Houston Trust Lawyer: Secure Your 2026 Legacy

Understanding Trusts: Your Foundation for Estate Planning in Houston

A houston trust lawyer helps families protect their assets, avoid probate, and ensure their wishes are carried out after death. Here’s what you need to know:

What is a Houston Trust Lawyer?

- An attorney who creates and administers trusts under Texas law

- Helps with estate planning, asset protection, and tax strategies

- Guides trustees and beneficiaries through trust disputes

- Works with the Texas Trust Code to ensure legal compliance

When You Need a Trust Lawyer:

- Setting up a trust to avoid probate court in Harris County

- Protecting assets for minor children or special needs beneficiaries

- Managing complex estates or business succession

- Resolving disputes between trustees and beneficiaries

- Planning for incapacity or long-term care needs

Planning for your assets after you’re gone is not easy. For Houston families with real estate in neighborhoods like Montrose or the Heights, business interests along Westheimer Road or the Energy Corridor, or careers in the Texas Medical Center, a trust is a powerful tool for protecting your legacy.

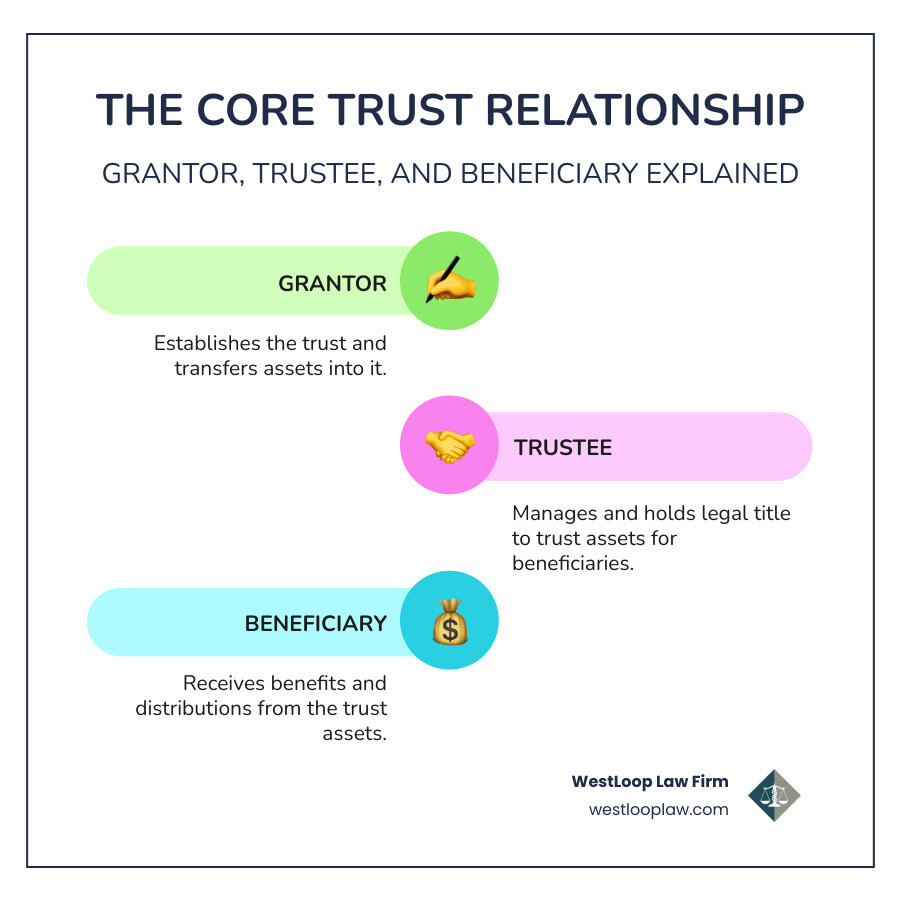

A trust is a legal arrangement where a grantor transfers assets to a trustee to manage for beneficiaries. Unlike a will, a properly funded trust can avoid probate in Harris County, keeping financial matters private and allowing for quicker asset distribution.

Trusts can be settled faster than wills, avoiding the hassle of probate in courts along Congress Avenue in downtown Houston. They also give you control over when and how your beneficiaries receive their inheritance, such as protecting assets for a young adult, providing for a loved one with disabilities, or caring for a spouse while preserving assets for your children.

Creating a trust requires legal guidance. The Texas Trust Code has specific requirements, and a poorly drafted trust can cause significant problems. A Houston trust lawyer is important to help ensure it is done correctly.

Key houston trust lawyer vocabulary:

- estate planning lawyer houston

- attorneys who handle wills near me

- houston texas estate planning lawyers

Understanding the Different Types of Trusts in Texas

A trust is a versatile legal tool for managing and distributing assets according to your wishes. For Houston residents, it’s a cornerstone of estate planning, offering benefits beyond a simple will. A trust acts like a private rulebook for your assets, complete with a manager and designated beneficiaries.

Why might someone in Houston need a trust? Many Houstonians have substantial real estate, a family business near the Energy Corridor, or investments that require careful stewardship. A trust allows you to:

- Protect Assets: Shield your wealth from creditors, lawsuits, or even irresponsible spending by beneficiaries.

- Avoid Probate: Keep your estate out of the public and time-consuming probate process in Harris County.

- Maintain Control: Dictate precisely how and when your beneficiaries receive their inheritance.

- Plan for Incapacity: Designate a trustee to manage your financial affairs if you become unable to do so yourself.

- Minimize Estate Taxes: Strategically transfer wealth to reduce federal estate tax burdens.

- Provide for Specific Needs: Care for minor children, beneficiaries with special needs, or pets.

Texas law, guided by the Texas Trust Code, provides a framework for various trust structures. Understanding these options is the first step in creating a plan that reflects your legacy.

Revocable vs. Irrevocable Trusts: Flexibility and Protection

The most fundamental distinction in trust planning lies between revocable and irrevocable trusts. The choice between them hinges on your priorities: flexibility or ironclad protection.

| Feature | Revocable Trust | Irrevocable Trust |

|---|---|---|

| Modification | Can be changed, amended, or canceled by grantor | Generally cannot be changed or revoked by grantor |

| Asset Protection | No protection from creditors or lawsuits | Strong protection from creditors and lawsuits |

| Estate Tax | Assets included in grantor’s taxable estate | Assets removed from grantor’s taxable estate |

| Probate Avoidance | Yes, if fully funded | Yes, if fully funded |

| Control | Grantor retains full control over assets | Grantor gives up control over assets |

| Medicaid Planning | No benefit | Potential benefit (after look-back period) |

A revocable trust, or “living trust,” offers maximum flexibility. As the grantor, you keep full control, allowing you to change or cancel the trust at any time. You can alter assets, beneficiaries, or instructions as life changes. While these assets remain part of your taxable estate and aren’t protected from creditors, they successfully bypass probate for a private, smooth transfer to beneficiaries.

An irrevocable trust is generally permanent. Once you transfer assets into it, you give up control. This is key to its power: the assets are no longer legally yours, providing strong protection from creditors and lawsuits while reducing or eliminating estate taxes. These trusts are useful for Medicaid planning (minding the five-year look-back period) and for holding life insurance policies to manage payouts tax-efficiently.

Trusts for Unique Houston Lifestyles

Beyond the revocable/irrevocable distinction, Texas residents have access to several trusts to address particular needs:

- Special Needs Trusts (SNTs) or Supplemental Needs Trusts: An SNT provides financial support for a beneficiary with disabilities without risking their eligibility for government benefits like Medicaid or SSI. The funds supplement public aid, covering extra needs like particular medical care, education, or quality-of-life expenses.

- Spendthrift Trusts: For a beneficiary who may struggle with managing money, a spendthrift trust appoints a trustee to distribute funds under specific conditions. This protects the inheritance from being spent too quickly or seized by the beneficiary’s creditors.

- Irrevocable Life Insurance Trusts (ILITs): An ILIT is an irrevocable trust that owns your life insurance policy. This removes the death benefit from your taxable estate, allowing the proceeds to pass to your beneficiaries free of estate taxes.

- Charitable Trusts: Charitable trusts let you support causes you care about while gaining tax advantages, such as income tax deductions and reduced estate taxes. They can be structured to provide benefits to charity now or in the future.

By carefully considering these options with a houston trust lawyer, we can craft a trust strategy that aligns with your family’s unique circumstances and secures your legacy.

Trusts vs. Wills: Avoiding Probate in Harris County

When we discuss estate planning, wills and trusts are often mentioned together, but they serve distinct purposes. Understanding their differences is key to making informed decisions for your future in Houston.

A will directs asset distribution after death, names an executor, and can appoint guardians. However, it must go through the public probate process in Texas, which can cause delays.

A trust is a legal entity that holds assets for beneficiaries. When funded correctly, a trust bypasses probate, offering privacy, faster distribution, and potentially lower costs for your family in Harris County.

Even with a trust, a “pour-over will” is often recommended. It acts as a safety net, transferring any forgotten assets into your trust at death. This ensures all assets follow the trust’s terms and allows you to name guardians for minor children.

For more information on how we can help you steer these choices, please visit our page on More info about estate planning services.

The Texas Probate Process Explained

Many Houstonians seek to avoid probate, and for good reason. Probate is the legal process that validates a will, inventories property, pays debts, and distributes the remaining assets. This process takes place in the deceased’s county of residence, such as Harris County.

While Texas probate is often less cumbersome than in other states, it still has drawbacks. It can take months or years for complex estates, and all court filings become public record, exposing your family’s financial details. This lack of privacy is a significant concern for many of our clients.

Texas offers different types of probate administration:

- Independent Administration: The most common type, allowing an executor to manage the estate with minimal court oversight.

- Dependent Administration: Requires court approval for most actions, used when there’s no will or if the will requires it.

- Muniment of Title: A simplified process for simple estates with a will, transferring property title without a full administration.

- Small Estate Affidavits: For estates under $75,000 (excluding certain property), an affidavit can transfer assets without formal probate.

For those near the Texas Medical Center, navigating the court system during a time of grief can be daunting. A well-structured trust offers a smoother path.

How Trusts Provide Privacy and Control

One of the most compelling advantages of a trust for Houston families is the privacy and control it offers.

- Keeping Family Matters Private: A trust is a private agreement, unlike a will that becomes public during probate. Your assets, beneficiaries, and plans remain confidential.

- Controlling Asset Distribution Post-Mortem: A trust lets you set specific conditions for inheritances, like distributing funds at certain ages or for specific purposes like education or housing. This control ensures your legacy is managed wisely.

- Managing Out-of-State Property: A living trust avoids separate probate processes (“ancillary probate”) for property you own outside of Texas. Placing all properties in your Houston-based trust creates one cohesive plan.

- Incapacity Planning: A trust also plans for incapacity. A successor trustee can manage your finances if you’re unable to, ensuring bills are paid without needing a court-appointed guardian.

Navigating Trust Administration and Disputes with a Houston Trust Lawyer

Establishing a trust is a powerful act of planning, but proper administration is crucial, and sometimes, disputes can arise. That’s when having a knowledgeable houston trust lawyer becomes indispensable.

Key Duties and Responsibilities of a Trustee

The trustee manages the trust’s assets for the beneficiaries. This role includes a legal fiduciary duty to act in the beneficiaries’ best interests, a requirement enforced by the Texas Trust Code.

Key duties include:

- Prudent Management of Assets: Investing trust assets wisely and avoiding undue risk.

- Distribution to Beneficiaries: Following the trust’s terms precisely when making distributions.

- Keeping Accurate Records: Maintaining meticulous financial records of all transactions.

- Communicating with Beneficiaries: Providing beneficiaries with relevant information about the trust.

- Impartiality: Treating all beneficiaries fairly, without favoritism.

The Texas Trust Code outlines these responsibilities in detail. You can review the specifics yourself here: The Texas Trust Code.

What Happens if a Trustee Breaches Their Fiduciary Duty?

A breach of fiduciary duty can lead to litigation, financial penalties, and the trustee’s removal. Common breaches include:

- Self-Dealing: Using trust assets for personal benefit.

- Mismanagement of Assets: Making reckless investments or failing to account for funds.

- Withholding Assets: Refusing or delaying distributions without cause.

- Conflict of Interest: Making decisions that benefit the trustee over the beneficiaries.

- Failure to Disclose Relevant Facts: Hiding information from beneficiaries.

- Bad Faith: Acting with malicious intent or gross negligence.

When a breach occurs, beneficiaries have legal options to seek remedies.

Common Trust Disputes and Litigation

Despite careful planning, trust disputes can arise. Common disputes in Houston trust litigation include:

- Disputes About the Trustee’s Conduct: Beneficiaries may allege the trustee mismanaged assets, showed favoritism, failed to provide accountings, or took excessive compensation. Lack of transparency is a common trigger for these disputes.

- Disputes About the Validity of the Trust: A trust’s validity can be challenged based on the grantor’s mental incapacity, undue influence, fraud, or improper signing. These cases require investigating the circumstances of the trust’s creation.

- Disputes About Interpretation of the Trust: Ambiguous language in a trust can lead to disagreements over asset distribution, trustee powers, or beneficiary rights.

- Disputes About the Administration of the Trust: Issues can arise regarding expenditures, record-keeping, or communication breakdowns.

These disputes can involve substantial assets, including family businesses or oil & gas royalties common in the Houston area.

Remedies and Attorney Fees in Texas Trust Litigation

When a trust dispute leads to litigation, Texas courts have broad powers to resolve the conflict. Available remedies include:

- Modification, Reformation, or Termination of a Trust: A court can alter a trust’s terms if circumstances change or if it contains errors.

- Removal of a Trustee: If a trustee has breached their duty, the court can remove them and appoint a successor.

- Disgorgement of Trustee Compensation: A trustee found in breach may be ordered to return their fees.

- Award of Costs and Attorney Fees: Courts can order the breaching party to pay for litigation costs.

How are attorney fees handled in Texas trust litigation? Generally:

- Payment by the Trust Estate: The trust may pay for legal fees if the litigation benefits the trust, such as when a trustee defends against frivolous claims or seeks to clarify the trust’s terms.

- Payment by Parties: A party who acts in bad faith or brings an unsuccessful claim may have to pay their own legal fees.

- Trustee’s Defense Costs: A trustee can use trust funds for a good-faith defense. If found in breach, they may have to reimburse the trust. The court has discretion in awarding fees based on the case’s outcome.

Navigating these complexities requires a houston trust lawyer who understands the Texas Trust Code and has a background in litigation.

Choosing and Working with a Houston Trust Attorney

Selecting the right houston trust lawyer is a key decision that can significantly impact your estate plan and your family’s future in Houston. Working with WestLoop Law Firm can help you feel confident your affairs are properly in order for your family’s peace of mind, whether you live near the 610 Loop, commute along I-10, or run a business close to the Galleria.

What to Look for in a Houston Trust Lawyer

When you are looking for a houston trust lawyer, consider these factors:

- Experience with the Texas Trust Code: The laws governing trusts are complex. You need someone thoroughly familiar with the Texas Trust Code and local Houston probate courts.

- Litigation Background: While the goal is to avoid disputes, if one arises, you will want an attorney with a strong background in trust and probate litigation. WestLoop Law Firm handles Texas trust and probate disputes as well as personal injury matters.

- Client Testimonials and Peer Reviews: Look for attorneys with positive feedback from clients and solid ratings from their peers.

- Communication Style: Choose an attorney who communicates clearly, explains complex legal concepts in plain language, and is responsive to your questions.

- Understanding of Complex Family Dynamics: Estate planning often involves sensitive family issues. A good attorney can steer these dynamics with empathy and discretion.

- Proximity and Local Knowledge: An attorney familiar with Houston’s landscape, from the downtown business district and the Texas Medical Center to areas near the Energy Corridor or Sugar Land, can offer valuable local insights.

How a Houston Trust Lawyer Helps with Asset Protection and Tax Planning

A houston trust lawyer is not just about drafting documents; they can also help you strategically plan for your financial future.

- Minimizing Federal Estate Tax: For high-value estates, federal estate taxes can be substantial. Your attorney can help structure irrevocable trusts and gifting strategies to legally minimize this tax burden and provide beneficiaries with tax-advantaged income.

- Protecting Assets from Creditors and Lawsuits: Certain types of irrevocable trusts can shield your assets from future creditors, divorcing spouses, or lawsuits. This is particularly relevant for Houston business owners or professionals in high-liability fields who may travel daily along Beltway 8 or Highway 59.

- Business Succession Planning: For Houston entrepreneurs, a trust is integral to business succession. It helps ensure a smooth ownership transition and maintains business continuity, whether for a shop in Montrose or a company in the Energy Corridor. Your attorney can help integrate this into a comprehensive estate plan.

- Integrating with Your Overall Financial Plan: A Houston trust lawyer can coordinate with your financial advisors and CPAs to ensure your trust integrates with your overall financial plan, including investments and retirement goals. This creates a cohesive strategy that takes into account the legal, financial, and tax aspects of trusts and estates.

WestLoop Law Firm helps clients prepare for the end of life and the proper distribution of responsibility and assets, through end-of-life healthcare directives, powers of attorney, revocable trusts, and wills, while also representing clients in personal injury and probate matters across the Houston area, including Harris County courts.

Frequently Asked Questions about Houston Trusts

How much does it cost to set up a trust in Houston?

The cost to set up a trust with a houston trust lawyer varies based on the complexity of your estate and the type of trust needed. A simple revocable trust will cost less than a complex irrevocable trust for a high-net-worth estate. While a trust is an upfront investment, it can save your family significant time, stress, and money by avoiding the potential costs and delays of probate court. We can discuss our fee structures during an initial consultation.

Can a trust help me qualify for Medicaid in Texas?

Yes, an irrevocable Medicaid Asset Protection Trust (MAPT) can help with Medicaid planning. By transferring assets into a MAPT, they are no longer counted for eligibility purposes. However, this must be done carefully due to Medicaid’s “five-year look-back period”; any transfers made within five years of applying can lead to a penalty. Working with a houston trust lawyer is vital to structure the trust correctly and protect assets while ensuring access to long-term care benefits.

What happens if a trustee is not doing their job correctly?

If you suspect a trustee is not doing their job, you have rights under the Texas Trust Code. You can demand a formal accounting of the trust’s finances. If there is evidence of mismanagement or a breach of fiduciary duty, you can petition a Texas court to remove the trustee and seek damages. It is important to act promptly if you suspect a problem. A lawyer can help investigate, review documents, and advise on the next steps, which could include negotiation or litigation.

Secure Your Houston Legacy Today

In a dynamic city like Houston, securing your legacy means more than just a will. It requires proactive planning to protect your assets and ensure your wishes are honored, whether your home is near Memorial Park, the Medical Center, or along Westheimer Road. A trust offers privacy, control, and efficiency, helping you avoid probate and provide for your loved ones in a structured way.

A well-drafted trust is a testament to your foresight. At WestLoop Law Firm, we are committed to helping Houstonians with the details of estate planning. Our team helps clients steer the legal process of creating trusts and estate plans, ensuring your documents reflect your current wishes while also being ready to assist with probate and related personal injury issues that may affect your family.

We are here to guide you through every step, from understanding the different types of trusts to addressing potential disputes in Harris County courts. Let us help you build a robust estate plan that offers peace of mind and safeguards your family’s future.

Contact WestLoop Law Firm today to discuss your estate plan and begin securing your Houston legacy, or contact us to discuss your estate plan. We look forward to working with you.