Houston Elder Law Attorney: Secure Your 2026

The Growing Need for Elder Law in Houston

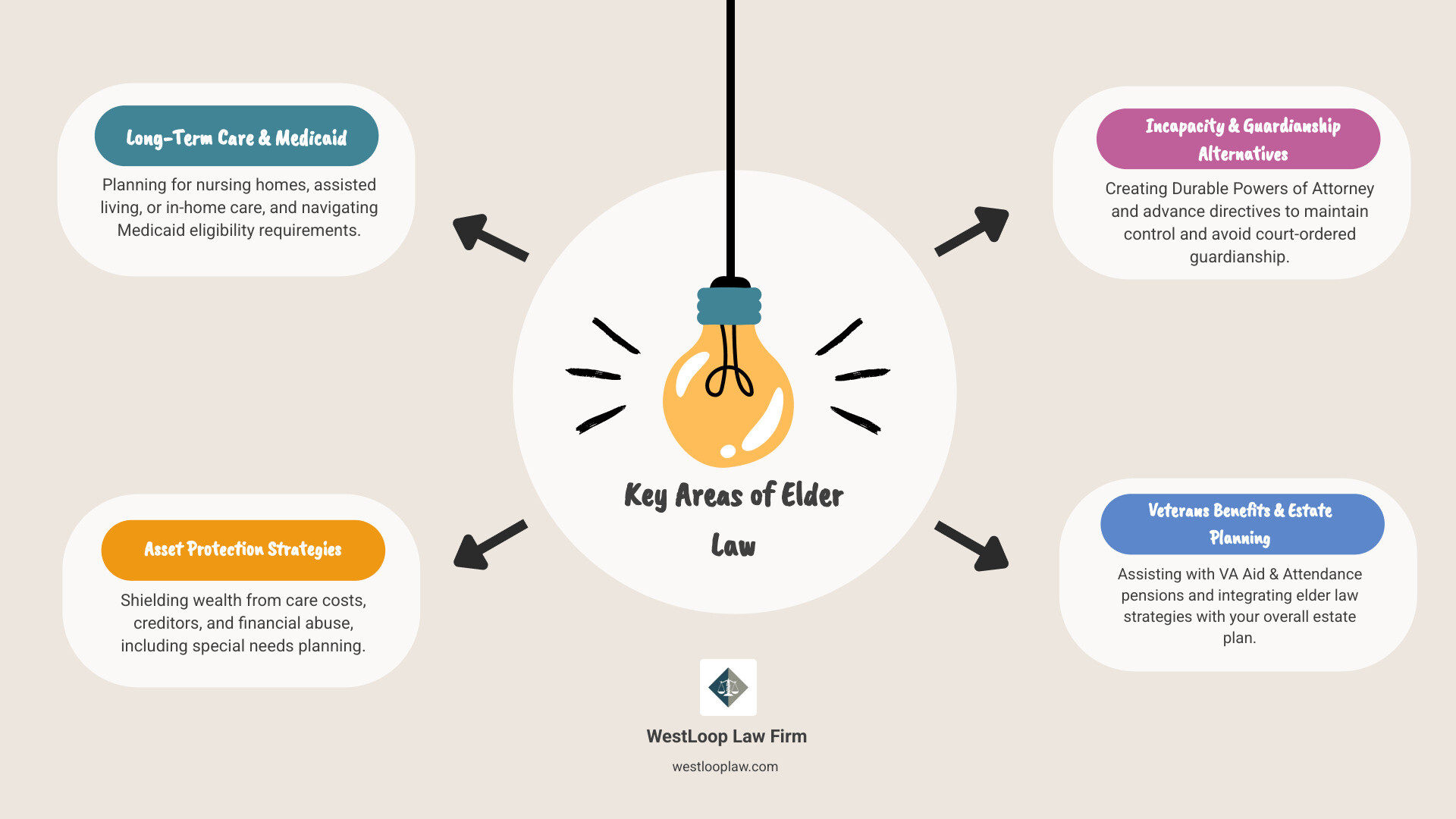

A Houston elder law attorney helps seniors and their families steer complex legal issues related to aging, including long-term care planning, Medicaid eligibility, asset protection, guardianship alternatives, and veterans benefits.

What Houston Elder Law Attorneys Do:

- Long-Term Care Planning – Help you afford nursing homes, assisted living, or in-home care without depleting your savings

- Medicaid Planning – Guide you through eligibility requirements and asset preservation strategies

- Asset Protection – Shield your hard-earned assets from creditors and potential financial abuse

- Guardianship Alternatives – Create powers of attorney and advance directives to avoid court proceedings

- Veterans Benefits – Assist with VA Aid and Attendance pensions for qualifying veterans and spouses

- Estate Planning Integration – Ensure your documents work together to protect you both now and after you’re gone

Houston’s senior population is growing fast. Harris County is home to hundreds of thousands of people aged 65 and older, and that number keeps climbing every year. The number of individuals aged 65 and older in the Houston metropolitan area is projected to increase significantly in the coming years, highlighting the growing need for elder law services.

This isn’t just a statistic. It’s your parents, your neighbors, maybe even you. And with longer lifespans comes a tough reality: most of us will need some form of long-term care before we die. The demand for elder law services in Houston is driven by the increasing lifespan of individuals and the associated need for long-term care planning, asset protection, and estate management.

The costs are staggering. The cost of long-term care in Houston can be substantial, making Medicaid planning a critical service offered by many Houston elder law attorneys to help families afford necessary care. Nursing homes in Houston can run $70,000 to $100,000 per year. Assisted living facilities along the I-10 corridor, near the Texas Medical Center, or close to Memorial Hermann Hospital and Houston Methodist Hospital in the Medical Center aren’t much cheaper. Even in-home care in neighborhoods off Westheimer Road, Kirby Drive, or around the Inner Loop can drain a lifetime of savings in just a few years.

Medicare doesn’t cover long-term care. Most people don’t have long-term care insurance. That leaves families scrambling to figure out how to pay for quality care without losing everything they’ve worked for.

This is where proactive planning makes all the difference. Waiting until a crisis hits means fewer options and more stress. Planning ahead gives you control over your future and protects your family from impossible decisions during an already difficult time.

Elder law in Houston addresses the unique legal challenges that come with aging. It’s not just about writing a will. It’s about making sure you can access the care you need in and around Houston, preserve your dignity, protect your assets, and maintain your independence for as long as possible.

Core Services: How a Houston Elder Law Attorney Can Help

Navigating the complexities of aging, especially in a vibrant and growing city like Houston, can be overwhelming. Fortunately, a Houston elder law attorney offers a comprehensive suite of services designed to support seniors and their families through these crucial stages of life. Houston families can receive help planning for the future, protecting their loved ones, and steering the unexpected.

Planning for Long-Term Care and Government Benefits

One of the most pressing concerns for many seniors and their families in Houston is the escalating cost of long-term care. Whether it’s a nursing home, an assisted living facility near the Galleria along Westheimer Road, a community near the Energy Corridor on I-10, or in-home care in neighborhoods near Bellaire Boulevard or Midtown, these expenses can quickly deplete a lifetime of savings. Our team at Westloop Law Firm understands that long-term care can cost six figures annually, and Medicare typically does not cover these ongoing costs.

A Houston elder law attorney can help you understand your options and develop a strategy to pay for care while protecting your assets. This often involves:

- Medicaid Planning: Many individuals may own too many assets to qualify for Medicaid but still face unsustainable long-term care costs. A Houston elder law attorney can guide you through the intricate eligibility requirements for Texas Medicaid, including strategies like “spend-down” and the use of specific trusts such as Miller Trusts or Qualified Income Trusts. This allows you to receive benefits without burning up your life’s savings. A substantial portion of elder law cases in Houston involve navigating complex government benefits such as Medicaid, requiring in-depth legal knowledge. Houston elder law attorneys frequently assist clients with obtaining government benefits, such as Medicaid, to cover the costs of long-term care.

- Asset Preservation: Houston elder law attorneys help structure your assets carefully to potentially qualify for government benefits while safeguarding them from unnecessary depletion. This ensures that you can access the care you need without impoverishing your family.

- Veterans Benefits: For our honored veterans and their spouses living in Houston, guidance is available for accessing specific benefits like the VA Aid and Attendance pension. This benefit can significantly help cover the costs of assisted living, personal care homes, or nursing home care. Attorneys who focus on elder law in Houston often have experience in navigating the complexities of public benefits planning, including Veterans Benefits. A Houston elder law attorney can help eligible veterans and their families apply for and receive these crucial benefits.

For more information on navigating long-term care challenges in Houston, you might find our insights on nursing home abuse in Texas helpful, as understanding care options often goes hand-in-hand with ensuring quality. The Texas Department of Health and Human Services also provides valuable resources for seniors and caregivers in the Houston area, which we can help you steer. You can find general information on their website: Information from the Texas Department of Health and Human Services.

Protecting Seniors and Their Assets

Protecting assets goes beyond just planning for long-term care costs. It’s about securing your financial legacy and guarding against potential threats in and around Houston. Westloop Law Firm assists families with various asset protection strategies to support peace of mind.

This includes:

- Irrevocable Trusts: These sophisticated tools can shield assets from creditors, lawsuits, and even the “spend-down” requirements for Medicaid, depending on how they are structured and when they are established.

- Preventing Elder Financial Abuse: Unfortunately, elder financial abuse is a growing concern across Houston, from the suburbs along Highway 59 to communities near the Texas Medical Center. A Houston elder law attorney can help put legal safeguards in place to protect vulnerable seniors from exploitation, helping ensure their hard-earned money and property remain secure.

- Disability Planning and Special Needs Trusts: For seniors who may develop disabilities, or for families with disabled loved ones, Houston elder law attorneys assist in creating plans that protect eligibility for crucial government benefits. This includes establishing Special Needs Trusts to help a disabled individual receive an inheritance or settlement without jeopardizing their eligibility for public assistance programs like Supplemental Security Income (SSI) or Medicaid. Many elder law attorneys in Houston also focus on special needs planning to maintain eligibility for Social Security disability benefits and Medicare Savings programs.

- Social Security and Medicare Issues: While these are federal programs, navigating their complexities can be challenging. A Houston elder law attorney can help address issues related to Social Security benefits, Medicare coverage, and appeals for denied benefits, helping Houston-area seniors receive the support they are entitled to.

Navigating Incapacity and Avoiding Guardianship

One of the greatest fears for many seniors is losing the ability to make their own decisions. Without proper planning, this can lead to stressful and costly guardianship proceedings in Harris County probate courts located in downtown Houston. Guardianship proceedings are a common area of elder law, where attorneys assist in appointing legal guardians for individuals who are unable to make decisions for themselves.

Houston elder law attorneys help clients proactively plan to avoid these situations by putting legal documents in place that empower trusted individuals to act on their behalf. This includes:

- Durable Power of Attorney: This document allows you to designate an agent to manage your financial affairs if you become incapacitated.

- Medical Power of Attorney and Advance Directives: These documents, often referred to as a Living Will, allow you to appoint someone to make healthcare decisions for you and to express your wishes regarding medical treatment if you cannot communicate them yourself. The role of a Living Will and Advance Directive also ensures your preferences are honored at Houston hospitals such as those in the Texas Medical Center, including Memorial Hermann and Houston Methodist.

- HIPAA Authorizations: These are crucial for allowing designated individuals to access your medical information, which is often necessary for making informed healthcare decisions.

By establishing these documents, you maintain control over your future and ensure that your wishes are respected, avoiding the need for potentially intrusive and expensive guardianship proceedings in Harris County. If you’re concerned about guardianship in Houston, our Guardianship Attorney Houston page offers more insights.

Elder Law vs. Estate Planning: Understanding the Key Differences

While both elder law and estate planning deal with future planning and asset management, they have distinct focuses. Think of it this way: estate planning looks to the future after you’re gone, while elder law focuses on ensuring your well-being during your lifetime.

What is the focus of a Houston elder law attorney?

A Houston elder law attorney primarily focuses on the needs of living individuals as they age. The legal practice area of elder law focuses on providing individuals with important help they need to steer the unique and often complex challenges they confront as they approach retirement, aging, and beyond. This means:

- Focus on the Living: Elder law addresses issues that arise during a person’s lifetime, such as long-term care needs, healthcare decisions, and managing assets for current support. It’s about preserving quality of life and independence.

- Managing Assets During Lifetime: Rather than just distributing assets after death, an elder law attorney helps manage and protect assets to ensure they can be used to pay for care, maintain a comfortable lifestyle, and qualify for government benefits without being completely depleted.

- Public Benefits Eligibility: A significant part of elder law involves planning for and securing eligibility for programs like Medicaid and VA benefits, which are crucial for affording long-term care.

- Crisis Planning: Often, families seek elder law attorneys during a health crisis, needing immediate guidance on how to pay for nursing home care or manage an incapacitated loved one’s affairs.

How does this overlap with traditional estate planning?

Despite their distinct focuses, elder law and estate planning have significant overlap. Many elder law firms in Houston offer comprehensive estate planning services, including wills, trusts, and powers of attorney, to address the diverse needs of aging individuals and their families. Both areas involve creating legal documents to guide future decisions and protect assets.

Here’s a quick comparison:

| Feature | Elder Law | Estate Planning |

|---|---|---|

| Primary Focus | Lifetime needs, quality of life, asset protection for care | Post-death distribution of assets, legacy |

| Key Concerns | Long-term care, Medicaid, VA benefits, incapacity | Inheritance, taxes, probate avoidance |

| Timing | Proactive planning for aging, crisis intervention | Planning for death |

| Main Goal | Maximize independence, access to care, protect assets | Ensure wishes are followed, minimize taxes, avoid probate |

As you can see, while traditional estate planning like writing a will or setting up a trust is vital for what happens after you pass, elder law extends that planning to cover your well-being and financial security during your later years. Many elder law attorneys in Houston focus on estate planning, including wills, trusts, and powers of attorney, to help clients protect their assets and ensure their wishes are followed.

We believe that multigenerational families should plan for their futures and create a life care plan for aging that makes sense for their unique needs. The “sandwich generation” is overloaded right now, and effective planning can significantly reduce stress. We can help integrate your estate planning goals with your elder law needs. Our Estate Planning Lawyer Houston page offers more details on wills and trusts, which are foundational to both areas. We also have extensive experience with Probate Attorney Houston services, helping families steer the process after a loved one passes.

How to Find and Choose the Right Houston Elder Law Attorney

Finding the right Houston elder law attorney is a crucial decision that can significantly impact your future and the well-being of your loved ones. You want someone who not only understands the law but also understands the unique challenges faced by seniors and their families in our Houston community.

What to Look For in a Houston Elder Law Attorney

When searching for legal counsel in Houston, consider these key factors:

- Board Certification: Look for attorneys who are board-certified in relevant areas. For instance, many elder law attorneys in Houston are board-certified in estate planning and probate law, indicating a high level of training and recognized proficiency in the field. This certification requires rigorous examination and ongoing education.

- Memberships in Elder Law Organizations: Affiliation with organizations like the National Academy of Elder Law Attorneys (NAELA) or the National Elder Law Foundation (NELF) can signify a commitment to the field and staying current with its evolving complexities.

- Experience with Harris County Probate Courts: Given that guardianship proceedings and probate are often intertwined with elder law, experience navigating the specific procedures and judges of the Houston probate court system in downtown Houston is invaluable.

- Client Reviews and Testimonials: Online reviews and testimonials can offer insights into an attorney’s communication style, compassion, and effectiveness.

- A Personal Connection: You’ll be discussing sensitive personal and financial matters. It’s important to feel comfortable and confident with your attorney.

Here are some questions to ask a potential attorney during your initial consultation in Houston:

- What percentage of your practice is dedicated to elder law in Houston?

- Are you board-certified in Estate Planning and Probate Law, or any other relevant areas?

- How do you stay current with changes in elder law, Medicaid, and VA benefits that affect Houston residents?

- Can you provide examples of how you’ve helped clients with similar situations to ours in Houston?

- What is your approach to crisis planning versus proactive planning for Houston families?

- How do you communicate with clients, and how often can we expect updates?

- What are the typical costs associated with the services we need?

Understanding the Costs

The typical costs associated with hiring a Houston elder law attorney can vary widely based on the complexity of your case and the attorney’s fee structure. While we cannot provide specific pricing, here’s a general overview for Houston residents:

- Initial Consultations: Many firms offer an initial consultation to discuss your needs. Some may offer this for free, others may charge a flat fee. This is a good opportunity to assess if the attorney is the right fit.

- Flat Fees: For certain predictable services, such as drafting basic estate planning documents (wills, powers of attorney, simple trusts), attorneys may charge a flat fee. For example, some Houston firms might offer a will-based estate plan starting at a certain amount for a single person.

- Hourly Rates: For more complex or ongoing matters, such as Medicaid applications, asset protection strategies, or guardianship proceedings in Harris County courts, attorneys typically charge an hourly rate. A retainer (an upfront payment) is usually required for these types of cases.

- Value of Proactive Planning vs. Crisis Costs: While there are costs associated with hiring an elder law attorney in Houston, consider it an investment. Proactive planning can often save families significantly more money and stress in the long run by preventing asset depletion, avoiding costly litigation (like guardianship), and helping ensure eligibility for crucial benefits. The cost of long-term care in Houston can be substantial, making Medicaid planning a critical service offered by many elder law attorneys to help families afford necessary care.

Where to Search for a Houston Elder Law Attorney

When you’re ready to begin your search in Houston, here are some reliable avenues:

- State Bar of Texas and Local Bar Associations: These organizations often have directories of attorneys by practice area and location, including Houston.

- Reputable Online Directories: Reputable legal directories online provide listings of Houston elder law attorneys, often including peer reviews and attorney profiles. These directories can highlight attorneys with various years of experience and different backgrounds.

- Referrals: Ask financial advisors, healthcare professionals at Houston-area hospitals like those in the Texas Medical Center, or even friends and family who have steered similar situations in Houston for recommendations.

Frequently Asked Questions about Houston Elder Law Attorneys

When should I consult a Houston elder law attorney?

It’s best to consult a Houston elder law attorney proactively, ideally years before a crisis. This allows for comprehensive planning, such as implementing asset protection strategies or setting up trusts, which often have look-back periods for Medicaid eligibility. We believe in planning ahead for normal aging challenges to allow families to focus on relationships rather than legal scrambling.

However, an attorney can also provide crucial help during a health or financial crisis, such as a sudden need for nursing home care near the Texas Medical Center. In these “crisis planning” situations, an attorney can help maximize available options, steer complex application processes, and mitigate financial losses. The “sandwich generation” is overloaded right now; while the stress may seem impossible, there are ways to plan ahead and manage these challenges.

Can a Houston elder law attorney help my veteran parent?

Absolutely. A Houston elder law attorney can provide invaluable assistance to veteran parents and their surviving spouses. They can help steer the complex requirements for accessing specific VA benefits, most notably the Aid and Attendance pension. This pension is designed to help cover the costs of long-term care, whether it’s in an assisted living facility, a personal care home, or for in-home care services, for qualifying veterans who served during wartime and meet certain medical and financial criteria. A substantial portion of elder law cases involve navigating complex government benefits such as Veterans Affairs benefits, requiring in-depth legal knowledge.

What is the main difference between elder law and estate planning?

While closely related, the main distinction lies in their primary focus:

- Elder law focuses on legal issues for the living. Its scope includes long-term care planning, qualifying for government benefits like Medicaid and VA Aid and Attendance, asset protection during your lifetime, and planning for incapacity through documents like Powers of Attorney and Advance Directives. It addresses how to live well and securely as you age.

- Estate planning primarily deals with the distribution of your assets and fulfilling your wishes after you pass away. This involves creating wills, various types of trusts (that take effect upon death), and minimizing estate taxes.

Many attorneys, including those at WestLoop Law Firm, offer both elder law and estate planning services, as they are often intertwined. The goal is to create a holistic plan that addresses both your needs during your lifetime and your legacy after you are gone.

Secure Your Family’s Future in Houston

The journey through aging in Houston can bring unexpected twists and turns, but with the right legal guidance, you can steer it with confidence and peace of mind. Proactive planning is key to protecting your legacy, ensuring your quality of life, and safeguarding your family’s future in Houston, whether you live near the Texas Medical Center, along I-45, or in suburbs off Highway 59.

We believe that every Houston family deserves a comprehensive plan that addresses the unique challenges of aging, long-term care, and asset protection. Our team at Westloop Law Firm has a deep understanding of the Houston probate court system and related planning needs. We are dedicated to providing clear, compassionate guidance, helping you make informed decisions that will benefit you and your loved ones for years to come.

Don’t wait for a crisis to take control of your future in Houston. We are here to help you develop a robust plan that secures your assets, ensures access to quality care, and honors your wishes. Contact us to discuss your estate and future planning needs.