Why Business Owners Need Estate Planning More Than Anyone

Estate planning for business owners is more complex and critical than personal estate planning because your business represents both your life’s work and often your family’s primary source of wealth. Without proper planning, your business could face forced liquidation, family disputes, or complete failure upon your death or incapacity.

Key Estate Planning Considerations for Business Owners:

- Business Succession Planning – Who will run your business and how ownership transfers

- Buy-Sell Agreements – Legal contracts defining ownership transitions between partners

- Asset Protection – Shielding business and personal assets from creditors and lawsuits

- Tax Minimization – Using trusts, gifting, and other strategies to reduce estate taxes

- Incapacity Planning – Ensuring business operations continue if you become unable to work

- Legal Documentation – Wills, trusts, powers of attorney custom to business ownership

The stakes are incredibly high. Research shows that over a third of business owners lack a succession plan, and an estimated 70% of family businesses fail when passing to the second generation. Your business likely represents the majority of your net worth – making estate planning failures catastrophic for your family’s financial future.

As a business owner, you face unique challenges that don’t affect other individuals. Your business assets may be illiquid, require specific knowledge to manage, or have complex ownership structures. State laws governing business ownership after death vary significantly, and without clear direction, courts may appoint someone unfamiliar with your business to manage it.

The good news? Proper planning can ensure your business thrives beyond your lifetime, provides for your family, and preserves the legacy you’ve built.

Estate planning for business owners helpful reading:

Why Estate Planning is a Non-Negotiable for Entrepreneurs

When you’re an entrepreneur, your business isn’t just a way to make money – it’s your legacy and often your largest asset. That’s why estate planning for business owners moves from “nice to have” to “absolutely essential.” Without it, everything you’ve built could crumble.

While you’re busy running your company, planning for the unexpected might feel like a low priority. However, life can throw curveballs when we least expect them.

Business continuity is the name of the game. A solid estate plan ensures your business keeps running even if you can’t be there. Your family’s financial security stays intact because they receive the full value of your business without getting tangled in legal red tape or crushing tax bills.

You’ll also dodge the probate nightmare – a lengthy, expensive, and public court process that can tie up your business for months or years. Instead, everything transfers smoothly and privately according to your wishes. Most importantly, you prevent family disputes that can tear relationships apart when everyone’s already grieving.

The numbers tell a sobering story. A recent Edward Jones study found that over a third of business owners don’t have a succession plan. That’s like driving without insurance – the consequences of an accident can be devastating.

We’ve helped countless Houston entrepreneurs avoid common estate planning mistakes and create plans that truly protect their family’s future. The peace of mind that comes with having everything properly arranged is priceless.

The High Cost of Inaction

Imagine your dream business being sold for a fraction of its worth. This is the reality of a forced business sale without an estate plan. Your family could be stuck with a fire-sale valuation that fails to provide the financial security you worked to create.

Beyond the financial hit, a lack of clear instructions can lead to bitter family fights over the business. We’ve seen it tear families apart when they should be supporting each other.

State intestacy laws can complicate matters further. They may divide your company among relatives who have no interest or conflicting visions for its future, leading to management by a committee that can’t agree.

Without asset protection, creditor claims can become a feeding frenzy, putting your business assets, personal assets, and even your family home on the chopping block. The statistics on business failure after an owner’s death are grim, and much of it comes down to poor planning.

Legal and administrative costs alone can eat up huge chunks of your estate’s value. Court fees, attorney fees, and accountant fees add up fast when everything has to go through probate. We focus on navigating potential family conflicts before they explode into expensive legal battles.

Preserving Your Business Legacy

Your business tells your story. It reflects your values, vision, and impact. Estate planning for business owners is how you ensure that story continues with the same purpose long after you’re gone.

Legacy preservation is about maintaining the mission continuity that made your business special. Will your company still treat employees like family? Will it still serve customers with the same dedication? Will it continue to grow in ways that would make you proud?

This is where mentoring successors becomes critical. Whether you’re grooming a family member, preparing a key employee, or setting up for an external buyer, they need to understand not just the operations, but the “why” behind them.

You might also weave charitable giving strategies into your legacy plan. Your business success can fund scholarships, support local nonprofits, or create a foundation. We can help you explore how incorporating philanthropy into your estate plan can extend your positive impact for generations.

The key is defining your vision clearly and putting systems in place to protect it. For deeper insights, check out our guide on preserving your business legacy. Your business legacy is too important to leave to chance.

The Core Components of Estate Planning for Business Owners

Think of estate planning for business owners like building a house – you need a solid foundation and multiple interconnected components. Each piece serves a specific purpose, but they all must work in harmony to protect your business and family.

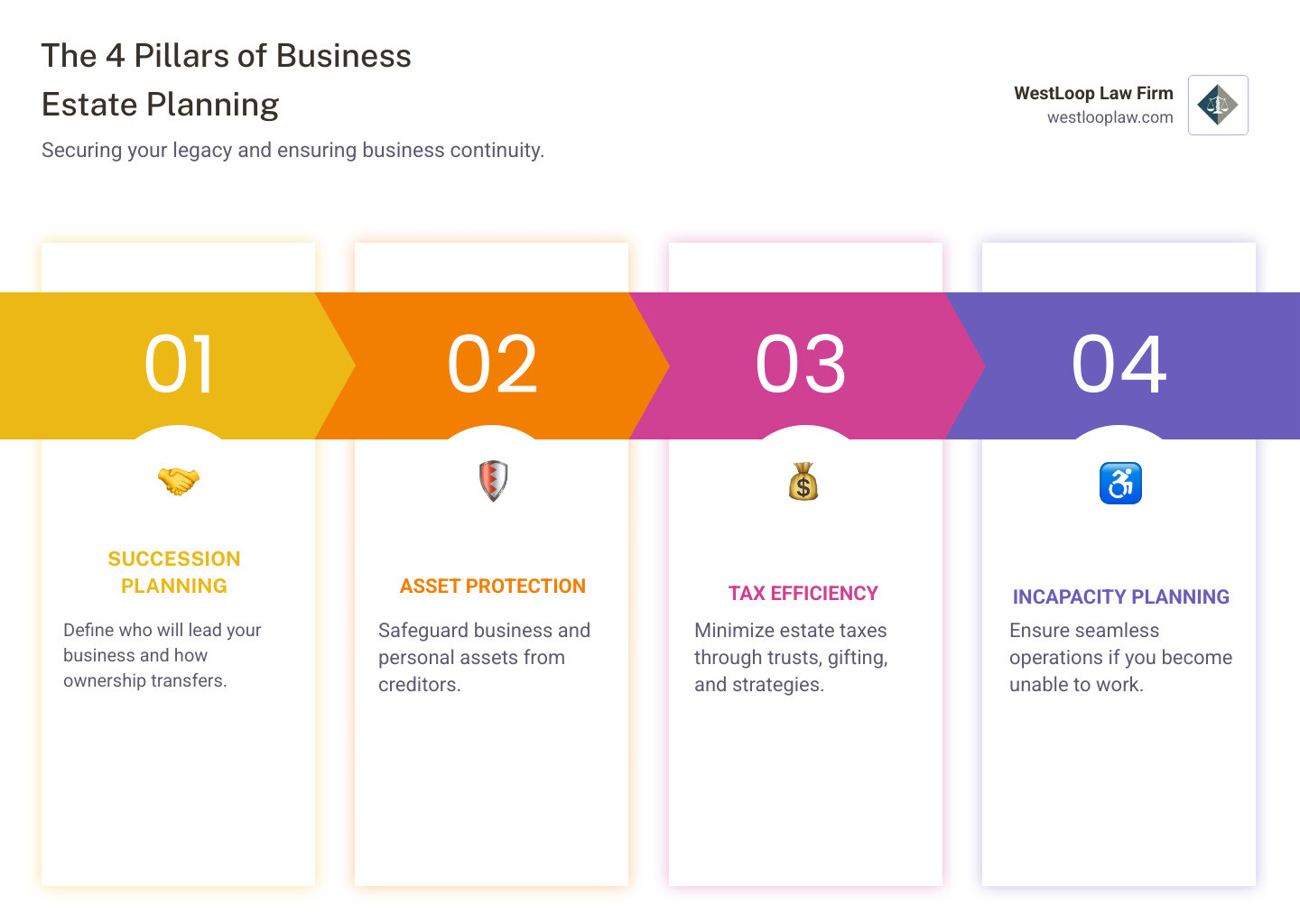

The four main pillars of your estate plan include a business succession plan, incapacity planning, a collection of essential legal documents, and careful consideration of your business structure.

Let’s walk through each of these crucial elements so you can understand how they create a comprehensive safety net for your business and family.

Crafting a Bulletproof Business Succession Plan

A business succession plan is the heart of estate planning for business owners. It’s the roadmap for what happens when you can no longer run the business, whether due to retirement, illness, or death. Without it, you leave your life’s work to chance.

The first big decision is choosing your successor. This isn’t always straightforward. You might have a child who knows the business inside and out. But what if your kids have no interest, or worse, would run it into the ground?

Sometimes the best choice is a key employee who understands your vision. They often make excellent successors because they know the operations and have relationships with customers and vendors. You might also consider an external buyer who brings fresh capital and ideas.

Whoever you choose needs proper training and transition time. You can’t just hand over the keys. A gradual transition allows your successor to learn the ropes while you’re still there to guide them.

Fidelity offers some great insights on succession planning strategies that can help you think through these decisions. We also have more detailed guidance on planning for small businesses that’s custom to the unique challenges Houston business owners face.

Essential Legal Documents for Every Business Owner

The right legal documents are crucial. Generic online forms are insufficient when your business and family’s future are at stake; documents must be tailored to your specific situation.

Your Last Will and Testament directs how your personal and business assets are distributed. For business owners, this must work with your succession plan. You’ll also name an executor to carry out your wishes. We walk clients through creating a Last Will and Testament step by step.

A Durable Power of Attorney is vital for your business’s day-to-day survival. It lets someone you trust make financial and business decisions if you become incapacitated, preventing your business from grinding to a halt. Learn more about managing affairs with a Power of Attorney.

Healthcare Directives, while personal, help your business. When your family knows your medical wishes, they can focus on your care instead of arguing, allowing them to handle business matters more effectively during a crisis.

Trusts can save your family significant money in taxes while protecting assets from creditors. We’ll dive deeper into these powerful tools in the next section.

If you have partners, a Buy-Sell Agreement is essential. This document prevents chaos by defining what happens to ownership interests when a partner dies, becomes disabled, or leaves the business.

The Critical Role of a Buy-Sell Agreement

For business partners, a buy-sell agreement is like a fire extinguisher—you hope you never need it, but you’ll be grateful it’s there in a disaster. This legally binding contract dictates what happens to an owner’s share when certain events occur.

Triggering events typically include death, disability, retirement, or even divorce. The agreement kicks in automatically, preventing confusion and arguments during stressful times.

The valuation method is a key component. You need a clear, fair way to determine an ownership share’s worth. Some use a formula, others an annual appraisal, or a pre-agreed price. The key is having a method everyone agrees on before emotions run high.

Funding mechanisms are crucial for providing the cash to buy out a departing owner’s share. Life insurance often plays a starring role. In a cross-purchase agreement, each owner buys policies on the others. When one dies, the survivors use the insurance money to buy the deceased’s share from their family.

In a redemption agreement, the business itself owns the policies and buys back the shares. Some agreements combine both approaches.

Without a buy-sell agreement, you could end up with your deceased partner’s spouse as your new business partner. Or, surviving partners might lack the cash to buy the shares, forcing a sale of the entire business at the worst possible time.

The critical role of life insurance in estate planning becomes clear when funding these agreements. It provides liquidity to make transitions smooth.

Advanced Strategies: Tax Minimization and Asset Protection

As a successful business owner, you’ve worked hard to build your wealth. Now, it’s time to work smart to protect it. Estate planning for business owners involves sophisticated strategies to minimize taxes and shield your assets from potential threats.

Without the right protection, taxes and creditors could diminish your legacy. Both federal and state estate taxes can take a significant bite, while lawsuits and creditor claims can threaten everything you’ve worked for.

With proper planning, you can legally minimize these threats. We focus on implementing strategies that reduce tax burdens and create protective barriers around your assets, ensuring more of your wealth stays with your family. For comprehensive insights, explore information on minimizing estate taxes and our guide on tax saving estate planning strategies.

Understanding and Using Trusts in Your Plan

Trusts are versatile tools in estate planning for business owners, offering benefits for asset protection, tax minimization, and wealth transfer, often while you maintain control during your lifetime. They allow you to dictate how assets are managed and distributed, often bypassing the lengthy and expensive probate process.

Revocable Living Trusts are a foundation for many plans. They give you complete control during your lifetime—you can change or cancel them. They are excellent for avoiding probate, maintaining privacy, and ensuring seamless asset management if you become incapacitated. When business interests are in a revocable trust, a successor trustee can step in immediately without court delays. Learn more about what a revocable living trust is and explore our guide on Houston estate planning trust structures.

Irrevocable Trusts offer more robust protection because they generally can’t be changed. This permanence is their strength—they can remove assets from your taxable estate and provide strong protection from creditors.

Irrevocable Life Insurance Trusts (ILITs) are particularly valuable. The trust owns your life insurance policy, keeping the death benefit out of your taxable estate. This provides tax-free cash to your heirs to pay estate taxes or fund buy-sell agreements without forcing the sale of business assets.

Grantor Retained Annuity Trusts (GRATs) work well for rapidly growing businesses. You transfer business interests to the trust, retaining an income stream. If the business grows faster than a specified rate, the excess growth passes to your heirs tax-free.

Dynasty Trusts preserve wealth across multiple generations. These trusts can protect assets from estate taxes, creditors, and divorce settlements for decades, creating a lasting financial legacy.

Key considerations in estate planning for business owners: Taxes

Taxes are a major potential drain on your business legacy, making tax planning a crucial part of estate planning for business owners. Understanding federal and state tax landscapes helps you make informed decisions.

The federal estate tax exemption is $13.99 million per individual in 2025. Estates below this threshold generally won’t face federal estate taxes. However, this amount can change, making it important to plan for various scenarios.

While Texas has no state estate tax, other states do. For instance, Washington State’s estate tax begins at $2,193,000 as of 2025. If you own property or business interests in other states, their tax laws could impact your plan.

Lifetime gifting is an effective tax minimization strategy. The annual gift tax exclusion allows you to transfer $18,000 per recipient per year in 2024 without gift tax consequences. This lets you gradually move assets out of your taxable estate, reducing the eventual tax burden.

Family Limited Partnerships (FLPs) offer another sophisticated approach. These entities let you transfer business ownership to family members while maintaining operational control. They often qualify for valuation discounts for gift and estate tax purposes, reducing the taxable value of transferred assets. This strategy works well in Texas, and you can learn more about Family Limited Partnerships in Texas.

The timing of asset transfers involves complex trade-offs between gift and estate taxes. We help you steer these decisions to find the most tax-efficient path for your specific situation.

Maintaining Your Plan and Avoiding Common Pitfalls

Your estate planning for business owners is a living document that must evolve with your business and family. It’s not a one-time task; it requires regular attention to stay effective.

We recommend reviewing your business estate plan every 3 to 5 years at minimum, but certain events should trigger an immediate review.

Major life changes like marriage, divorce, a new child, or a death can alter your planning needs. Imagine an ex-spouse still having power of attorney over your business.

Significant business changes also demand attention. Dramatic growth, new partners, or a change in business structure all affect how your business can be transferred and the tax implications.

Changes in tax laws can make old strategies less effective or open up new opportunities. What worked five years ago might not be the best approach today.

We see certain preventable mistakes repeatedly. Not funding a trust is a common error. A trust is just expensive paperwork if you don’t transfer assets into it. It’s like buying a safe but leaving your valuables on the counter.

Outdated beneficiary designations on life insurance, retirement accounts, and bank accounts cause endless headaches. These designations override your will, so if they aren’t updated after major life events, assets can go to unintended people.

Failing to communicate your plan creates confusion and hurt feelings. Your key family members and business partners should understand the broad strokes of your plan to avoid making decisions that work against your strategies.

This ongoing process of review and maintenance is critical. You must keep legal documents updated, re-evaluate your business valuation for buy-sell agreements and tax planning, and communicate with chosen successors to ensure they are still the right fit. Aligning your personal and business plans prevents conflicts between your financial goals. For more insights, check out our tips from an attorney on estate planning pitfalls and the essential steps for estate planning.

Advanced estate planning for business owners: A Living Document

Your estate planning for business owners should evolve just like your business does. What made sense when you were starting out might not fit your current situation or future goals.

Updating legal documents goes beyond just changing names or addresses. Your business relationships, family dynamics, and financial situation all shift over time, and your legal documents need to reflect these changes. A will that made perfect sense ten years ago might not align with your current wishes or circumstances.

Re-evaluating your business valuation is crucial for several reasons. Your buy-sell agreement might specify a valuation method that no longer reflects reality. Your gifting strategies depend on accurate valuations to maximize tax benefits. And your overall estate tax planning hinges on knowing what your business is actually worth in today’s market.

Communicating with your chosen successors keeps everyone on the same page. The family member or employee you identified as your successor years ago might have developed new skills, changed their interests, or taken on different responsibilities. Regular conversations ensure they’re still the right fit and properly prepared for their future role.

Aligning your personal and business plans prevents conflicts between your various financial goals. Your retirement planning, charitable giving intentions, and business succession strategy all need to work together harmoniously. When they’re out of sync, you might find yourself working against your own interests.

This ongoing process is one of the essential steps for estate planning that we emphasize with all our clients. We’re here to help you steer these updates, ensuring your plan stays current and effective no matter what changes life brings your way.

Frequently Asked Questions about Business Estate Planning

As Houston business owners ourselves, we know you have questions about estate planning for business owners. After helping countless entrepreneurs protect their legacies, we’ve noticed the same concerns come up again and again. Let’s address the big ones.

What happens to my business if I become incapacitated without a plan?

This is one of the scariest scenarios. If you’re suddenly unable to make decisions, your business could spiral into chaos. A court may appoint a guardian to manage your affairs. This person could be a stranger to your business and industry, unable to understand its operations, customers, or key relationships, putting the business at risk.

We’ve seen businesses lose contracts, miss payroll, and face lawsuits because court-appointed guardians didn’t know what they were doing. Your business value could plummet while everyone waits for legal proceedings to sort things out.

The solution is simple: a durable power of attorney. This document lets you choose someone you trust—your spouse, partner, or key employee—to make financial and business decisions if you can’t. It’s like having a backup quarterback who knows the playbook. For specific guidance, you can learn about guardianship in Houston.

How does my business structure (LLC, Sole Proprietorship, etc.) affect my estate plan?

Your business structure is the foundation of your estate plan. Each structure creates different challenges and opportunities for estate planning for business owners.

If you’re a sole proprietor, your business and personal assets are legally the same. When you pass away, your business assets are distributed according to your will or state law. Your family might inherit a business they can’t run, or it might be sold off piece by piece.

Partnerships create their own headaches. Without a solid partnership agreement and buy-sell agreement, your family could suddenly be in business with your partners, and your partners could be stuck with your spouse or kids as new business partners.

LLCs and corporations offer more flexibility because they create a legal wall between you and your business. Your ownership is represented by membership interests or stock shares, which can be transferred more easily via your estate plan. However, you must ensure your operating or shareholder agreement works with your estate planning documents.

The key is making sure your business structure and estate plan work together. If they’re fighting each other, neither will work properly when your family needs them most.

Can I leave my business to one child and treat my other children fairly?

This question comes up in almost every family business consultation. You want to be fair, but equal doesn’t always mean identical.

The answer is absolutely yes, and it’s more common than you might think. The secret is equalization—making sure each child receives roughly the same value, even in different forms.

Here’s how it works: You leave the business to the child who’s been involved. Then you use other assets to “equalize” what the other children receive. Life insurance is popular for this because it provides tax-free cash that can match the business value. You might also use real estate, investment accounts, or other assets.

The trick is getting the math right and communicating your plan clearly. Don’t assume your children will understand the reasoning behind unequal distributions—explain your thinking while you’re here to have the conversation.

One warning: avoid giving all your children equal shares in the business if only one wants to run it. That’s a recipe for conflict and potential business failure. It’s better to give the working child control and the others equivalent value in assets they can actually use.

Conclusion: Secure Your Business, Solidify Your Legacy

Your business represents more than just a source of income – it’s the culmination of your dreams, hard work, and dedication. Through our exploration of estate planning for business owners, we’ve seen how proper planning transforms uncertainty into security, chaos into order, and potential family conflict into lasting harmony.

The key takeaways are clear: without a comprehensive estate plan, your business faces forced liquidation, your family may struggle with financial insecurity, and years of hard work could vanish in legal fees and tax obligations. But with proactive planning, you create a roadmap that ensures business continuity, protects your family’s financial future, and preserves the legacy you’ve built.

This isn’t about planning for failure – it’s about planning for success beyond your lifetime. Whether through a carefully crafted succession plan, strategic use of trusts, or buy-sell agreements, each component works together to protect your life’s work.

The importance of proactive planning cannot be overstated. We’ve seen too many families torn apart by preventable disputes, too many thriving businesses forced into fire sales, and too much wealth lost to unnecessary taxes. These tragedies are avoidable with proper planning.

At WestLoop Law Firm, we understand the unique challenges Houston entrepreneurs face. Our combined knowledge in estate planning and probate law means we don’t just help you create a plan – we understand what happens when plans fail, and we use that knowledge to build bulletproof strategies for your business and family.

Your business deserves to outlive you. Your family deserves financial security. Your legacy deserves protection. The value of professional guidance in navigating these complex waters is immeasurable, especially when your advisor understands both the planning process and the potential pitfalls.

Don’t let another day pass wondering “what if.” Take action now to secure your business and solidify your legacy. Contact an experienced Houston estate planning lawyer to protect your legacy today. We’re here to help you transform uncertainty into confidence, ensuring your business thrives for generations and your family remains financially secure no matter what the future holds.