Houston Uninsured Motorist Lawyer: Critical 2025 Guide

The High Risk of Uninsured Drivers on Houston Roads

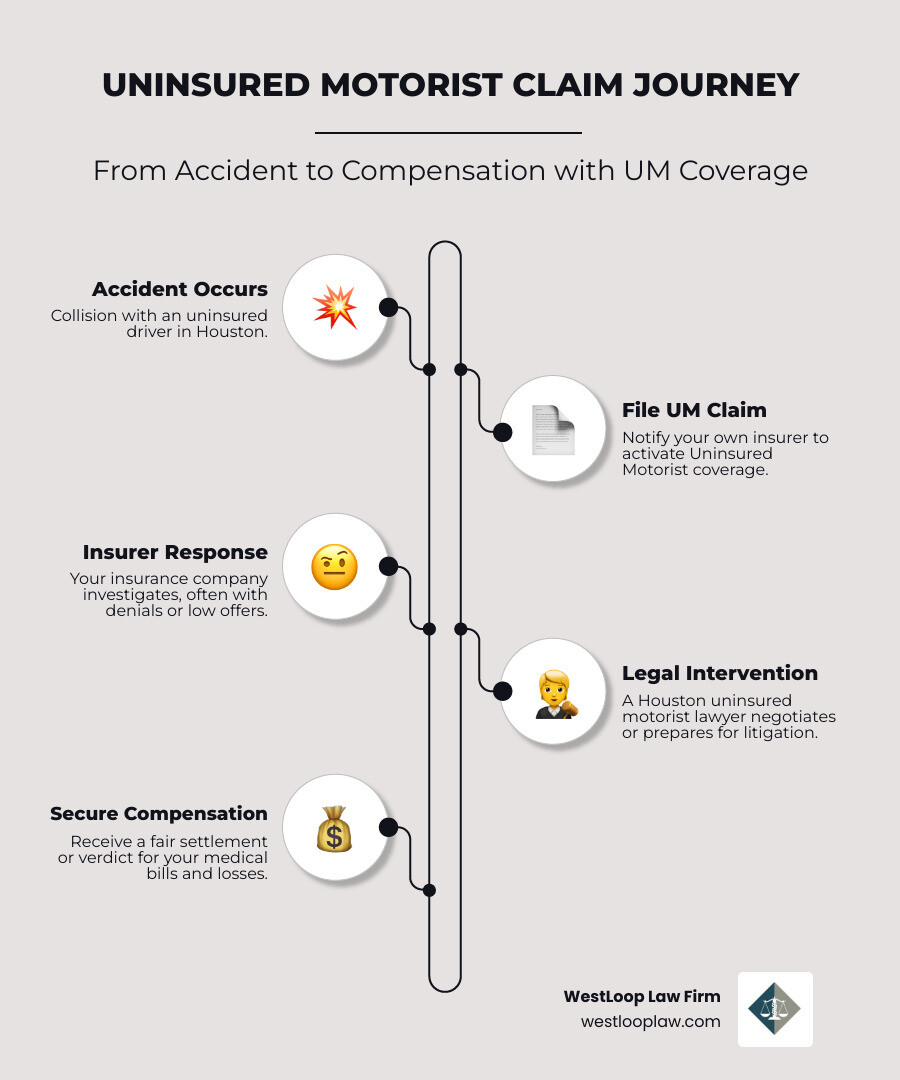

A houston uninsured motorist lawyer can help you recover compensation when an at-fault driver has no insurance or insufficient coverage. Your own uninsured/underinsured motorist (UM/UIM) policy provides this protection, but insurance companies often fight these claims.

Quick Answer: What to Do After an Accident with an Uninsured Driver in Houston

- Call 911 and get medical attention immediately.

- Document everything – photos, witness info, police report.

- Notify your insurance company but limit your statements.

- Review your own policy for UM/UIM coverage.

- Contact a Houston uninsured motorist lawyer before accepting any settlement.

This scenario is unfortunately common in Houston. About one out of every three drivers on Texas roads are driving without insurance, despite state law requiring all drivers to carry coverage. This puts every responsible driver at financial risk.

When an uninsured driver causes an accident, you face medical bills, lost wages, and property damage with no obvious way to pay. If you have uninsured motorist coverage on your own policy, you can file a claim with your insurance company. However, even though you’ve paid premiums for this protection, insurers often deny UM claims, offer low settlements, or drag out the process. This guide explains how to steer an uninsured motorist accident in Houston and fight for fair compensation.

Quick houston uninsured motorist lawyer definitions:

Understanding Your Insurance Coverage in Texas

When you’re hit by an uninsured driver in Houston, you may already have protection built into your own insurance policy. Texas law requires drivers to carry minimum insurance, but it also allows you to add protections that become a lifeline when another driver can’t pay. Understanding your coverage is the first step toward getting the compensation you deserve.

For a deeper understanding of how fault works in Texas car accidents, check out our guide on Texas Tort Law.

Texas Minimum Liability Insurance Requirements

Every driver in Texas must carry liability insurance under the state’s Financial Responsibility Law. This is often called the “30/60/25 rule”:

- $30,000 for bodily injury or death for one person in an accident you cause.

- $60,000 for bodily injury or death for multiple people in an accident you cause.

- $25,000 for property damage per accident.

This liability insurance only pays for harm you cause to others; it does not cover your own injuries or vehicle. The problem arises when an at-fault driver has no insurance, or their minimum coverage is insufficient for your medical bills. A serious injury can easily exceed the $30,000 minimum, which is why your own Uninsured and Underinsured Motorist coverage is essential.

Uninsured (UM) vs. Underinsured (UIM) Motorist Coverage

UM and UIM coverage is your financial safety net. While optional, they are among the most important protections you can buy. By law, your insurance company must offer you UM/UIM coverage, and you can only decline it by signing a written rejection form. If you don’t recall signing a rejection, you likely have this coverage.

-

Uninsured Motorist (UM) Coverage applies when the at-fault driver has no liability insurance. It covers your medical bills, lost wages, pain and suffering, and property damage up to your policy limits. The National Association of Insurance Commissioners provides more information about uninsured motorist insurance.

-

Underinsured Motorist (UIM) Coverage applies when the at-fault driver has insurance, but their policy limits are too low to cover your damages. For example, if you have $100,000 in damages and the at-fault driver has a $30,000 policy, their insurance pays $30,000, and your UIM coverage can pay the remaining $70,000 (if your UIM limit is high enough).

In a state where so many drivers are uninsured or underinsured, UM/UIM coverage is critical. A houston uninsured motorist lawyer can help you maximize these benefits.

How UM/UIM Differs from PIP and MedPay

UM/UIM, PIP, and MedPay all help with accident expenses but serve different purposes.

| Feature | Uninsured/Underinsured Motorist (UM/UIM) | Personal Injury Protection (PIP) | Medical Payments (MedPay) |

|---|---|---|---|

| Fault-Based? | Yes (pays when another driver is at-fault) | No (pays regardless of who is at-fault) | No (pays regardless of who is at-fault) |

| Coverage Type | Medical expenses, lost wages, pain/suffering, property damage | Medical expenses, 80% lost wages, household duties, funeral expenses | Medical expenses only |

| Purpose | Protects you when at-fault driver has no/insufficient insurance | Covers immediate medical costs and lost income quickly | Covers immediate medical costs |

| Texas Mandate? | Must be offered, can be declined in writing | Must be offered, can be declined in writing | Optional |

| Offsets? | Can be offset by PIP payouts | No offsets from other coverages | Often requires reimbursement if you recover from a third party |

Personal Injury Protection (PIP) is no-fault coverage automatically included in Texas auto policies unless rejected in writing. It quickly covers medical bills and 80% of lost wages, regardless of who caused the accident.

Medical Payments (MedPay) is also no-fault but only covers medical expenses. Unlike PIP, MedPay often must be reimbursed if you recover money from the at-fault driver.

While PIP and MedPay cover immediate costs, only UM/UIM coverage is designed to fully compensate you for all losses, including pain and suffering and reduced quality of life, when an uninsured or underinsured driver is at fault.

Does UM Coverage Apply to Hit-and-Run Accidents?

Yes, your Uninsured Motorist coverage protects you in a hit-and-run accident, treating the fleeing driver as an uninsured one. However, to make a claim, you must meet certain conditions:

- File a police report quickly, typically within 24 hours.

- There must be physical contact between your vehicle and the hit-and-run vehicle. This rule helps prevent fraud.

- The at-fault driver must remain unidentified despite reasonable law enforcement efforts.

If you were a pedestrian or cyclist struck by a hit-and-run driver, your own auto policy’s UM coverage can still apply. These cases have unique challenges, and our Pedestrian Accident Lawyer page offers specific guidance. Always check your policy for the exact requirements, as insurers scrutinize these claims.

Immediate Steps After an Accident with an Uninsured Driver

After a crash, learning the other driver is uninsured adds another layer of stress. What you do in the first few hours is critical for your ability to recover compensation. Every photo, note, and witness statement helps a houston uninsured motorist lawyer build your case.

Protecting yourself doesn’t require being a legal professional, just knowing what matters most. For a broader look at handling injury accidents, see our guide: What to do if you are injured after a car accident in Houston TX.

At the Scene: Safety and Evidence Collection

First, call 911. A police report is often required for an uninsured motorist claim and creates an official record of the crash. Do not let the other driver talk you out of it.

If you can, move to safety. Pull to the shoulder and turn on your hazard lights to prevent a second accident. Then, begin gathering evidence:

- Exchange Information: Get the other driver’s name, phone number, address, and vehicle details (make, model, license plate). Ask for any insurance information they have, even if they believe the policy has lapsed.

- Photograph Everything: Take photos of vehicle damage from multiple angles, the entire accident scene, road conditions, traffic signs, and skid marks. Document any visible injuries.

- Get Witness Information: If anyone saw the crash, get their name and phone number. A neutral third-party witness can be invaluable.

- Do Not Admit Fault: Avoid apologies or statements like “I didn’t see you.” Such comments can be used against you. Stick to the facts when speaking with police.

- Decline Cash Offers: Politely decline any on-the-spot cash offers from the uninsured driver. It will not be enough to cover your potential medical bills and complicates any future claim.

For a complete checklist, see our guide on Documents for car accidents Houston TX.

Reporting the Accident and Documenting Your Damages

The work continues after you leave the scene. These next steps are vital for your claim.

Get medical attention immediately, even if you feel fine. Adrenaline can mask serious injuries like whiplash or concussions, which may not show symptoms for hours or days. We see many Common Car Accident Injuries in Houston TX that people initially dismiss. A delay in seeking treatment gives insurance companies an excuse to argue your injuries aren’t serious or were caused by something else. Follow all medical advice and attend all appointments.

Notify your own insurance company promptly. Report the basic facts: date, time, location, and that the other driver appears to be uninsured. Avoid detailed statements about your injuries or how you feel, as adjusters can use this information to minimize your claim.

Save every document related to the accident in an organized folder. This includes medical bills, doctor’s notes, repair estimates, and receipts for rental cars or other out-of-pocket expenses. Document any lost wages with a letter from your employer.

Start a pain and suffering journal. Each day, note your pain levels, activities you can no longer do, and the emotional impact of the accident. This journal is a powerful record of how the crash has affected your life, including psychological impacts like Post-Traumatic Stress Disorder.

Finally, stay off social media. Do not post about the accident or your recovery. Insurers monitor social media accounts for any evidence they can use to dispute your claim. A single photo could be misinterpreted to argue you aren’t truly injured.

Navigating the Uninsured Motorist Claim Process

After documenting the accident and notifying your insurer, you might expect your own insurance company to support you. Unfortunately, the process of filing an uninsured motorist (UM) claim often becomes an adversarial one.

Insurance companies, including your own, are businesses focused on minimizing payouts. Your UM/UIM claim will likely face scrutiny, delays, and lowball offers. This is why having a houston uninsured motorist lawyer is so important.

The Role of Your Own Insurance Company

When you file a UM/UIM claim, your insurer’s interests no longer align with yours. They may employ several tactics to reduce their payout:

- Lowball Settlement Offers: Insurers often make a quick, low offer, hoping you’re desperate for cash and unaware of your claim’s true value.

- Recorded Statements: Adjusters may ask for a recorded statement to get you to downplay your injuries or say something that can be used against you. It is wise to consult a lawyer before providing one.

- Independent Medical Examinations (IMEs): Your insurer may require an examination by a doctor they hire. These doctors often produce reports that minimize the severity of your injuries.

- Delay Tactics: Insurers might drag out the investigation or be slow to respond, hoping to frustrate you into accepting a lower settlement.

- Claim Denials: In some cases, an insurer may deny your claim outright, arguing there is insufficient evidence or your injuries are not severe. If this denial is unfair, you may have grounds for a bad faith insurance lawsuit, which can result in additional damages.

A Houston Insurance Claim Attorney understands How to insurance companies after a car accident operate and can fight these tactics on your behalf.

Can You Sue the Uninsured Driver Directly?

Yes, you have the legal right to file a personal injury lawsuit against the at-fault uninsured driver. They are legally responsible for your damages, regardless of their insurance status.

However, winning a lawsuit is not the same as collecting payment. Many uninsured drivers lack the financial resources to pay a judgment, making them judgment proof. The process of garnishing wages (which is limited in Texas) or seizing assets can be long, expensive, and ultimately unsuccessful. An at-fault driver could also declare bankruptcy, which might discharge the debt to you entirely.

Before suing, a houston uninsured motorist lawyer can conduct an asset search to see if the driver has any collectible resources. In most situations, pursuing a UM/UIM claim with your own insurer is the most reliable path to financial recovery. For more information, see our guides on filing a personal injury lawsuit and How to file personal injury lawsuits in Houston.

Know the Deadlines: The Texas Statute of Limitations

Texas law imposes strict deadlines, or statutes of limitations, for filing lawsuits. If you miss these deadlines, you permanently lose your right to seek compensation.

- For a personal injury lawsuit against the at-fault driver, you generally have two years from the date of the accident to file.

- For a UM/UIM claim against your own insurance company, the case is typically treated as a breach of contract. You generally have four years from the date your insurer denies or fails to pay your claim to file a lawsuit.

Do not wait. Your insurance policy also has its own deadlines for reporting accidents and filing claims. Consulting a houston uninsured motorist lawyer early ensures all deadlines are met and your rights are protected. For a detailed overview, visit our page on the Texas Statute of Limitations.

Why You Need a Houston Uninsured Motorist Lawyer

After being hit by an uninsured driver, the next challenge is dealing with your own insurance company. You might expect them to be on your side, but their goal is to protect their bottom line. They employ adjusters and lawyers to minimize what they pay out, putting you at a disadvantage while you’re trying to recover.

A houston uninsured motorist lawyer levels the playing field, lifting the legal burden so you can focus on healing. For more on why representation matters, read our guide on Why you need a Houston Personal Injury Lawyer on your side.

How an Experienced Lawyer Maximizes Your Claim

A skilled lawyer does more than file paperwork. We build your case from the ground up to ensure you are fully compensated.

- Investigation: We gather police reports, interview witnesses, and review medical records to prove the other driver was at fault.

- Damage Calculation: We calculate your full damages, which include not just current medical bills but also future medical care, lost wages, and non-economic damages like pain and suffering. We often work with medical and economic professionals to project these costs. To understand potential outcomes, see our Houston Guide Car Accident Settlement Payouts.

- Negotiation: We handle all communications with the insurance company, protecting you from their tactics. We know their playbook and negotiate for a fair settlement. If they refuse, we are prepared to file a lawsuit and take your case to court.

Choosing the Right Houston Uninsured Motorist Lawyer for Your Case

Not all personal injury lawyers have deep experience with UM/UIM claims, which involve unique legal complexities. When choosing an attorney, look for:

- Specific UM/UIM Experience: Ask about their track record with these specific case types.

- Positive Client Testimonials: See what past clients say about their communication and service.

- Clear Communication: You need a lawyer who listens and keeps you informed.

- Trial Resources: Choose a firm with a reputation for being willing to go to court. This gives you leverage in negotiations.

At WestLoop Law Firm, we believe in the 5 Traits Houston Personal Injury Lawyer should have and hold ourselves to that standard.

Understanding the Costs: How a Houston Uninsured Motorist Lawyer Gets Paid

Hiring a top-tier lawyer doesn’t require any upfront money. We work on a contingency fee basis, which means our fee is a percentage of the settlement or verdict we win for you. If we don’t recover compensation for you, you owe us nothing.

This arrangement aligns our interests with yours—we are motivated to get you the maximum possible compensation. We are transparent about our fee structure from the start.

We also offer a free, no-obligation case evaluation to discuss your legal options. Learn more about What to expect free consultation Houston lawyer provides.

Frequently Asked Questions about Houston Uninsured Motorist Claims

When you’re dealing with an uninsured motorist accident, it’s natural to have questions. Here are clear, honest answers to some of the most common ones we hear.

What if the at-fault driver’s insurance isn’t enough to cover my bills?

This is an underinsured motorist (UIM) situation, and it’s precisely why UIM coverage exists. If your damages exceed the at-fault driver’s policy limits (for example, the $30,000 state minimum), your UIM coverage can bridge the gap.

The process involves first securing the maximum payout from the at-fault driver’s insurance. Then, we file a UIM claim with your own insurer for the remaining amount needed to cover your damages, up to your policy limits. A houston uninsured motorist lawyer can manage both claims to ensure you receive full and fair compensation.

My UM/UIM claim was denied. What now?

A claim denial is frustrating, but it is not the end of the road. First, carefully review the denial letter, as insurers must provide a specific reason for their decision. If the denial seems unreasonable or lacks a proper investigation, your insurer may be acting in bad faith.

You have the right to challenge the decision. This is a critical time to have a houston uninsured motorist lawyer on your side. We can evaluate the denial, gather evidence to dispute it, and negotiate with the insurer. If they still refuse a fair settlement, we can file a lawsuit for breach of contract and bad faith. A successful bad faith claim in Texas can result in damages up to three times your original claim amount, giving us significant leverage.

Do I still need a lawyer if my insurance company seems cooperative?

Yes. Even a friendly insurance adjuster is a trained professional whose job is to settle your claim for as little as possible. An early cooperative stance can quickly change once the full extent of your injuries and damages becomes clear.

An early settlement offer might cover your initial medical bills but fail to account for future physical therapy, long-term lost wages, chronic pain, or emotional trauma. A houston uninsured motorist lawyer protects you from accepting a settlement that is less than what you are owed. We ensure all your present and future damages are calculated and claimed, and we handle all communications to prevent you from inadvertently harming your case. The insurance company has a team of professionals working to minimize your payout; you should have an advocate on your side working to maximize it.

Contact WestLoop Law Firm for Your Uninsured Motorist Claim

Being hit by an uninsured driver in Houston can leave you facing mounting medical bills and the stress of dealing with an uncooperative insurance company. Even though you paid for uninsured motorist (UM) coverage, your own insurer may use delays, lowball offers, or denials to protect their bottom line.

At WestLoop Law Firm, we fight these battles for our clients. Our team has deep experience with Texas personal injury law and a thorough understanding of how UM and UIM claims work. We know the insurance companies’ tactics and how to counter them effectively to fight for every dollar you deserve.

We handle the paperwork, negotiations, and legal complexities so you can focus on your recovery. A houston uninsured motorist lawyer from our firm will be your dedicated advocate.

We work on a contingency fee basis, meaning you pay nothing upfront. Our fee comes only from the compensation we successfully recover for you. If we don’t win, you owe us nothing. This “no win, no fee” promise ensures everyone can afford quality legal representation.

Don’t let an uninsured driver’s mistake jeopardize your financial future. Get help from an experienced Car Accident Lawyer in Houston who will stand up for your rights. Contact WestLoop Law Firm today for a free, no-obligation consultation to review your case and explain your options. You’ve been through enough—let us take it from here.