Peace of Mind: Securing Your Future with an Estate Planning Lawyer in Houston

Finding the right estate planning lawyer Houston is key to protecting your family and legacy. Estate planning allows you to decide what happens to your assets, your health, and your loved ones’ future, ensuring your wishes are clear even when you can’t speak for yourself.

An estate planning lawyer in Houston can help you:

- Create Your Will: Ensure your belongings go to the right people.

- Set Up Trusts: Protect assets, avoid probate, and minimize taxes.

- Plan for Incapacity: Name trusted individuals to make healthcare and financial decisions for you.

- Appoint Guardians: Secure care for minor children if needed.

- Steer Texas Law: Understand local rules for your estate.

Houston has a large legal community with over 1000 estate planning attorneys. This guide will help you understand the importance of estate planning and provide clear steps to choose the best lawyer for your needs, giving you peace of mind and securing your family’s future.

Estate planning lawyer houston terms you need:

Why Every Houstonian Needs an Estate Plan

Estate planning isn’t just for the wealthy. If you own anything—a home, car, or bank account—you have an estate. An estate planning lawyer Houston will tell you it’s a comprehensive strategy for your health, finances, and how decisions are made throughout your life. It’s a detailed instruction manual for your belongings and, more importantly, for your family, should you become unable to make decisions or pass away.

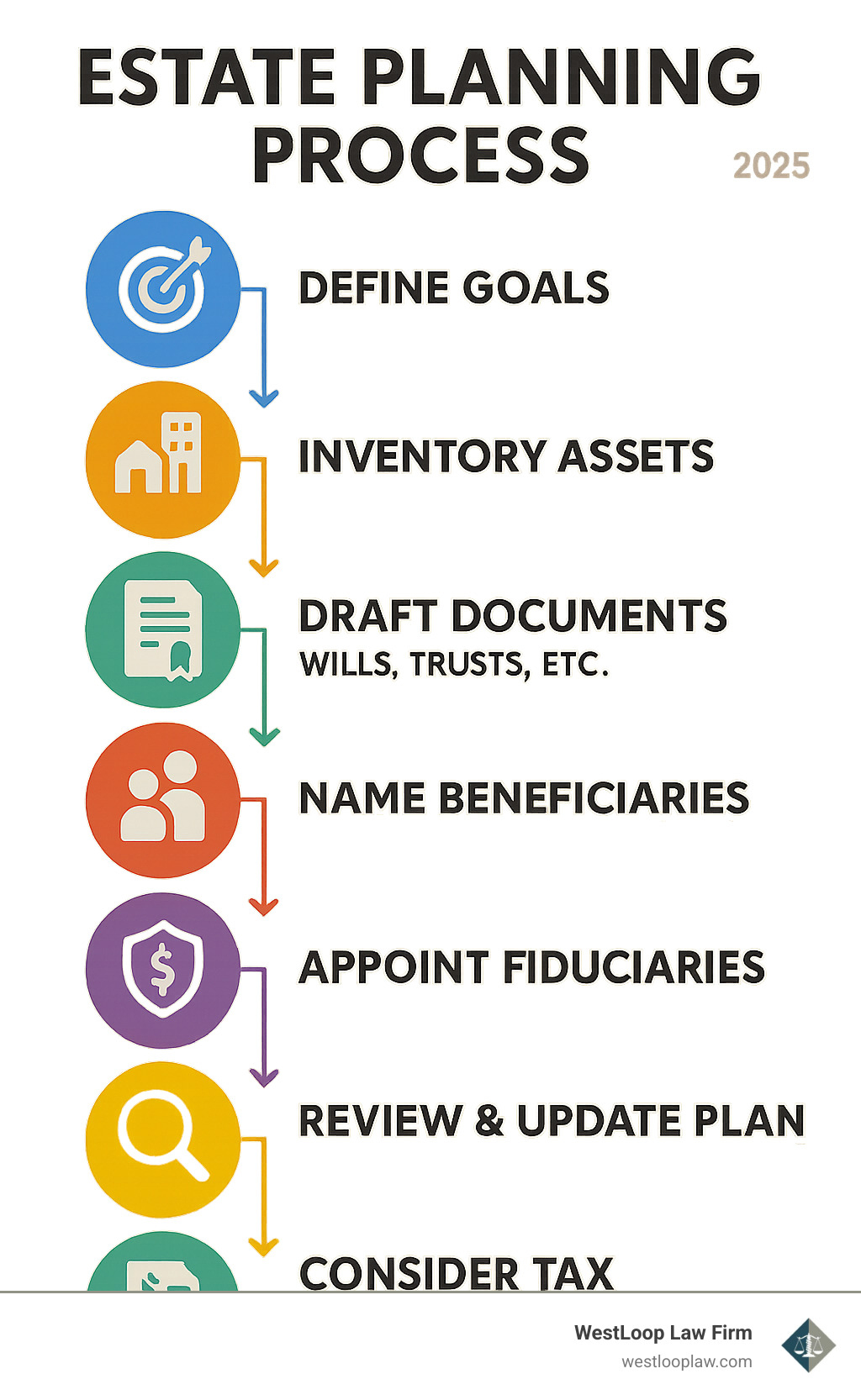

For Houston residents, understanding Texas community property laws is crucial, especially for blended families. An estate plan ensures your wishes are followed, protects your family, and helps avoid the costly probate process. Without a plan, you risk leaving behind family arguments and expensive legal battles. An experienced estate planning lawyer Houston can guide you through the Essential Steps an Estate Planning Lawyer Can Help With to secure your family’s future.

What Happens Without a Plan in Texas?

Dying without a will in Texas is called dying “intestate.” The state then distributes your assets according to its own laws, meaning a court—not you—decides who gets what and who cares for your minor children. This lack of control can lead to significant headaches:

- State-controlled distribution: Your assets might not go to your intended heirs. A non-married partner, for example, might inherit nothing.

- Potential family conflicts: Without clear instructions, disagreements over inheritances can cause emotional and financial stress.

- Court-appointed administrators: A court will appoint someone to manage your estate in a potentially long and expensive process.

- Lack of control over guardianship: The court will decide who raises your minor children, possibly against your wishes.

We’ve seen the heartache that occurs when someone passes away without a proper estate plan. Understanding Inheritance Laws and Probate: What You Need to Know is vital.

Estate Planning for Different Life Stages

Estate planning is a dynamic process that should adapt to your life’s stages:

- Young adults: A plan is crucial even with few assets. A medical power of attorney is vital for college-aged children, and a prenuptial agreement can be a smart investment. For more insights, see Why Young Adults Should Consider Estate Planning.

- Blended families: These families require complex planning to ensure assets are divided fairly among children and spouses from different relationships. We can help you steer Estate Planning for Blended Families: Houston Laws.

- Business owners: Estate planning must include business succession. Planning ensures your business continues to thrive and helps minimize tax implications.

- Retirees: At this stage, wealth preservation and planning for long-term care become critical. Medicaid planning can help protect assets from being depleted by healthcare costs.

- High-net-worth individuals: Advanced strategies are needed to minimize estate, gift, and generation-skipping taxes and protect assets for future generations.

No matter your life stage, a customized estate plan is essential to prepare for the unexpected and ensure your loved ones are cared for.

Core Components of a Texas Estate Plan

Your estate plan is a collection of legal documents that ensures your wishes are followed. While every plan is customized, most Texas estate plans include several core components designed to protect you, your loved ones, and your assets:

- Last Will and Testament: States who gets your property and names guardians for minor children.

- Trusts: Can help you avoid probate and protect what you own.

- Durable Power of Attorney: Gives a trusted person power to manage your finances if you can’t.

- Medical Power of Attorney: Lets a chosen person make healthcare decisions for you if you’re unable.

- Directive to Physicians (Living Will): Spells out your wishes for end-of-life medical treatment.

- HIPAA Release: Allows specific people to access your medical records.

- Guardianship Designations: Names who would care for your minor or adult dependents.

- Disposition of Remains: Outlines your preferences for your funeral and burial.

Wills, Trusts, and Powers of Attorney

A Last Will and Testament outlines who receives your property and names an executor. However, a will alone does not avoid probate in Texas; assets mentioned in it must still go through the court process to be legally transferred. We can walk you through Creating a Last Will and Testament: Process.

Revocable Living Trusts are powerful tools where you place assets into a trust while maintaining full control. The biggest benefit is that assets in a living trust typically bypass the lengthy and costly probate process, ensuring privacy and faster distribution to your loved ones.

Irrevocable Trusts generally cannot be changed once created. In exchange for this lack of flexibility, they offer significant benefits, such as protecting assets from creditors and lawsuits and reducing estate and gift taxes.

A Durable Power of Attorney (DPOA) lets you appoint a trusted agent to handle your financial matters if you become incapacitated. A Medical Power of Attorney (MPOA) allows your chosen agent to make healthcare decisions on your behalf. A skilled estate planning lawyer Houston can explain all your choices, including different Houston Estate Planning Trust Structures, to find what fits your goals.

Guardianships and Advance Directives

These documents focus on your personal well-being and the care of your loved ones.

A Directive to Physicians (Living Will) is an advance directive that states your wishes about medical treatment if you’re facing a terminal or irreversible condition, ensuring your voice is heard.

A HIPAA Release is vital for allowing your designated agent to access your medical information, which is necessary for them to make informed healthcare decisions for you.

If you have minor children, appointing guardians for children in your will is one of the most critical decisions you’ll make. This prevents a court from making that personal decision for your family.

Together, these documents are key for planning for incapacity. They ensure your financial and health decisions are handled by people you trust, avoiding the need for a court-appointed guardian. We also assist with Special Needs Estate Planning for Vulnerable Loved Ones and can guide you through Long-Term Care Planning: Houston Estate Planning Attorneys Guide.

How a Top Estate Planning Lawyer in Houston Can Help

Choosing an estate planning lawyer Houston is about finding a trusted guide to create a customized plan. A top firm simplifies the legal process and ensures your plan is solid and truly reflects your wishes. This includes:

- Customizing your plan: We build solutions just for you, whether it’s providing for a family member with special needs, ensuring a fair split of assets in a blended family, or protecting your business.

- Navigating probate: While we often help you avoid probate, we are also adept at handling the Texas probate system, making it as smooth as possible for your loved ones.

- Protecting your assets: We help shield your hard-earned wealth from potential creditors, lawsuits, and other risks.

- Minimizing taxes: A smart estate plan can significantly reduce or eliminate federal estate, gift, and other transfer taxes. Learn more about Tax-Saving Estate Planning: Maximizing Benefits.

Navigating Texas Probate

Probate is the court-supervised process of validating a will, paying debts, and distributing assets. In Texas, the complexity of probate often depends on the quality of the estate plan.

Most people prefer Independent Administration because it allows the executor to manage the estate with minimal court oversight, saving time and money. Dependent administration, conversely, requires court approval for most actions, leading to delays and higher costs. A skilled estate planning lawyer Houston can structure your will to allow for smoother independent administration.

In some cases, a Muniment of Title can be used to transfer assets with little court involvement. Assets held in a living trust completely avoid probate, offering privacy and speed. The Role of an Executor is to carry out your wishes as stated in your will. We provide guidance to your chosen executor and are here to be your trusted Probate Lawyer in Houston.

Services for Complex Needs

We offer services for clients with significant wealth or complex financial situations.

For High-Net-Worth Estates, we use advanced strategies to manage large assets, minimize taxes across generations, and protect wealth from risks.

Business Succession Planning is vital if you own a business. We help you plan for the smooth transfer of ownership if you can no longer run your company. See our guide on Estate Planning for Small Business Owners.

If giving back is part of your legacy, we can help with Charitable Giving Strategies, setting up trusts or funds to achieve your philanthropic goals while providing tax benefits.

We can also help with Protecting Assets from Creditors. Through smart planning, we can create a shield around your assets to protect them from future legal issues.

Finally, we help with Navigating Potential Family Conflicts. By planning ahead, we can prevent disputes by setting up clear divisions of assets, especially in blended families. Read more about Navigating Potential Family Conflicts with an Estate Planning Lawyer.

Your Guide to Choosing the Right Houston Lawyer

With over 1000 estate planning attorneys in Houston, choosing the right one can feel overwhelming. By focusing on key factors, you can simplify your search for the perfect estate planning lawyer Houston for your family.

Look for an attorney with substantial experience (ideally over a decade) and strong credentials. Check client reviews on sites like Avvo and Google for feedback on professionalism, empathy, and clear communication. A great lawyer should make you feel comfortable and confident, explaining complex legal ideas in plain language. You should have direct access to the attorney, not just support staff.

Understand their fee structures. Many attorneys offer flat-fee packages, while others bill hourly. A free initial consultation is a great way to discuss fees and get a clear estimate.

Here’s a quick look at common billing methods:

| Fee Structure | Pros | Cons |

|---|---|---|

| Flat Fee | – Predictable cost, no surprises | – May not cover extensive revisions or complex issues |

| – Encourages efficiency from the lawyer | – Less flexible if needs change significantly | |

| – Often preferred for standard packages (Wills, POAs) | ||

| Hourly Rate | – Flexible, only pay for time spent | – Costs can escalate unexpectedly |

| – Suitable for complex, unpredictable cases | – Requires careful tracking of hours | |

| – May feel less transparent initially |

Key Credentials to Look For

When searching for an estate planning lawyer Houston, certain credentials indicate a higher level of proficiency. Board Certification in Estate Planning and Probate Law is a key distinction granted by the state board responsible for certifying attorneys in specific practice areas. This certification is achieved by only a small percentage of attorneys and requires rigorous exams and peer reviews. We highly encourage you to check for an attorney’s board certification status.

Also, look for membership in professional associations like the Texas Bar College, which shows a commitment to ongoing education. Peer reviews and accolades in publications like Best Lawyers in America or Super Lawyers are another good sign. Finally, the years of practice dedicated specifically to estate planning speaks to their depth of experience.

Questions to Ask a Potential Estate Planning Lawyer in Houston

Your initial consultation is an interview. Here are key questions to ask:

- “What is your experience with cases like mine, specifically for Houston residents?”

- “Who will be my primary point of contact, and will I have direct access to you?”

- “How do you bill for your services (flat fee, hourly, or a combination), and can you provide a detailed estimate?”

- “How often should we communicate, and what is your preferred method?”

- “What is your process for updating my estate plan as my life changes?”

- “Can you explain the common pitfalls or Houston Estate Planning Mistakes to Avoid?”

Asking these questions will help you find the right partner to secure your family’s legacy.

Frequently Asked Questions about Estate Planning in Houston

It’s natural to have questions when planning for your family’s future. Here are some of the most common ones we hear.

How often should I review my estate plan?

Review your estate plan every 3-5 years or after any major life event. Significant changes that warrant a review include marriage, divorce, the birth or adoption of a child, the death of a family member or executor, a major change in finances, moving to a new state, or a serious health diagnosis. Regular reviews ensure your plan remains aligned with your current life and goals.

What is the typical cost of an estate plan in Houston?

The cost of an estate plan in Houston varies based on complexity. A simple will may cost a few hundred dollars. Comprehensive flat-fee packages, including a will, powers of attorney, and directives, typically range from $1,000 to $3,000 or more. Plans involving trusts can range from $3,000 to $10,000 or more, depending on their complexity. Some attorneys bill at an hourly rate for unique situations. Many reputable firms, including ours, offer free initial consultations to provide a clear cost estimate.

Can an estate plan help me avoid taxes?

Yes, a well-structured estate plan can significantly reduce or eliminate taxes. An estate planning lawyer Houston can use strategies like irrevocable trusts to minimize the federal estate tax. Strategic lifetime gifting can reduce the gift tax, while specific trusts can avoid the Generation-Skipping Transfer Tax (GSTT). Certain trusts can also offer income tax benefits. By customizing legal documents, we can help you maximize asset protection and minimize taxes, ensuring more of your wealth stays with your loved ones.

Conclusion

Taking charge of your legacy is an empowering decision that provides peace of mind. Estate planning protects those you care about, ensures your wishes are honored, and secures your family’s future. It’s about leaving “No Unfinished Business®,” so your loved ones can grieve without added stress or confusion.

The process can seem complex, but a compassionate estate planning lawyer Houston can be your trusted advisor. They will simplify legal concepts and create customized solutions for your family’s unique situation, navigating Texas law with proficiency.

At WestLoop Law Firm, we pride ourselves on our deep experience in both estate planning and probate law. This means we don’t just help you create a robust plan; we also understand exactly how it will function when it’s needed most, especially when navigating the probate process. Our combined knowledge ensures your plan isn’t just well-written, but truly effective and smooth for your family.

Don’t leave your family’s future to chance. Taking that first step toward securing your peace of mind is often much easier than you might imagine. We’re here to guide you. Contact a Houston estate planning lawyer today to secure your family’s future.