Your Guide to Securing Your Legacy

Attorneys who focus on wills near me are legal professionals trained in estate planning who help you create legally binding documents that protect your assets and ensure your wishes are carried out after your death. These lawyers draft wills, establish trusts, and guide you through the complex process of securing your family’s future.

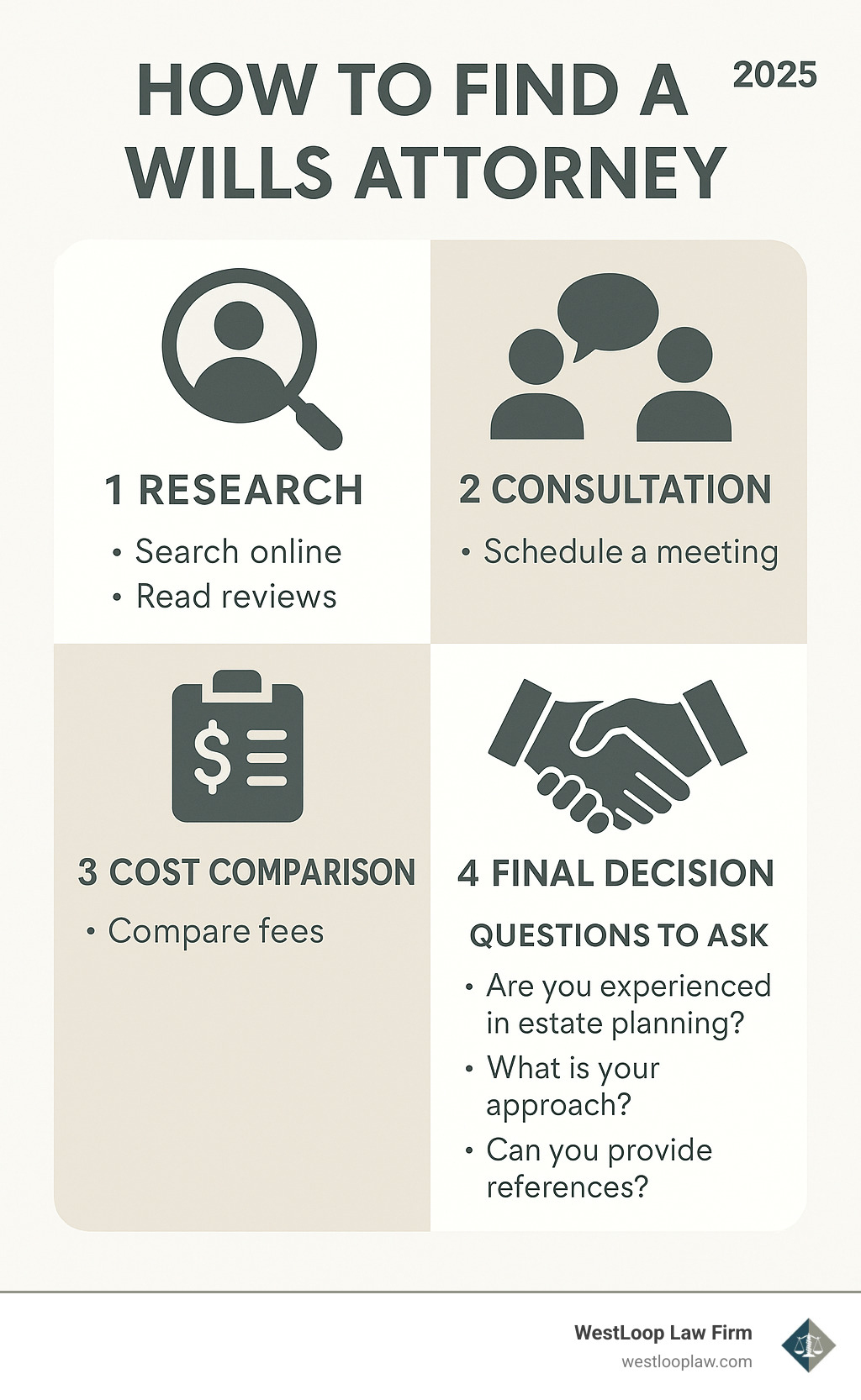

Quick Answer – How to Find the Right Will Attorney:

- Search local bar associations, like the State Bar of Texas, for lawyers certified in estate planning

- Read client reviews on platforms like Avvo or Google Reviews

- Ask about their experience – look for attorneys with 5+ years in estate law

- Get cost estimates – most charge $940-$1,500 for a basic will

- Schedule consultations – many offer free initial meetings

- Verify credentials – ensure they’re licensed in your state

Creating a will isn’t just about distributing your possessions. As one estate planning professional notes: “Estate planning is a highly personal and sensitive process to plan for the future according to your precise wishes, helping to pass on your values as well as your valuables.”

The stakes are high when it comes to protecting what you’ve worked your entire life to build. Without proper legal guidance, your family could face lengthy court battles, unexpected tax burdens, or see your assets distributed in ways you never intended.

Whether you’re recovering from an injury and thinking about your family’s security, or simply want to ensure your hard-earned assets go to the right people, finding the right attorney makes all the difference.

Simple wills and estate planning glossary:

The Foundations of Estate Planning

Think of your estate plan as a personal roadmap for your future and for those you love most. It’s more than just a stack of papers. It’s about protecting everything you’ve worked so hard for – your lifetime of work, your assets, and even your family’s peace of mind. Here at WestLoop Law Firm, we see it as a way to secure your legacy, ensuring your values are passed down, not just your valuables. We offer comprehensive services to build this roadmap, giving you comfort that your wishes will be honored, no matter what.

Many people search for attorneys for wills near me because they want to make sure their wishes are clearly understood and legally sound. That’s exactly what we help you do. To understand more about how we help you put your final wishes into writing, explore our guide on Creating a Last Will and Testament: The Process.

What is estate planning and why is it important?

So, what exactly is estate planning? Simply put, it’s the thoughtful way you arrange your legal and financial life. It’s about making clear decisions now for how your assets will be managed and shared later. This also includes your personal wishes for things like healthcare and who would care for your children, if you ever couldn’t make those choices yourself. It’s a very personal process, designed to make sure your exact wishes are followed, passing on not just your money and property, but your beliefs and values too.

Why is this so important? Imagine leaving your loved ones with a huge puzzle to solve during a difficult time. Without a clear plan, your estate could get stuck in a long, expensive court process called probate. We’ll talk more about probate soon, but a good estate plan helps you avoid it. It can also help reduce estate taxes. Most importantly, it protects your family from stress, confusion, and arguments when they need peace the most. It truly preserves what you’ve built and keeps your family safe and sound.

Ready to secure your future and that of your loved ones? Dive deeper into our approach by visiting our Estate Planning Law Houston page.

What documents are typically included in an estate plan?

A complete estate plan is like a custom-made suit – it’s designed just for you and your family’s needs. While every plan is unique, certain key documents form the backbone of a solid strategy. These are the pieces that work together to make sure your wishes are clearly understood and legally followed:

First, there’s your Last Will and Testament. This is a core document. It clearly states how you want your belongings and money distributed after you’re gone. It also names the person who will manage your estate (your executor) and, super importantly, names guardians for any minor children. Think of it as your voice speaking clearly, even when you’re no longer here. It ensures your property goes exactly where you intend and that your children are cared for by those you trust most.

Then, we often consider a Revocable Living Trust. This type of trust can hold your assets, helping them avoid the often lengthy and public probate process after your passing. It offers more privacy and gives you greater control over how and when your assets are distributed. It’s also incredibly useful if you ever become unable to manage your own affairs.

Next, we have the Financial Power of Attorney (POA). This document gives a trusted person (your “agent”) the power to manage your money and financial matters if you can’t. This includes paying bills, handling bank accounts, or managing investments. Without it, your loved ones might face a lot of legal problems just to pay your everyday expenses.

Similarly, a Medical Power of Attorney (Healthcare Proxy) lets you name someone to make healthcare decisions for you if you’re ever too sick to speak for yourself. This makes sure your medical care matches your personal values and preferences, taking a huge burden off your family during a crisis.

Finally, a Living Will (Advance Directive) spells out your specific wishes for end-of-life medical treatments. This could include things like life support or feeding tubes. It’s your way of making crucial decisions about your care in advance, providing peace of mind for both you and your family.

These important documents fit together to create a strong plan for your estate. They ensure your wishes are honored and your loved ones are always protected. For a deeper look at how a Power of Attorney can help manage your affairs, visit our page on Power of Attorney: Managing Financial and Medical Affairs.

Wills, Trusts, and Probate Explained

Think of estate planning as building a bridge between your life today and your family’s future tomorrow. The most important tools in this construction are wills, trusts, and understanding how probate works. Each serves a different purpose, but together they create a comprehensive plan that protects your loved ones and honors your wishes.

At WestLoop Law Firm, we’ve guided countless families through these complex legal waters. We understand that the distinction between wills and trusts can feel confusing, and the probate process often seems mysterious and intimidating. That’s why we’re here to break it down in simple terms.

Without proper planning, Texas intestacy laws will decide who gets what from your estate. This means a judge who never knew you will make decisions about your life’s work based on a legal formula, not your personal wishes. Even worse, your family might face lengthy court battles and unexpected costs during an already difficult time.

To learn more about how we guide families through these processes, visit our Probate Lawyer in Houston page.

What is the difference between a will and a trust?

Imagine a will as your final letter of instructions and a trust as a secure container that starts working immediately. Both are essential tools, but they operate very differently and serve distinct purposes in your estate plan.

A Last Will and Testament is your voice speaking from beyond, telling everyone exactly how you want your assets distributed after your death. It becomes public record once it goes through probate, meaning anyone can read about your family’s financial affairs at the courthouse. Your will only takes effect after you pass away, and it must go through the court-supervised probate process before your beneficiaries receive anything.

A trust, on the other hand, is like a private vault that you can use during your lifetime and continues working after you’re gone. Assets placed in a revocable living trust typically avoid probate entirely, meaning your family gets faster access to their inheritance without court involvement. Trusts also remain completely private – no public records, no courthouse drama.

Here’s how they stack up:

| Feature | Last Will and Testament | Revocable Living Trust |

|---|---|---|

| Privacy | Becomes public record through probate | Remains completely private |

| Probate Process | Must go through probate court | Bypasses probate entirely |

| When It Takes Effect | Only after your death | Immediately upon creation |

| Control During Incapacity | Provides no help if you become incapacitated | Allows successor trustee to manage your affairs |

| Cost | Lower upfront cost | Higher initial setup cost |

| Time to Distribute Assets | Months or years through probate | Can be immediate |

Think of it this way: if you become incapacitated, your will sits in a drawer doing nothing, but your trust springs into action with your chosen successor trustee managing your affairs. This is why many families choose to use both a will and a trust together – the will handles anything not in the trust, while the trust manages the bulk of their assets.

For more detailed information about different trust structures, check out our page on Houston Estate Planning Trust Structures.

What happens if I die without a will?

Dying without a will is called dying “intestate,” and it’s like leaving your family to steer a maze without a map. When this happens, Texas state law steps in with a rigid formula that decides who gets what from your estate – and these decisions might surprise you.

The state becomes your estate planner, but it doesn’t know your family dynamics, your values, or your wishes. Texas intestacy laws follow a mathematical approach that splits your assets based on legal relationships, not emotional bonds or financial need. Your beloved stepchild who you raised from age five? They might get nothing. That estranged relative you haven’t spoken to in decades? They could inherit a significant portion of your estate.

The court will also appoint an administrator to handle your estate – someone you never chose and who may not understand your family’s needs. This person will have broad authority over your assets and will be paid from your estate for their services.

Even more challenging, dying intestate often creates family conflicts that can tear relationships apart. Without clear instructions from you, family members may disagree about what you “would have wanted,” leading to expensive legal battles that drain your estate and create lasting resentment.

Your minor children face additional complications. Without a will naming guardians, the court will decide who raises them based on legal standards, not your personal knowledge of who would provide the best care and share your values.

The timeline becomes unpredictable and lengthy. While a well-planned estate might settle in months, intestate estates often drag on for years as the court works through complex family trees and resolves disputes.

This is why attorneys who handle wills near me always emphasize that even a basic will is infinitely better than no will at all. To understand more about how intestacy affects families, visit our resource on Inheritance Laws and Probate: What You Need to Know.

What is probate and how can estate planning help avoid it?

Probate is the court-supervised process of validating your will, paying your debts, and distributing your assets to beneficiaries. Think of it as the legal system’s way of making sure everything is done properly after someone passes away. While probate serves an important purpose, it can be time-consuming, expensive, and emotionally draining for your family.

During probate, your estate becomes an open book. Court records are public, meaning anyone can see what you owned, who you owed money to, and who’s inheriting what. The process typically takes six months to two years or even longer if there are complications or disputes.

The costs add up quickly. Court fees, attorney fees, executor fees, and other administrative expenses can easily consume 3-7% of your estate’s value. For a $500,000 estate, that could mean $15,000 to $35,000 in probate costs – money that could have gone to your beneficiaries instead.

Your family also faces emotional stress during an already difficult time. They must steer court deadlines, gather extensive documentation, and potentially deal with creditor claims while they’re grieving your loss.

Smart estate planning can minimize or eliminate probate entirely. Living trusts are the most powerful tool for probate avoidance. When you place assets in a properly funded living trust, they technically belong to the trust, not to you personally. Since the trust doesn’t die when you do, these assets can be distributed immediately according to your trust instructions without court involvement.

Other probate-avoidance strategies include joint ownership with rights of survivorship, beneficiary designations on retirement accounts and life insurance policies, and payable-on-death accounts for bank accounts.

However, these strategies require careful planning and proper execution. A trust that isn’t properly funded with your assets won’t help avoid probate. Beneficiary designations that are outdated or missing can create problems. This is where working with experienced attorneys who handle wills near me becomes invaluable.

For more information about how probate works in Texas, visit our comprehensive guide on Probate Laws in Houston: Process for Residents.

Secure Your Family’s Future Today

You’ve dedicated your life to building something wonderful – a family, a home, a legacy. Now, it’s time to ensure that all your hard work, all your precious memories, and all your valuable assets are thoughtfully protected for the people you love most.

We understand that navigating wills, trusts, and probate can feel a bit daunting. It’s complex, and it touches on deeply personal decisions. But imagine the incredible peace of mind that comes from knowing your family will be cared for, your wishes will be honored, and your legacy will be secure, no matter what tomorrow brings. That’s a feeling worth investing in.

This journey requires more than just legal documents; it requires a knowledgeable and compassionate guide. At WestLoop Law Firm, we pride ourselves on being that guide. We don’t just draft papers; we help you craft a roadmap for your family’s future, explaining every step in clear, understandable language. We’re here to explain the process and ensure your plan truly reflects your unique life and values.

If you’re searching for attorneys for wills near me – a team that combines deep legal knowledge with a genuinely warm and supportive approach – you’ve found us. The WestLoop Law Firm team is ready to help you create a plan that protects your legacy and ensures your loved ones are cared for, always.

Ready to take that important next step towards securing your family’s future? Explore our Estate Planning Law Houston services today. Let’s build that peace of mind together.