a house for less than market value?

An executor (or administrator) has a fiduciary duty to act in the best interests of the estate and its beneficiaries. This means they generally cannot sell real estate in probate for less than its fair market value. Doing so could expose them to liability from beneficiaries who believe the estate was undervalued or mismanaged.

- Fair Market Value: The sale price should reflect the property’s fair market value, often determined by an appraisal.

- Beneficiary Consent: In some cases, if all beneficiaries agree and provide written consent, a sale below market value might be permissible, especially if there are compelling reasons (e.g., urgent need for funds, significant repair costs).

- Court Approval: For dependent administrations, the court will scrutinize the sale price to ensure it’s reasonable and in the estate’s best interest. The court may even open the bidding to others if the proposed price is deemed too low.

Who pays for repairs on a house in probate?

Generally, any necessary repairs for real estate in probate are paid for by the estate funds. However, it’s common for probate properties in Houston to be sold “as-is.”

- Estate Funds: If the executor decides that repairs are essential to maximize the sale price and benefit the estate, these costs would be legitimate estate expenses.

- “As-Is” Sales: In an “as-is” sale, the buyer typically assumes responsibility for all repairs. This is often preferred by estates to avoid additional expenses and delays.

- Negotiation with Buyers: Sometimes, an estate might agree to cover minor repairs as part of the negotiation to secure a sale, especially if the repairs are minimal and improve the property’s appeal.

- Executor Responsibilities: The executor is responsible for maintaining the property during the probate period, which includes basic upkeep and ensuring it’s secured and insured.

Get Guidance on Your Houston Probate Matter

Selling a home in probate can be a demanding process, requiring careful attention to legal procedures set by the Harris County courts. Having knowledgeable legal counsel can ensure the process is handled correctly and efficiently. For assistance with your estate administration needs in Houston, the team at WestLoop Law Firm is here to help. Learn more about our estate planning services.