Why Estate Planning is Critical for LGBTQ+ Couples

Estate planning for LGBTQ couples isn’t just about money and property—it’s about protecting your partner, honoring your identity, and ensuring your wishes are respected when you can’t speak for yourself.

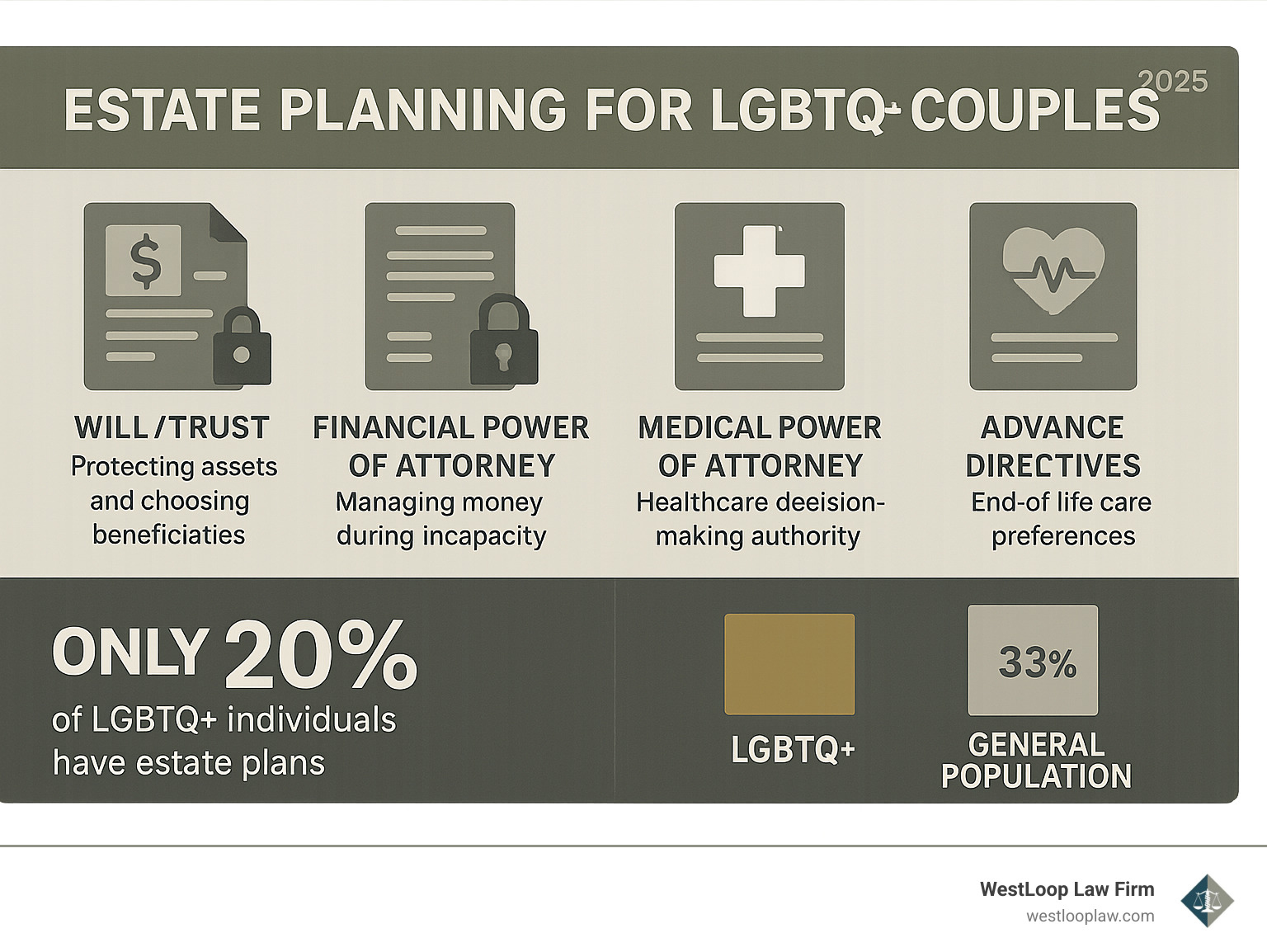

Essential Components of LGBTQ+ Estate Planning:

- Will or Trust – Controls who inherits your assets

- Financial Power of Attorney – Lets your partner manage money if you’re incapacitated

- Medical Power of Attorney – Gives your partner authority to make healthcare decisions

- Advance Healthcare Directive – Documents your end-of-life wishes

- Beneficiary Designations – Updates retirement accounts and insurance policies

The statistics tell a sobering story. Only 20% of the LGBTQ+ community has a will or estate plan, compared to 33% of the general population. This gap becomes concerning when you consider the unique challenges facing LGBTQ+ individuals and couples.

After coming out, the share of LGBTQ+ people who can rely on family for financial support drops from 75% to 62%. Meanwhile, 47% of LGBTQ+ Americans consider close friends to be family—nearly double the rate of the general population at 26%.

These numbers reveal a critical truth: LGBTQ+ individuals often can’t rely on traditional family structures for support. Without proper legal documents, your biological family—who may not support your relationship or identity—could make decisions about your medical care, finances, and final arrangements.

“Marriage gives you privilege. Estate planning gives you power,” explains estate-planning lawyer Angela Giampolo. This distinction matters because only 59% of same-sex couples living together are married, compared to 87% of opposite-sex couples.

The political climate adds another layer of urgency. 71% of LGBTQ+ adults expect negative impacts from changing political landscapes, making comprehensive estate planning more important than ever.

Common estate planning for LGBTQ couples vocab:

Why Your Relationship Isn’t Enough: The Urgency of Estate Planning for the LGBTQ+ Community

Love validates your relationship, but it does not create legal rights. Without signed, state-compliant documents, judges and default intestacy laws decide who inherits, who makes medical decisions, and even who can visit you in the hospital—not your partner or chosen family.

Key numbers highlight the risk:

- Only 20% of LGBTQ+ adults have an estate plan.

- 71% fear negative political changes.

- Family financial support drops from 75% to 62% after coming out, while nearly half of LGBTQ+ adults treat close friends as family.

Unique Challenges in Estate Planning for LGBTQ Couples

Before the 2015 Obergefell v. Hodges ruling, couples cobbled together protections with adoptions, joint ownership and powers of attorney. Even now, shifting court opinions and state laws keep many on edge. Comprehensive estate planning remains the surest way to protect your partner regardless of future legal battles.

Protecting Your Partner and Assets from Family Conflict

If you die without a will, assets flow to blood relatives by default. For an unmarried partner, that can mean zero inheritance and no decision-making power. Prevent conflict by

- drafting a clear will or trust;

- inserting no-contest clauses to deter challenges; and

- expressly disinheriting anyone who might undermine your wishes.

Protecting Your Family’s Future with Estate Planning explains these tools in more detail.

Honoring Your Chosen Family and True Identity

Chosen family often provides the love and support biology cannot. Proper planning lets you leave assets to friends, appoint them as guardians, and detail medical or funeral instructions that respect your gender identity.

For transgender and non-binary individuals, use your current legal name, avoid pronouns where possible, and detail your wishes for gender-affirming care or memorial arrangements.

The Essential Toolkit: Core Documents for Your Estate Plan

Think of these documents as a shield that activates the moment you cant speak for yourself. Together they cover asset distribution, medical decisions and privacy.

Last Will and Testament: Your Primary Instruction Manual

A will overrides intestacy laws, appoints an executor, and lets you name guardians for minor childrencrucial when the non-biological parent lacks automatic rights. Wills become public during probate; keep sensitive details minimal.

Creating a Last Will and Testament: The Process

Revocable Living Trusts: Privacy and Continuity

A trust avoids probate, keeps your affairs confidential, and allows a successor trustee to manage assets immediately if you are incapacitated. You can change or revoke it at any time.

Navigating the Benefits of a Revocable Living Trust in Houston

Powers of Attorney: Naming Your Advocate

- Durable Financial POA lets your agent pay bills and manage investments.

- Medical POA / Healthcare Proxy authorizes someone to make treatment decisions.

Banks and hospitals respect paperwork, not romance.

Power of Attorney: Managing Financial and Medical Affairs

Advance Healthcare Directives (Living Wills)

An advance directive records your wishes on life-sustaining treatment, organ donation and pain management, sparing loved ones from agonizing guesses.

Tailoring Your Plan: Specific Strategies for LGBTQ+ Families

Every family is unique. Below are focused tips for protecting yours.

Comprehensive Estate Planning for LGBTQ Couples with Children

Guardianship clauses in your will should name the parent you wantusually your partnerto avoid custody battles with unsupportive relatives. When possible, complete a second-parent adoption; it cements legal parentage in all 50 states.

Coordinate life-insurance and trust beneficiaries so funds flow smoothly to the caregiver.

Blended Families and Estate Planning in Houston

State laws on second-parent adoption

Navigating the Legal Maze: Married vs. Unmarried Couples

| Legal Right | Married | Unmarried |

|---|---|---|

| Intestacy inheritance | Automatic | None |

| Estate & gift tax perks | Unlimited | Limited |

| Medical decisions | Presumed | Must be granted |

| Social Security survivor benefits | Yes | No |

Because 41 % of co-habiting same-sex couples remain unmarried, unmarried partners must rely on wills, trusts and powers of attorney for virtually every protection spouses receive by default.

Inclusive Language: Gender Identity in Your Legal Documents

Use your current legal name, avoid pronouns where possible, and keep copies of name-change orders with your estate plan. Explicitly state how you want to be referred to in medical settings and obituaries to prevent deadnaming or misgendering.

Inclusive drafting preserves not only your assets but also your dignity.

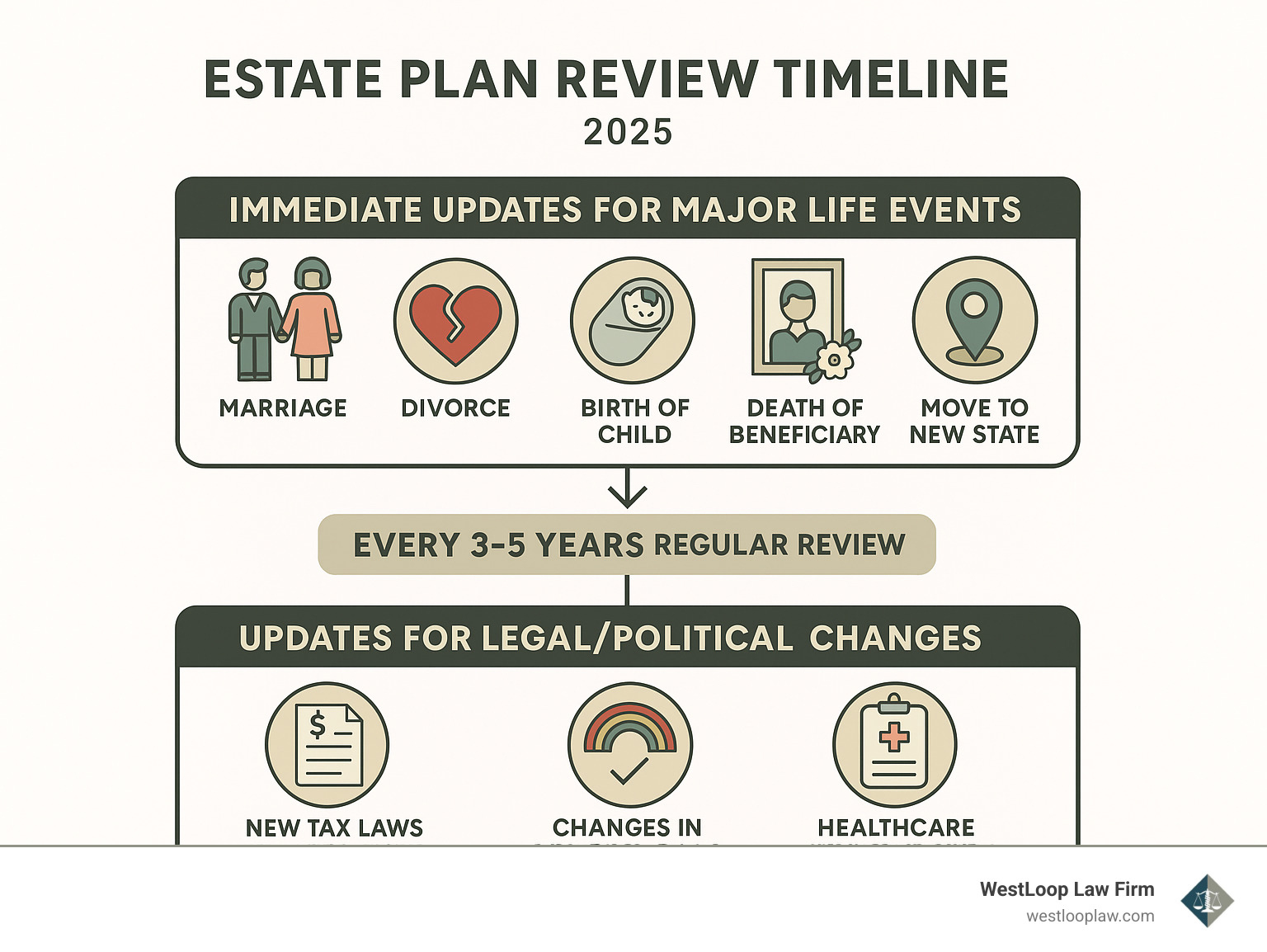

Keeping Your Plan Current: When and Why to Update

Your estate planning for LGBTQ couples isn’t something you can set and forget. Life has a way of throwing curveballs, and your estate plan needs to evolve with your changing circumstances.

An outdated estate plan can be worse than no plan at all. Imagine your carefully crafted documents naming an ex-partner as your healthcare proxy, or your will leaving everything to someone who’s no longer in your life. These situations create exactly the kind of family drama and legal complications that good estate planning is supposed to prevent.

Life’s Major Milestones

Certain life events should send you straight to your attorney’s office to review your estate plan. These moments fundamentally change your legal rights, family structure, or financial situation.

Getting married or entering a domestic partnership transforms your legal landscape overnight. Marriage brings automatic inheritance rights, unlimited gift tax exemptions between spouses, and decision-making authority that unmarried couples don’t have.

Divorce or separation requires immediate attention to your estate planning documents. You’ll want to remove your ex-partner from decision-making roles and update beneficiary designations on all accounts.

The birth or adoption of a child brings new responsibilities and considerations. You’ll need to add guardianship nominations, adjust your asset distribution plans, and ensure that life insurance coverage is adequate for your growing family.

Significant changes in your financial situation—whether from inheritance, starting a business, or major purchases—may require adjustments to your planning strategies.

The death of a beneficiary, executor, or guardian leaves gaps in your plan that need immediate attention.

Moving to a new state can complicate your estate plan because laws vary significantly between states.

For LGBTQ+ couples, relationship milestones might not follow traditional patterns. Consider reviewing your plan when you move in together, complete a second-parent adoption, or experience changes in family acceptance.

The Shifting Legal and Political Landscape

The legal environment for LGBTQ+ rights continues to evolve, sometimes in ways that directly impact estate planning. Tax laws change regularly, affecting everything from the federal estate tax exemption to gift tax rules. Healthcare regulations shift with new administrations, potentially affecting your medical directives and healthcare proxy documents.

Political changes can create uncertainty about the stability of LGBTQ+ rights. While we hope for continued progress, it’s wise to ensure your estate plan can withstand potential changes in the legal landscape.

A Rule of Thumb for Reviews

Even without major life changes, plan to review your estate plan every 3-5 years. This regular maintenance ensures that your documents remain current and that your wishes haven’t shifted over time.

During these reviews, take a fresh look at your chosen executors, trustees, and agents. Are they still the right people for these important roles? Consider whether your asset distribution plans still reflect your current relationships and values.

Review whether your documents comply with current laws and use appropriate legal language. Don’t forget to check beneficiary designations on retirement accounts, life insurance policies, and other financial accounts.

Working with an experienced estate planning attorney for these reviews is usually worth the investment. Family Matters: Houston Estate Planning Attorneys on the Importance of Inheritance Planning emphasizes how regular reviews keep your plan relevant and effective.

Your estate plan is a living document that should grow and change with you. Regular updates ensure that it continues to protect the people you love and honor the life you’ve built together.

Conclusion: Securing Your Legacy and Peace of Mind

Estate planning for LGBTQ couples is an act of love and self-determination. By putting a solid plan in place, you ensure that your partner can make medical decisions, your chosen family can inherit, and your identity will be respected.

With legal landscapes shifting and only 20 % of LGBTQ+ adults currently prepared, the best time to act is now. WestLoop Law Firm combines probate knowledge with compassionate advocacy for Houston families. To begin crafting your plan, explore our services at Estate Planning Law in Houston.

Because every love story deserves the security of the law behind it.